ICICI Bank 2009 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F72

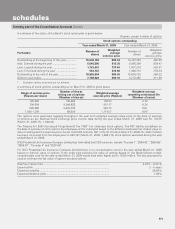

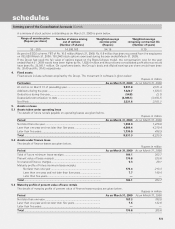

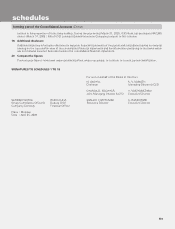

A summary of the status of the stock option plan of ICICI Prudential Life Insurance Company Limited is given below.

Rupees, except number of options

Stock options outstanding

Year ended March 31, 2009 Year ended March 31, 2008

Particulars Number of

shares

Weighted

average

exercise price

Number of

shares

Weighted

average

exercise price

Outstanding at the beginning of the year ............... 12,684,277 94.61 7,279,964 58.17

Add: Granted during the year ................................. 6,074,000 400.00 7,004,675 130.00

Less: Forfeited/lapsed during the year ................... 1,005,695 244.04 1,464,563 86.02

Less : Exercised during the year1 .......................... 1,143,570 58.72 135,799 59.08

Outstanding at the end of the year ......................... 16,609,012 199.72 12,684,277 94.61

Options exercisable ................................................ 2,920,138 71.27 2,030,765 51.30

1. Excludes options exercised by employees in respect of which equity shares are pending allotment.

A summary of stock options outstanding as on March 31, 2009 is given below.

Range of exercise price

(Rupees per share)

Number of shares arising

out of options

(Number of shares)

Weighted average

exercise price

(Rupees)

Weighted average

remaining contractual life

(Number of years)

30-400 16,609,012 199.72 7

As per the ESOS scheme, FBT of Rs. 114.0 million (March 31, 2008: Rs. 3.2 million) has been recovered from the employees

on 1,143,570 (March 31, 2008: 135,799) stock options exercised during the year ended March 31, 2009.

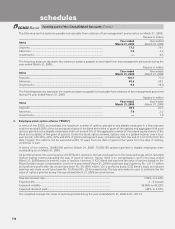

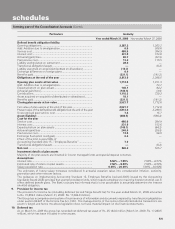

ICICI Lombard General Insurance Company Limited has granted stock options to employees. If the entity would have estimated

fair value computed on the basis of Black-Scholes pricing model, compensation cost for the year ended March 31, 2009 would

have been higher by Rs. 172.0 million. The key assumptions used to estimate the fair value of options are given below.

Risk-free interest rate .......................................................................................... 6.39% – 8.17%

Expected life ....................................................................................................... 3 – 7 years

Expected volatility ............................................................................................... 17.00% – 29.00%

Expected dividend yield ...................................................................................... 0.80% – 2.85%

A summary of the status of the stock option plan of ICICI Lombard General Insurance Company Limited is given below.

Rupees, except number of options

Stock options outstanding

Year ended March 31, 2009 Year ended March 31, 2008

Particulars Number of

shares

Weighted

average

exercise price

Number of

shares

Weighted

average

exercise price

Outstanding at the beginning of the year ................ 12,378,256 48.00 7,390,776 37.91

Add: Granted during the year .................................. 5,050,000 200.00 5,625,000 60.00

Less: Forfeited/lapsed during the year .................... 2,246,266 96.69 487,280 37.07

Less: Exercised during the year1 ............................. 783,828 39.20 150,240 36.23

Outstanding at the end of the year .......................... 14,398,162 94.19 12,378,256 48.00

Options exercisable ................................................. 1,250,394 61.86 1,478,820 37.43

1. Excludes options exercised by employees in respect of which equity shares are pending allotment.

forming part of the Consolidated Accounts (Contd.)

schedules