ICICI Bank 2009 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2009 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180

|

|

F98

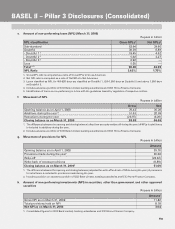

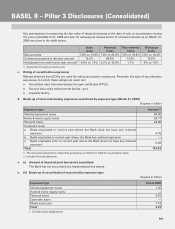

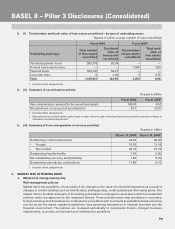

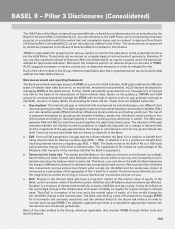

f. Break-up of aggregate amount of securitisation exposures retained or purchased by exposure type1

Rupees in billion

Exposure type March 31, 2009

Vehicle/equipment loans 35.41

Home & home equity loans 50.93

Personal loans 24.94

Corporate loans 4.15

Mixed asset pool 33.54

Total2,3 148.97

1. Securitisation exposures, include, but are not restricted to, securities, liquidity facilities, other commitments and credit

enhancements such as interest only strips, cash collateral accounts and other subordinated assets.

2. Includes direct assignments.

3. Net of provisions.

g. (i) Risk weight bands break-up of aggregate amount of securitisation exposures retained or

purchased

Rupees in billion

Risk weight bands March 31, 2009

Less than 100% 68.60

100% 48.61

More than 100% 0.56

Total1117.77

1. Includes direct assignments.

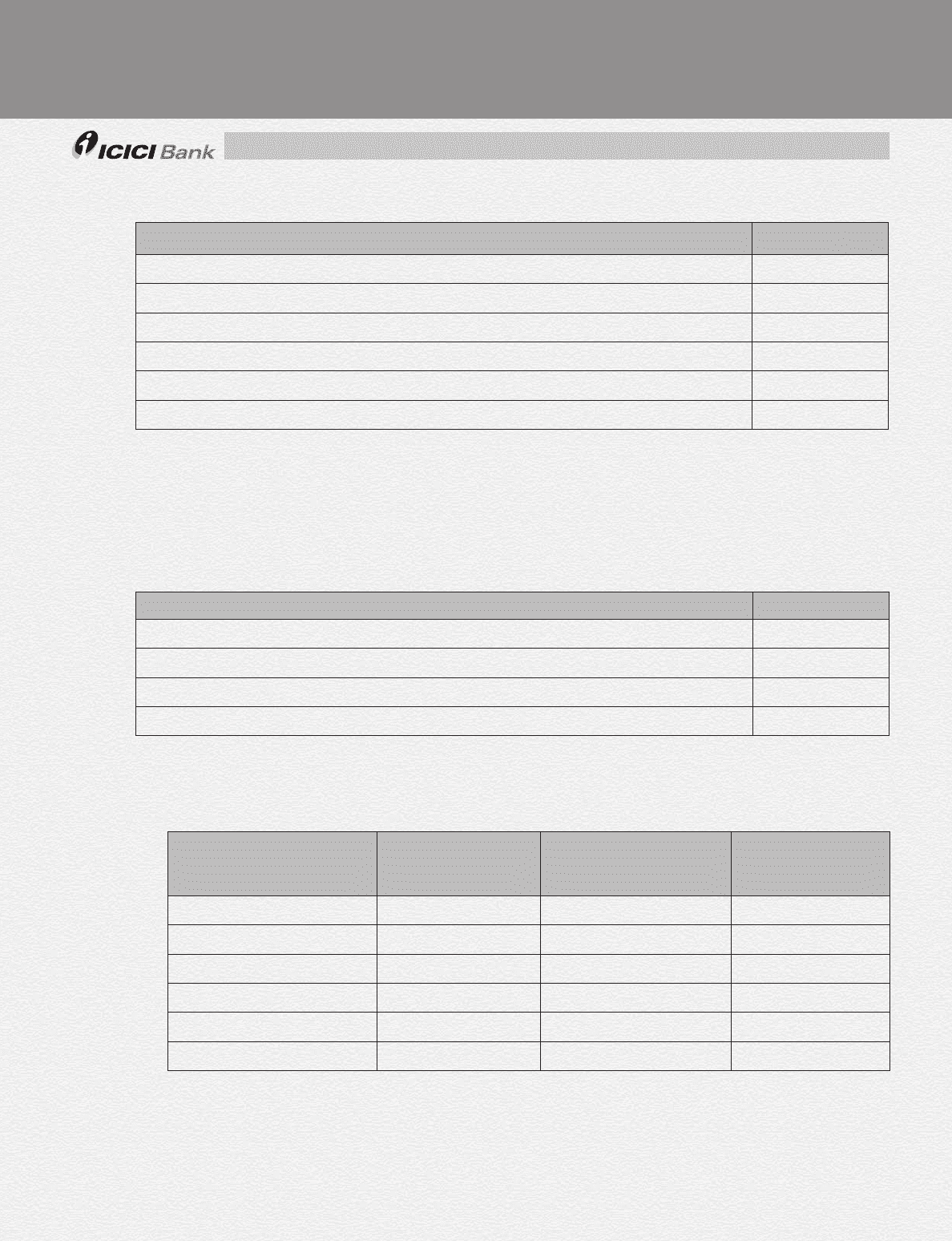

g. (ii) Break-up of securitisation exposures deducted from capital by exposure type

Rupees in billion

Exposure type

Exposures

deducted entirely

from Tier-1 capital1,4

Credit enhancement

(interest only) deducted

from total capital2,4

Other exposures

deducted from total

capital 3,4

Vehicle/equipment loans — 1.55 7.96

Home & home equity loans — 0.07 2.09

Personal loans — 2.39 7.32

Corporate loans — — —

Mixed assets — 0.42 9.39

Total — 4.43 26.76

1. This includes gain on sale of assets.

2. Includes subordinate contribution amount deducted from capital.

3. Includes credit enhancements and capital deducted on PTCs originated by ICICI Bank as well as devolved PTCs & PTCs

purchased in case of third party originated securitisation transactions.

4. Includes direct assignments.

BASEL II – Pillar 3 Disclosures (Consolidated)