ICICI Bank 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

Management’s Discussion and Analysis

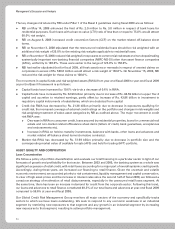

(US$ 402 million) from the AFS category of investments to ‘loans and receivables’ category. If these re-classifications

had not been made, ICICI Bank UK’s profit would have reduced by Rs. 2.45 billion [expense on fair value of financial

instruments through profit and loss would have increased by Rs. 2.69 billion (US$ 59 million) offset by change in

net interest income by Rs. 0.24 billion (US$ 5 million)].

ICICI Bank UK’s mark-to-market provisions against AFS investments adjusted against its shareholders’ equity

increased by post-tax amount of Rs. 8.31 billion (US$ 164 million) during fiscal 2009 to post-tax amount of

Rs. 13.43 billion (US$ 265 million) at year-end fiscal 2009. If the above re-classifications had not been made, these

provisions would have increased by a further pre-tax amount of Rs. 0.53 billion (US$ 11 million).

ICICI Bank Canada has made a profit of Rs. 1.39 billion in fiscal 2009 as compared to a loss of Rs. 0.57 billion

in fiscal 2008 due to increase in net interest income and income from investment banking and client-centric

derivative business. ICICI Bank Canada’s loss in fiscal 2008 was due to provision for mark-to-market loss and

other losses through the profit and loss account on investments, including asset backed commercial paper and

credit derivatives portfolio.

ICICI Prudential Life Insurance Company Limited (ICICI Life) incurred a loss of Rs. 7.80 billion in fiscal 2009 as

compared to Rs. 13.95 billion in fiscal 2008. The decline in the loss of ICICI Life was on account of higher renewal

premiums and lower new business premiums, resulting in lower upfront expenses and commission expenses,

together with rationalisation of various operating expenses. Life insurance companies incur losses in the initial

years mainly due to higher business set-up costs in the initial years of rapid growth, non-amortisation of acquisition

costs and reserving for actuarial liability in line with insurance company accounting norms. These factors have

resulted in statutory losses for the life insurance business since the company’s inception, as its business has grown

rapidly year on year. The impact on consolidated profits for fiscal 2009 on account of the loss is Rs. 5.77 billion.

ICICI Lombard General Insurance Company Limited (ICICI General) made a profit of Rs. 0.24 billion in fiscal 2009 as

compared to Rs. 1.03 billion in fiscal 2008 primarily due to decrease in premium rates on account of de-tariffing,

enhanced investments in technology architecture, brand building and offices in small towns, certain high value

claims and impairment provision on investments during fiscal 2009.

ICICI Prudential Asset Management Company made a profit of Rs. 7.1 million in fiscal 2009 as compared to

Rs. 821.0 million in fiscal 2008 primarily due to reduction in the average funds under management and expenses

towards scheme support.

ICICI Securities Limited made a profit of Rs. 0.04 billion in fiscal 2009 as compared to Rs. 1.51 billion in fiscal 2008

on account of sharp decline in brokerage volumes and corporate finance fees due to the unfavourable conditions

in domestic and international markets.

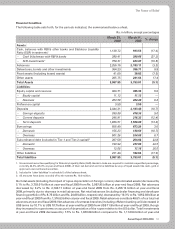

Consolidated assets of the Bank and its subsidiaries were Rs. 4,826.91 billion at year-end fiscal 2009 as against

Rs. 4,856.17 billion at year-end fiscal 2008. Consolidated advances of the Bank and its subsidiaries increased to

Rs. 2,661.30 billion at year-end fiscal 2009 from Rs. 2,514.02 billion at year-end fiscal 2008.

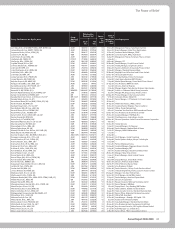

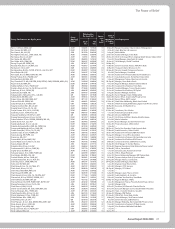

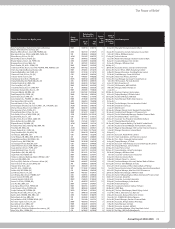

The following table sets forth, for the periods indicated, the profit/(loss) of our principal subsidiaries.

Rs. in billion

Fiscal 2008 Fiscal 2009

ICICI Bank UK PLC 1.55 0.31

ICICI Bank Canada (0.57) 1.39

ICICI Bank Eurasia Limited Liability Company (0.08) (0.07)

ICICI Prudential Life Insurance Company Limited (13.95) (7.80)

ICICI Lombard General Insurance Company Limited 1.03 0.24

ICICI Prudential Asset Management Company Limited 0.82 0.01

ICICI Securities Limited 1.51 0.04

ICICI Securities Primary Dealership Limited 1.40 2.72

ICICI Home Finance Company Limited 0.70 1.43

ICICI Venture Funds Management Company Limited 0.90 1.48