ICICI Bank 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F55

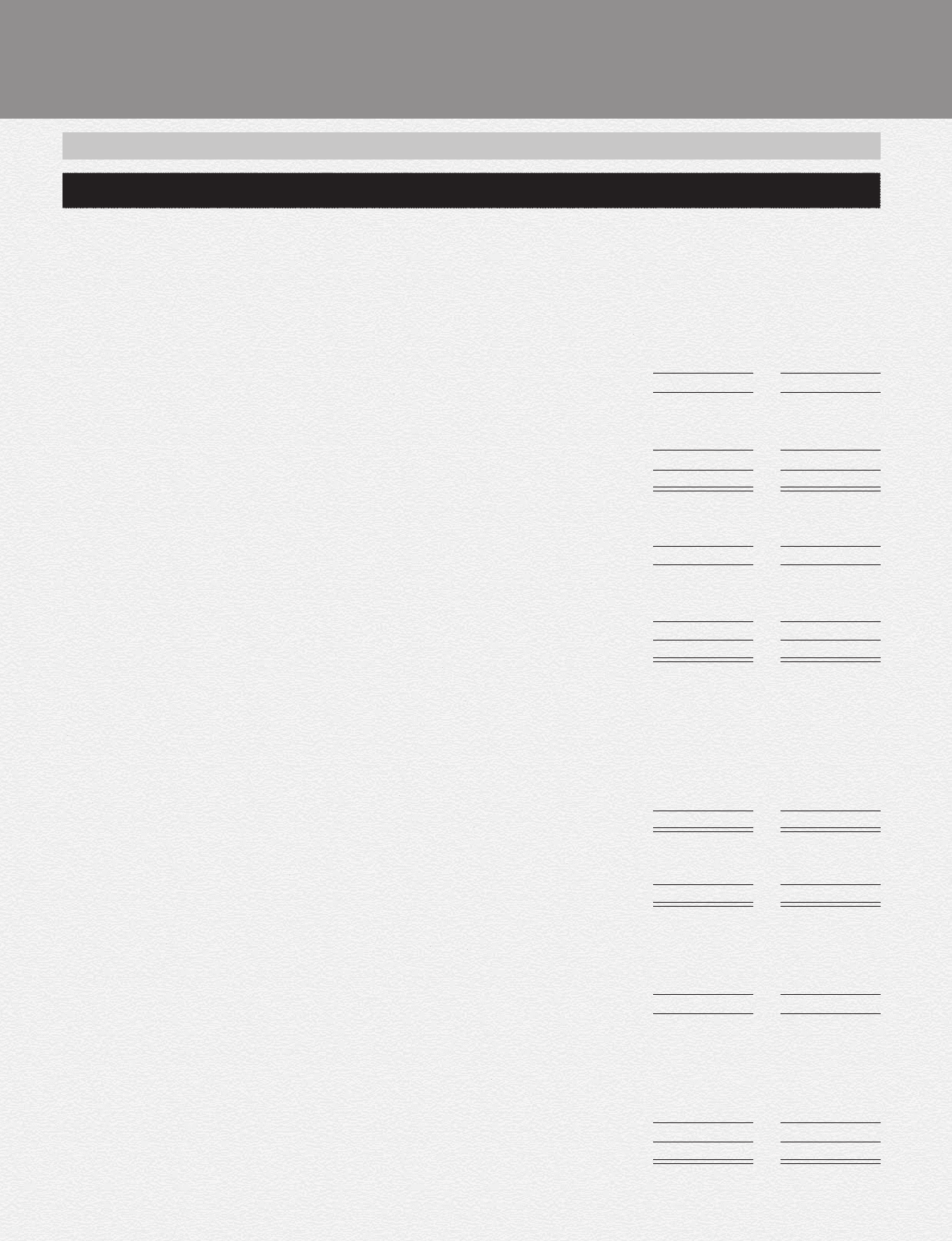

schedules

(Rs. in ‘000s)

forming part of the Consolidated Balance Sheet (Contd.)

