ICICI Bank 2009 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F85

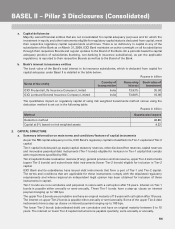

a. Capital deficiencies

Majority owned financial entities that are not consolidated for capital adequacy purposes and for which the

investment in equity and other instruments eligible for regulatory capital status is deducted from capital, meet

their respective regulatory capital requirements at all times. There is no deficiency in capital in any of the

subsidiaries of the Bank as on March 31, 2009. ICICI Bank maintains an active oversight on all its subsidiaries

through their respective Boards and regular updates to the Board of the Bank. On a periodic basis the capital

adequacy position of subsidiaries (banking, non-banking & insurance subsidiaries), as per the applicable

regulations, is reported to their respective Boards as well as to the Board of the Bank.

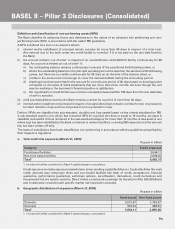

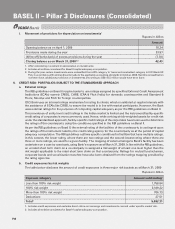

b. Bank’s interest in insurance entities

The book value of the Bank’s total interest in its insurance subsidiaries, which is deducted from capital for

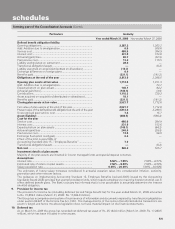

capital adequacy under Basel II is detailed in the table below.

Rupees in billion

Name of the entity Country of

incorporation Ownership

interest Book value of

investment

ICICI Prudential Life Insurance Company Limited India 73.93% 35.90

ICICI Lombard General Insurance Company Limited India 73.80% 10.96

The quantitative impact on regulatory capital of using risk weighted investments method versus using the

deduction method is set out in the following table:

Rupees in billion

Method Quantitative impact

Deduction method 46.86

Capital at 9% based on risk weighted assets 4.22

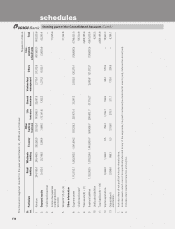

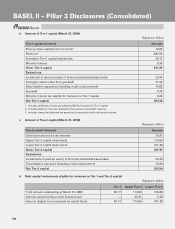

2. CAPITAL STRUCTURE

a. Summary information on main terms and conditions/features of capital instruments

As per the RBI capital adequacy norms, ICICI Bank’s regulatory capital is classified into Tier-1 capital and Tier-2

capital.

Tier-1 capital includes paid-up equity capital, statutory reserves, other disclosed free reserves, capital reserves

and innovative perpetual debt instruments (Tier-1 bonds) eligible for inclusion in Tier-1 capital that comply

with requirement specified by RBI.

Tier-2 capital includes revaluation reserves (if any), general provision and loss reserve, upper Tier-2 instruments

(upper Tier-2 bonds) and subordinate debt instruments (lower Tier-2 bonds) eligible for inclusion in Tier-2

capital.

ICICI Bank and its subsidiaries have issued debt instruments that form a part of Tier-1 and Tier-2 capital.

The terms and conditions that are applicable for these instruments comply with the stipulated regulatory

requirements and where required an independent legal opinion has been obtained for inclusion of these

instruments in capital.

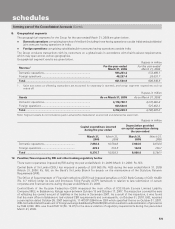

Tier-1 bonds are non-cumulative and perpetual in nature with a call option after 10 years. Interest on Tier-1

bonds is payable either annually or semi-annually. These Tier-1 bonds have a step-up clause on interest

payment ranging up to 100 bps.

The upper Tier-2 bonds are cumulative and have an original maturity of 15 years with call option after 10 years.

The interest on upper Tier-2 bonds is payable either annually or semi-annually. Some of the upper Tier-2 debt

instruments have a step-up clause on interest payment ranging up to 100 bps.

The lower Tier-2 bonds (subordinated debt) are cumulative and have an original maturity between 5 to 15

years. The interest on lower Tier-2 capital instruments is payable quarterly, semi-annually or annually.

BASEL II – Pillar 3 Disclosures (Consolidated)