ICICI Bank 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

Management’s Discussion and Analysis

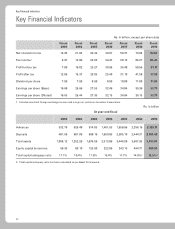

fiscal 2008 primarily due to the 15.5% decrease in SLR investments to Rs. 633.87 billion at year-end fiscal 2009 from

Rs. 750.31 billion at year-end fiscal 2008, offset, in part, by an increase in other investments by 8.9% to Rs. 396.71

billion at year-end fiscal 2009 from Rs. 364.23 billion at year-end fiscal 2008 which primarily includes investment in

international banking subsidiaries. SLR investments decreased primarily on account of reduction in domestic net

demand and time liabilities and a reduction of 100 basis points in SLR requirement from 25.0% to 24.0% during

fiscal 2009. Non-SLR investments include investment in security receipts in asset reconstruction companies of

Rs. 32.18 billion. At year-end fiscal 2009, we had a gross portfolio of funded credit derivatives of Rs. 18.41 billion

and non-funded credit derivatives of Rs. 38.71 billion.

Our equity share capital and reserves at year-end fiscal 2009 increased to Rs. 495.33 billion as compared to

Rs. 464.71 billion at year-end fiscal 2008 primarily due to annual accretion to reserves out of profits. Total deposits

decreased by 10.7% to Rs. 2,183.48 billion at year-end fiscal 2008 from Rs. 2,444.31 billion at year-end fiscal

2008 primarily due to the Bank’s conscious strategy of reducing wholesale deposits. Term deposits decreased to

Rs. 1,556.80 billion at year-end fiscal 2009 from Rs. 1,806.51 billion at year-end fiscal 2008. Our savings account

deposits increased to Rs. 410.36 billion at year-end fiscal 2009 from Rs. 390.89 billion at year-end fiscal 2008,

while current account deposits decreased to Rs. 216.32 billion at year-end fiscal 2009 from Rs. 246.91 billion at

year-end fiscal 2008. Borrowings (including subordinated debt) increased to Rs. 928.06 billion at year-end fiscal

2009 from Rs. 863.99 billion at year-end fiscal 2008 primarily due to capital-eligible borrowings, in the nature of

subordinated debt and the impact of rupee depreciation on foreign currency denominated borrowings.

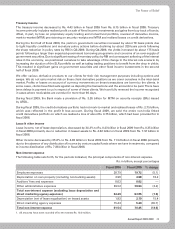

Off Balance Sheet Items, Commitments and Contingencies

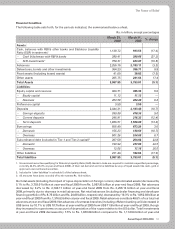

The table below sets forth, for the periods indicated the principal components of off-balance sheet items,

commitments and contingent liabilities.

Rs. in billion, except percentages

March 31,

2008 March 31,

2009 % change

Claims against the bank, not acknowledged as debts 40.31 32.82 (18.6)

Liability for partly paid investments 0.13 0.13 —

Notional principal amount of outstanding forward exchange contracts 3,071.71 2,583.67 (15.9)

Guarantees given on behalf of constituents 412.81 580.88 40.7

Acceptances, endorsements & other obligations 250.99 306.78 22.2

Notional principal amount of currency swaps 477.04 569.65 19.4

Notional amount of Interest rate swaps and currency options 7,665.29 4,146.35 (45.9)

Other items for which bank is contingently liable 192.54 126.55 (34.3)

Total 12,110.82 8,346.83 (31.1)

Off-balance sheet items, commitments and contingencies decreased by 31.1% or Rs. 3,763.99 billion to

Rs. 8,346.83 billion at year-end fiscal 2009 from Rs. 12,110.82 billion at year-end fiscal 2008 primarily due to a

45.9% decrease in notional principal amount of interest rate swaps and currency options and 15.9% decrease in

notional principal amount of outstanding forward exchange contracts.

We enter into foreign exchange forwards, options, swaps and other derivative products to enable customers to

transfer, modify or reduce their foreign exchange and interest rate risk and to manage our own interest rate and

foreign exchange positions. We manage our foreign exchange and interest rate risk with reference to limits set by

RBI and/ or internally. An interest rate swap does not entail exchange of notional principal and the cash flow arises

on account of the difference between interest rate pay and receive legs of the swaps which is generally much

smaller than the notional principal of the swap. With respect to the transactions entered into with customers, we

generally enter into off-setting transactions in the inter-bank market. This results in generation of a higher number

of outstanding transactions, and hence a large value of gross notional principal of the portfolio, while the net

market risk is low. For example, if a transaction entered into with a customer is covered by an exactly opposite

transaction entered into with counter-party, the net market risk of the two transactions will be zero whereas the

notional principal which is reflected as an off-balance sheet item will be sum of both the transactions.