ICICI Bank 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F39

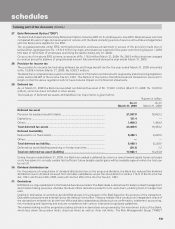

27. Early Retirement Option (“ERO”)

The Bank had implemented an Early Retirement Option Scheme 2003 for its employees in July 2003. All employees who had

completed 40 years of age and seven years of service with the Bank (including period of service with entities amalgamated

with the Bank) were eligible for the ERO.

The ex-gratia payments under ERO, terminations benefits and leave encashment in excess of the provision made (net of

tax benefits), aggregating to Rs. 1,910.0 million has been amortised over a period of five years commencing August 1, 2003

(the date of retirement of employees exercising the Option being July 31, 2003).

On account of the above ERO scheme, an amount of Rs. 118.0 million (March 31, 2008: Rs. 384.0 million) has been charged

to revenue being the balance of proportionate amount fully amortised during the year ended March 31, 2009.

28. Provision for income tax

The provision for income tax (including deferred tax and fringe benefit tax) for the year ended March 31, 2009 amounted

to Rs. 13,558.4 million (March 31, 2008: Rs. 8,953.7 million).

The Bank has a comprehensive system of maintenance of information and documents required by transfer pricing legislation

under section 92-92F of the Income Tax Act, 1961. The Bank is of the opinion that all international transactions are at arm’s

length so that the above legislation will not have material impact on the financial statements.

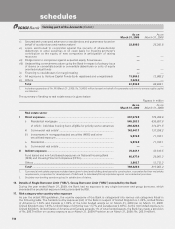

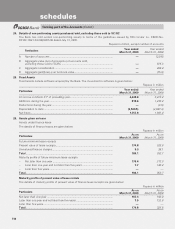

29. Deferred tax

As on March 31, 2009 the Bank has recorded net deferred tax asset of Rs. 17,923.1 million (March 31, 2008: Rs. 13,233.9

million), which has been included in other assets.

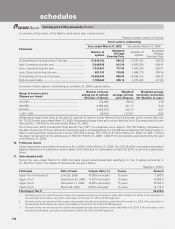

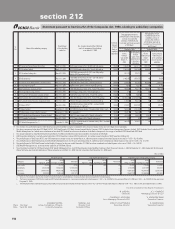

The break-up of deferred tax assets and liabilities into major items is given below:

Rupees in million

As on

March 31, 2009 As on

March 31, 2008

Deferred tax asset

Provision for bad and doubtful debts ........................................................... 21,597.8 18,043.3

Capital loss .................................................................................................... 131.4 —

Others ........................................................................................................... 1,680.3 1,409.9

Total deferred tax assets ............................................................................ 23,409.5 19,453.2

Deferred tax liability

Depreciation on fixed assets ........................................................................ 5,460.1 6,220.5

Others ........................................................................................................... ——

Total deferred tax liability ........................................................................... 5,460.1 6,220.5

Deferred tax asset/(liability) pertaining to foreign branches ......................... (26.3) 1.2

Total net deferred tax asset/(liability) ....................................................... 17,923.1 13,233.9

During the year ended March 31, 2009, the Bank has created a deferred tax asset on carry forward capital losses as based

on its firm plans it is virtually certain that sufficient future taxable capital gains will be available against which the loss can

be set off.

30. Dividend distribution tax

For the purpose of computation of dividend distribution tax on the proposed dividend, the Bank has reduced the dividend

distribution tax on dividend received from its Indian subsidiaries as per the amendment to section 115-O of the Income Tax

Act, 1961 vide Finance Bill, 2008, read with Section 294 of the Income Tax Act, 1961.

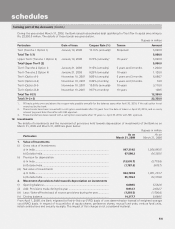

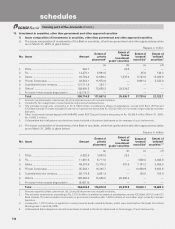

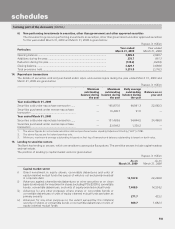

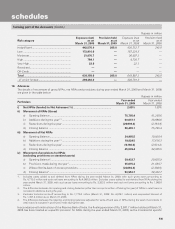

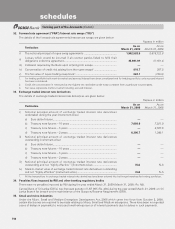

31. Derivatives

ICICI Bank is a major participant in the financial derivatives market. The Bank deals in derivatives for balance sheet management

and market making purposes whereby the Bank offers derivative products to its customers, enabling them to hedge their

risks.

Dealing in derivatives is carried out by identified groups in the treasury of the Bank based on the purpose of the transaction.

Derivative transactions are entered into by the treasury front office. Treasury middle office conducts an independent check of

the transactions entered into by the front office and also undertakes activities such as confirmation, settlement, accounting,

risk monitoring and reporting and ensures compliance with various internal and regulatory guidelines.

The market making and the proprietary trading activities in derivatives are governed by the investment policy of the Bank,

which lays down the position limits, stop loss limits as well as other risk limits. The Risk Management Group (“RMG”)

forming part of the Accounts (Contd.)

schedules