ICICI Bank 2009 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180

|

|

F86

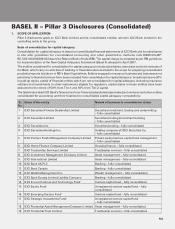

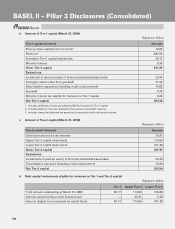

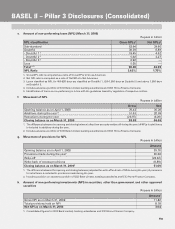

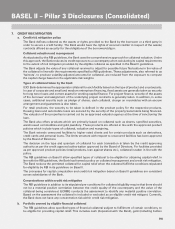

b. Amount of Tier-1 capital (March 31, 2009)

Rupees in billion

Tier-1 capital elements Amount

Paid-up share capital/common stock112.80

Reserves2487.93

Innovative Tier-1 capital instruments 30.17

Minority interest 0.35

Gross Tier-1 capital 531.26

Deductions:

Investment in paid-up equity of financial subsidiaries/associates 23.43

Intangible assets other than goodwill337.35

Securitisation exposures including credit enhancements 15.60

Goodwill 0.74

Minority interest not eligible for inclusion in Tier-1 capital 0.04

Net Tier-1 capital 454.10

1. Includes preference shares permitted by RBI for inclusion in Tier-1 capital.

2. Includes statutory reserves, disclosed free reserves and capital reserves.

3. Includes losses and deferred tax assets and unamortized early retirement options.

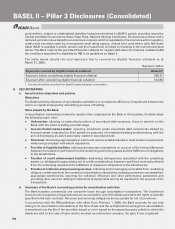

c. Amount of Tier-2 capital (March 31, 2009)

Rupees in billion

Tier-2 capital elements Amount

General provisions & loss reserves 16.91

Upper Tier-2 capital instruments 113.66

Lower Tier-2 capital instruments 101.40

Gross Tier-2 capital 231.97

Deductions :

Investments in paid-up equity of financial subsidiaries/associates 23.43

Securitisation exposure including credit enhancement 15.60

Net Tier-2 capital 192.94

d. Debt capital instruments eligible for inclusion in Tier-1 and Tier-2 capital

Rupees in billion

Tier-1 Upper Tier-2 Lower Tier-2

Total amount outstanding at March 31, 2009 30.17 113.66 126.80

Amount raised during current financial year — 45.21 5.20

Amount eligible to be reckoned as capital funds 30.17 113.66 101.40

BASEL II – Pillar 3 Disclosures (Consolidated)