ICICI Bank 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

Management’s Discussion and Analysis

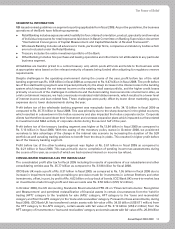

The key changes introduced by RBI under Pillar 1 of the Basel II guidelines during fiscal 2009 are as follows:

RBI on May 14, 2008 enhanced the limit of Rs. 2.0 million to Rs. 3.0 million in respect of bank loans for

residential purposes. Such loans with a loan-to-value (LTV) ratio of less than or equal to 75.0% would attract

50.0% risk weight.

RBI on August 8, 2008 increased credit conversion factors (CCF) on the market related off-balance sheet

items.

RBI on November 3, 2008 stipulated that the restructured residential loans should be risk weighted with an

additional risk weight of 25.0% to the existing risk weights applicable to residential loans.

RBI on November 15, 2008 reduced risk weights for exposures to commercial real estate and non-deposit taking

systemically important non-banking financial companies (NBFC-ND-SI) other than asset finance companies

(AFCs), uniformly to 100.0%. These were earlier in the range of 125.0% to 150.0%.

RBI had earlier stipulated that for fiscal 2009, all fresh sanctions or renewals in respect of unrated claims on

corporates in excess of Rs. 500.0 million would attract a risk weight of 150.0%. On November 15, 2008, RBI

reduced the risk weight for these claims to 100.0%.

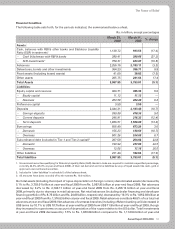

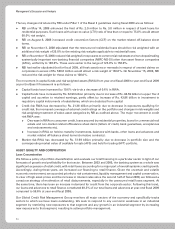

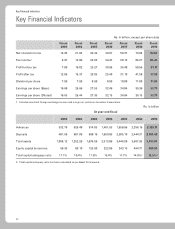

The movement in capital funds and risk weighted assets (RWA) from year-end fiscal 2008 to year-end fiscal 2009

as per the Basel II framework is as follows:

Capital funds have increased by 10.6% vis-à-vis a decrease of 0.6% in RWA.

Capital funds have increased by Rs. 52.96 billion primarily due to increase of Rs. 84.59 billion in upper Tier-2

capital and accretion to retained earnings, partly offset by increase of Rs. 43.86 billion in investment in

regulatory capital instruments of subsidiaries, which are deducted from capital.

Credit risk RWA has decreased by Rs. 21.38 billion primarily due to decrease in exposures qualifying for

credit risk, the increased coverage of external credit ratings on the portfolio and changes in risk weights and

risk weighting treatment of select asset categories by RBI as outlined above. The major movement in credit

risk RWA was:

Decrease in RWA on consumer credit, loans secured by residential properties, loans for commercial real

estate and non-market related off-balance sheet items (letters of credit, bank guarantees, acceptances

and endorsements etc).

Increase in RWA on held-to-maturity investments, balances with banks, other loans and advances and

market related off-balance sheet items (derivative contracts).

Market risk RWA has decreased by Rs. 51.69 billion primarily due to decrease in portfolio size and the

corresponding market value of available for sale (AFS) and held for trading (HFT) portfolio.

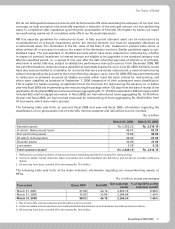

ASSET QUALITY AND COMPOSITION

Loan Concentration

We follow a policy of portfolio diversification and evaluate our total financing in a particular sector in light of our

forecasts of growth and profitability for that sector. Between 2003 and 2006, the banking system as a whole saw

significant expansion of retail credit, with retail loans accounting for a major part of overall systemic credit growth.

Accordingly, during these years, we increased our financing to retail finance. Given the uncertain and volatile

economic environment, we accorded priority to risk containment, liquidity management and capital conservation.

In view of high asset prices and the increase in interest rates since the second half of fiscal 2008, we followed a

conscious strategy of moderation of retail disbursements, especially in the unsecured retail loans segment. At

the same time, there has been an increase in demand for credit from the corporate sector. Following this trend,

our loans and advances to retail finance constituted 49.3% of our total loans and advances at year-end fiscal 2009

compared to 58.6% at year-end fiscal 2008.

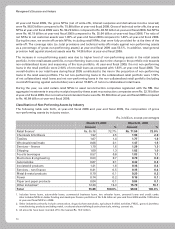

Our Global Credit Risk Management Group monitors all major sectors of the economy and specifically tracks

sectors to which we have loans outstanding. We seek to respond to any economic weakness in an industrial

segment by restricting new exposures to that segment and any growth in an industrial segment by increasing

new exposures to that segment, resulting in active portfolio management.