As on

31.03.2009 As on

31.03.2008

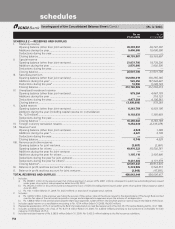

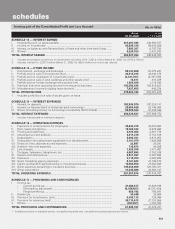

SCHEDULE 8 — INVESTMENTS

I. Investments in India (net of provisions)

i) Government securities .................................................................................... 682,931,198 786,560,746

ii) Other approved securities............................................................................... 93,405 97,946

iii) Shares (includes equity and preference shares)1 ........................................... 29,708,664 47,118,726

iv) Debentures and bonds ................................................................................... 52,956,402 49,447,032

v) Assets held to cover linked liabilities of life insurance business ................... 286,139,525 248,450,720

vi) Others (commercial paper, mutual fund units, pass through certificates,

security receipts etc.) ...................................................................................... 216,658,105 210,887,719

TOTAL INVESTMENTS IN INDIA .......................................................................... 1,268,487,299 1,342,562,889

II. Investments outside India (net of provisions)

i) Government securities .................................................................................... 4,525,830 40,899,298

ii) Others .............................................................................................................. 208,056,900 217,005,392

TOTAL INVESTMENTS OUTSIDE INDIA .............................................................. 212,582,730 257,904,690

TOTAL INVESTMENTS .................................................................................................. 1,481,070,029 1,600,467,579

III. Investments in India

Gross value of investments2 ................................................................................... 1,290,031,307 1,340,676,954

Less: Aggregate of provision/depreciation/(appreciation) .................................... 21,544,008 (1,885,935)

Net investments ...................................................................................................... 1,268,487,299 1,342,562,889

IV. Investments outside India

Gross value of investments .................................................................................... 234,903,006 267,772,200

Less: Aggregate of provision/depreciation/(appreciation) ..................................... 22,320,276 9,867,510

Net investments ..................................................................................................... 212,582,730 257,904,690

TOTAL INVESTMENTS .................................................................................................. 1,481,070,029 1,600,467,579

1. Includes acquisition cost of investment in associates of Rs. 459.2 million (March 31, 2008: Rs. 95.4 million).

2. Net of depreciation of Rs. 36,369.6 milion (net of appreciation, March 31, 2008: Rs. 19,534.4 million) on investments held to cover linked

liabilities of life insurance business.

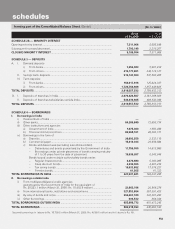

SCHEDULE 9 — ADVANCES (net of provisions)

A. i) Bills purchased and discounted ...................................................................... 40,915,231 47,896,278

ii) Cash credits, overdrafts and loans repayable on demand ............................. 350,610,312 351,458,670

iii) Term loans....................................................................................................... 2,167,574,693 2,009,110,336

iv) Securitisation, finance lease and hire purchase receivables .......................... 102,204,423 105,551,409

TOTAL ADVANCES ................................................................................................ 2,661,304,659 2,514,016,693

B. i) Secured by tangible assets (includes advances against book debts) ............ 2,009,647,889 1,928,756,159

ii) Covered by bank/government guarantees ...................................................... 14,815,009 42,087,202

iii) Unsecured ....................................................................................................... 636,841,761 543,173,332

TOTAL ADVANCES ................................................................................................ 2,661,304,659 2,514,016,693

C. I. Advances in India

i) Priority sector .......................................................................................... 620,515,976 597,325,197

ii) Public sector ............................................................................................ 3,494,486 3,559,887

iii) Banks ....................................................................................................... 252,580 45,947

iv) Others ...................................................................................................... 1,112,523,081 1,238,575,133

TOTAL ADVANCES IN INDIA ................................................................................ 1,736,786,123 1,839,506,164

II. Advances outside India

i) Due from banks ....................................................................................... 16,618,624 53,593,670

ii) Due from others

a) Bills purchased and discounted

...................................................... 14,069,137 21,006,755

b) Commercial loans............................................................................ 419,791,632 324,669,709

c) Others .............................................................................................. 474,039,143 275,240,395

TOTAL ADVANCES OUTSIDE INDIA .................................................................... 924,518,536 674,510,529

TOTAL ADVANCES ................................................................................................ 2,661,304,659 2,514,016,693