ICICI Bank 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33Annual Report 2008-2009

The Power of Belief

given us a large footprint in the country and would serve as an integrated channel for deposit mobilisation, selected

retail asset origination and distribution of third party products. In fiscal 2009, about 23% of ICICI Prudential Life

Insurance Company’s new business premium (on an annualised premium equivalent basis) was generated through

ICICI Bank. We will continue to focus on cross-sell as a means to improve profitability and offer a complete suite

of products to our customers. We continue to leverage our multi-channel network for distribution of third party

products like mutual funds, Government of India relief bonds and insurance products.

Customer service is a key focus area for the Bank and we have adopted a multi-pronged approach to continuously

monitor and enhance customer service levels. We conduct regular training programmes for employees to improve

customer handling and interaction and have incorporated customer service metrics in performance evaluation.

Small Enterprises

We have expanded our reach to about one million Small and Medium Enterprise (SME) customers servicing

their needs through more than 1,400 branches and technology enabled channels. We have focused on providing

transaction banking, trade, investment and financing solutions to SMEs. To deliver these services efficiently, we

have evolved a unique cluster banking approach, corporate linked lending programmes, bouquet of small business

banking products and investment banking and advisory services.

Over the years we have undertaken various SME focused initiatives to support and shape the SME ecosystem in

the country. We setup the “Emerging India Awards” which recognises the spirit of successful entrepreneurship

across the industry clusters; played a role in setting up a SME credit rating agency “SMERA”; launched “SME

India toolkit” an on-line business and advisory resource for SMEs in collaboration with International Finance

Corporation and IBM; started the “SME Dialogue” a weekly feature on SMEs which shares best practices and

success stories of SMEs; and created a unique platform “SME CEO Knowledge Series” to mentor and assist

SMEs entrepreneurs.

During fiscal 2009, we were named the “Best Private Sector Bank in SME Financing” by Dun & Bradstreet. Our

SME strategy will continue to focus on building a deeper customer relationship by offering comprehensive and

customised financial solutions and to be a preferred banking partner for SMEs.

Corporate Banking

Our corporate banking strategy is based on providing comprehensive and customised financial solutions to our

corporate customers. We offer a complete range of corporate banking products including rupee and foreign

currency debt, working capital credit, structured financing, syndication and transaction banking products and

services.

Our corporate and investment banking franchise is built around a core relationship team that has strong relationships

with almost all of the country’s corporate houses. The relationship team is product agnostic and is responsible

for managing banking relationships with clients. We have also put in place product specific teams with a view

to focus on specific areas of expertise in designing financial solutions for clients. The investment banking team

is responsible for working with the relationship team in India and our international subsidiaries and branches,

for origination, structuring and execution of investment banking mandates on a global basis. We have created a

separate credit function inside the corporate banking group to monitor the credit portfolio. While we had dedicated

sales teams for trade services and transaction banking products, we have now created a Commercial Banking

Group within the Wholesale Banking Group for growing this business through identified branches, while working

closely with the corporate relationship teams. Our strategy for growth in commercial banking, or meeting the

regular banking requirements of companies for transactions and trade, is based on not only leveraging our strong

client relationships, but also focusing on enhancing client servicing capability at the operational level.

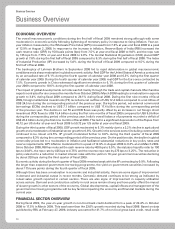

The first half of fiscal 2009 saw continued demand for credit from the corporate sector, with growth and additional

investment demand across all sectors. We were able to leverage our international presence and deep corporate

relationships to work closely on overseas expansion of Indian companies and infrastructure projects in India.

However, post the deterioration in the global economic environment in the second half of fiscal 2009, we adopted

a cautious approach to lending and were selective in extending new loans.

As the Indian economy resumes its growth path, the need for infrastructure development and expansion of Indian

companies will provide exciting opportunities for our corporate banking business. We will continue to focus on

increasing the granularity and hence stability of our revenue streams by executing our transaction banking and

trade services strategy and deepening our client relationships by offering complete solutions for their trade,

transaction banking and funding requirements.