ICICI Bank 2009 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F67

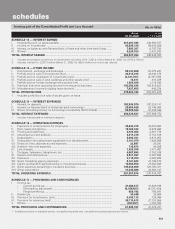

SCHEDULE 19

Notes forming part of the accounts

The following additional disclosures have been made taking into account the requirements of accounting standards and RBI

guidelines in this regard.

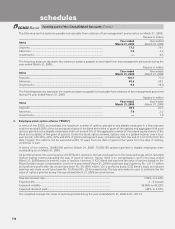

1. Earnings per Share (“EPS”)

Basic and diluted earnings per equity share are computed in accordance with Accounting Standard 20, “Earnings per Share”.

Basic earnings per share is computed by dividing net profit after tax by the weighted average number of equity shares

outstanding during the year. The diluted earnings per share is computed using the weighted average number of equity

shares and dilutive potential equity shares issued by the Group outstanding as at the end of the year.

The computation of earnings per share is given below.

Rupees in million, except per share data

Year ended

March 31, 2009 Year ended

March 31, 2008

Basic

Weighted average no. of equity shares outstanding.......................................... 1,113,129,213 1,055,591,068

Net profit ............................................................................................................. 35,769.5 33,982.3

Basic earnings per share (Rs.) ............................................................................ 32.13 32.19

Diluted

Weighted average no. of equity shares outstanding.......................................... 1,115,328,034 1,062,103,167

Net profit 35,763.5 33,982.3

Diluted earnings per share (Rs.) .......................................................................... 32.07 32.00

Face value per share (Rs.) ................................................................................... 10.00 10.00

The dilutive impact is mainly due to options granted to employees by the Group.

2. Related party transactions

The Group has transactions with its related parties comprising of associates/other related entities and key management

personnel and their relatives.

Associates/other related entities

Financial Information Network & Operations Limited, I-Process Services (India) Private Limited, I-Solutions Providers (India)

Private Limited, NIIT Institute of Finance Banking and Insurance Training Limited, ICICI Venture Value Fund, Comm Trade

Services Limited, Loyalty Solutions & Research Limited (upto March 31, 2008), Traveljini.com Limited (upto March 31,

2008), Contests2win.com India Private Limited1, Crossdomain Solutions Private Limited1, Transafe Services Limited1, Prize

Petroleum Company Limited1, Firstsource Solutions Limited (Bank’s holding is 24.79% as on March 31, 2009), and ICICI

Foundation for Inclusive Growth1.

1. With respect to entities, which have been identified as related parties during the year ended March 31, 2009, previous year’s

comparative figures have not been reported.

Key management personnel

K. V. Kamath, Chanda D. Kochhar, V. Vaidyanathan, Madhabi Puri Buch1, Sonjoy Chatterjee2, K. Ramkumar3, Kalpana Morparia4,

Nachiket Mor5.

Relatives of key management personnel

Rajalakshmi Kamath, Ajay Kamath, Ajnya Pai, Mohan Kamath, Deepak Kochhar, Arjun Kochhar, Aarti Kochhar, Mahesh Advani,

Varuna Karna, Sunita R. Advani, Jeyashree V., V. Satyamurthy, V. Krishnamurthy, K. Vembu, Dhaval Buch1, Kamal Puri1, Rama

Puri1, Ameeta Chatterjee2, Somnath Chatterjee2, Tarak Nath Chatterjee2, R. Shyam3, R. Suchithra3, J. Krishnaswamy3.

1. Transactions reported with effect from June 1, 2007 and upto January 31, 2009.

2. Transactions reported with effect from October 22, 2007.

3. Transactions reported with effect from February 1, 2009.

4. Transactions reported upto May 31, 2007.

5. Transactions reported upto October 18, 2007.

The following are the significant transactions of the Group with its associates/other related entities and key management

personnel. The material transactions are reported wherever the transaction with an entity exceeds 10% of the particular

category of transactions.

Insurance services

During the year ended March 31, 2009, the Group received insurance premium from associates/other related entities

amounting to Rs. 207.0 million (March 31, 2008: Rs. 116.8 million) and from key management personnel of the Bank

amounting to Rs. 0.3 million. The material transaction for the year ended March 31, 2009 was with Firstsource Solutions

Limited for Rs. 196.0 million (March 31, 2008: Rs. 107.2 million).

forming part of the Consolidated Accounts (Contd.)

schedules