ICICI Bank 2009 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F99

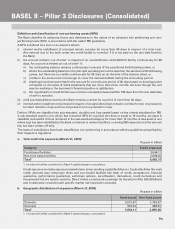

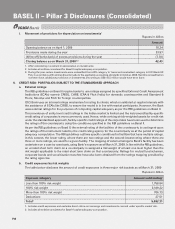

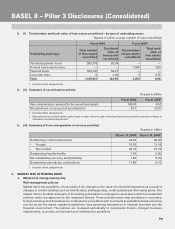

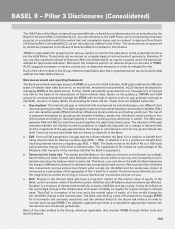

h. (i) Total number and book value of loan assets securitised – by type of underlying assets

Rupees in billion, except number of loans securitised

Fiscal 2008 Fiscal 20091

Underlying asset type

Total number

of loan assets

securitized

Total book

value of

loan assets

securitised

Total number

of loan assets

securitized

Total book

value of

loan assets

securitized

Vehicle/equipment loans 585,779 83.34 — —

Home & home equity loans — — 7,050 3.83

Personal loans 564,147 54.21 — —

Corporate loans 5 3.30 3 4.75

Total 1,149,931 140.85 7,053 8.58

1. Includes direct assignments.

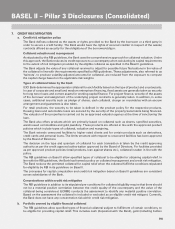

h. (ii) Summary of securitisation activity

Rupees in billion

Fiscal 2008 Fiscal 20091

Sale consideration received for the securitised assets 142.47 8.62

Net gain/(loss) on account of securitisation20.17 (3.21)

1. Includes direct assignments.

2. Represents loss booked upfront, gain/(loss) on deal closures, gain amortised during the period & expenses relating to

utilisation of credit enhancement.

h. (iii) Summary of form and quantum of services provided

Rupees in billion

March 31, 2008 March 31, 20091

Outstanding credit enhancement 44.86 40.92

– Funded 15.70 13.19

– Non-funded 29.16 27.73

Outstanding liquidity facility 7.74 6.85

Net outstanding servicing asset/(liability) 1.36 0.75

Outstanding subordinate contributions 11.80 9.15

1. Includes direct assignments.

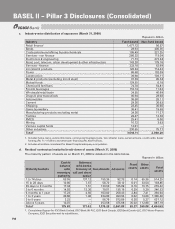

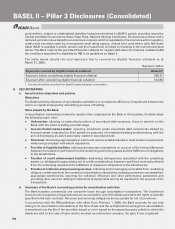

9. MARKET RISK IN TRADING BOOK

a. Market risk management policy

Risk management policies

Market risk is the possibility of loss arising from changes in the value of a financial instrument as a result of

changes in market variables such as interest rates, exchange rates, credit spreads and other asset prices. The

market risk for the Bank and each of its banking subsidiaries is managed in accordance with the investment

policies, which are approved by the respective Boards. These policies ensure that operations in securities,

foreign exchange and derivatives are conducted in accordance with sound and acceptable business practices

and are as per the extant regulatory guidelines, laws governing transactions in financial securities and the

financial environment. The policies are reviewed periodically to incorporate therein, changed business

requirements, economic environment and revised policy guidelines.

BASEL II – Pillar 3 Disclosures (Consolidated)