ICICI Bank 2009 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F83

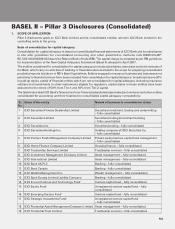

1. SCOPE OF APPLICATION

Pillar 3 disclosures apply to ICICI Bank Limited and its consolidated entities, wherein ICICI Bank Limited is the

controlling entity in the group.

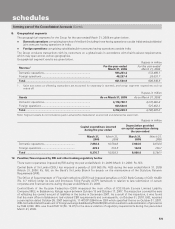

Basis of consolidation for capital adequacy

Consolidation for capital adequacy is based on consolidated financial statements of ICICI Bank and its subsidiaries

in line with guidelines for consolidated accounting and other quantitative methods vide DBOD.No.BP.

BC.72/21.04.018/2001-02 issued by Reserve Bank of India (RBI). The capital charge is computed as per RBI guidelines

for implementation of the New Capital Adequacy Framework (Basel II) released in April 2007.

The entities considered for consolidation for capital adequacy include subsidiaries, associates and joint ventures of

the Bank, which carry on activities of banking or financial nature as stated in the scope for preparing consolidated

prudential reports laid down in RBI’s Basel II guidelines. Entities engaged in insurance business and businesses not

pertaining to financial services have been excluded from consolidation for capital adequacy. Investment above 30%

in paid-up equity capital of financial entities which are not consolidated for capital adequacy (including insurance

entities) and investments in other instruments eligible for regulatory capital status in those entities have been

deducted to the extent of 50% from Tier-1 and 50% from Tier-2 capital.

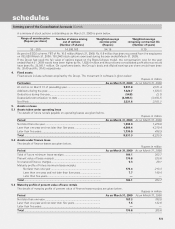

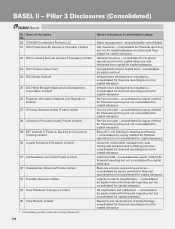

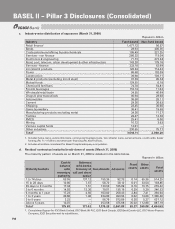

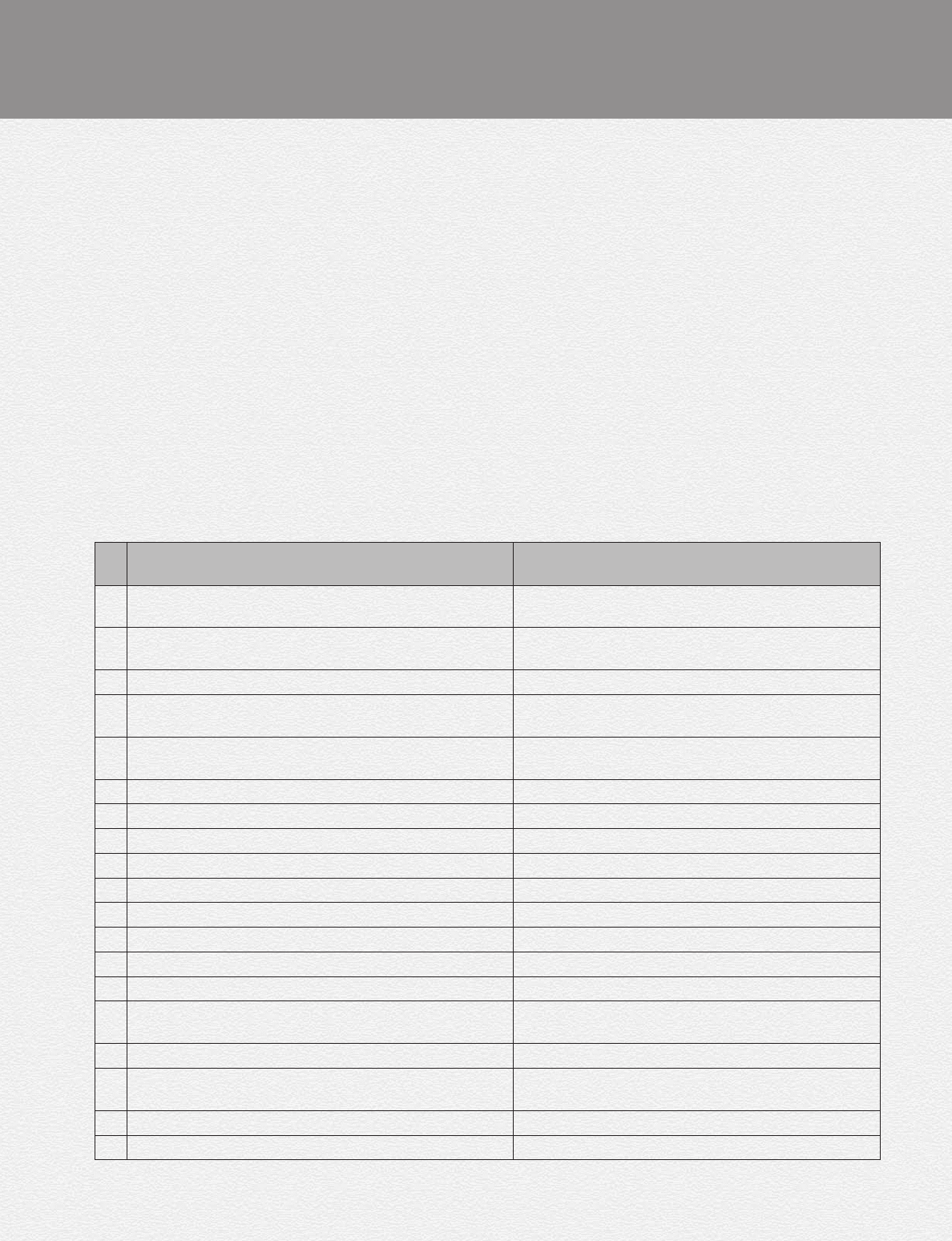

The table below lists ICICI Bank’s financial and non-financial subsidiaries/associates/joint ventures and other entities

consolidated for accounting and their treatment in consolidated capital adequacy computations:

Sr.

No. Name of the entity Nature of business & consolidation status

1 ICICI Securities Primary Dealership Limited Securities investment, trading and underwriting

– fully consolidated

2 ICICI Securities Limited Securities broking & merchant banking

– fully consolidated

3 ICICI Securities Inc. Securities broking – fully consolidated

4 ICICI Securities Holdings Inc. Holding company of ICICI Securities Inc.

– fully consolidated

5 ICICI Venture Funds Management Company Limited Private equity/venture capital fund management

– fully consolidated

6 ICICI Home Finance Company Limited Housing finance – fully consolidated

7 ICICI Trusteeship Services Limited Trusteeship services – fully consolidated

8 ICICI Investment Management Company Limited Asset management – fully consolidated

9 ICICI International Limited Asset management – fully consolidated

10 ICICI Bank UK PLC Banking – fully consolidated

11 ICICI Bank Canada Banking – fully consolidated

12 ICICI Wealth Management Inc. Wealth management – fully consolidated

13 ICICI Bank Eurasia Limited Liability Company Banking – fully consolidated

14 ICICI Eco-net Internet and Technology Fund1Venture capital fund – fully consolidated

15 ICICI Equity Fund1Unregistered venture capital fund – fully

consolidated

16 ICICI Emerging Sectors Fund1Venture capital fund – fully consolidated

17 ICICI Strategic Investments Fund1Unregistered venture capital fund

– fully consolidated

18 ICICI Prudential Asset Management Company Limited Asset management – fully consolidated

19 ICICI Prudential Trust Limited Trusteeship services – fully consolidated

BASEL II – Pillar 3 Disclosures (Consolidated)