Xerox 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

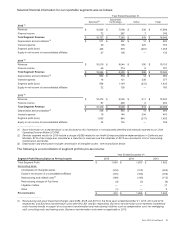

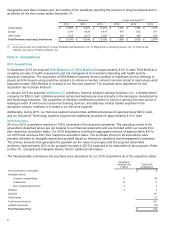

Selected financial information for our reportable segments was as follows:

Year Ended December 31,

Services(2) Document

Technology Other Total

2015 (1)

Revenue $10,065 $7,098 $536 $17,699

Finance income 72 267 7 346

Total Segment Revenue $10,137 $7,365 $543 $18,045

Depreciation and amortization(3) $571 $297 $12$

880

Interest expense 20 108 225 353

Segment profit (loss) 446 879 (267)1,058

Equity in net income of unconsolidated affiliates 27 108 — 135

2014 (1)

Revenue $10,519 $8,044 $590 $19,153

Finance income 65 314 8 387

Total Segment Revenue $10,584 $8,358 $598 $19,540

Depreciation and amortization(3) $602 $334 $14$

950

Interest expense 18 121 238 377

Segment profit (loss) 956 1,149 (272)1,833

Equity in net income of unconsolidated affiliates 32 128 — 160

2013 (1)

Revenue $10,412 $8,500 $611 $19,523

Finance income 67 408 8 483

Total Segment Revenue $10,479 $8,908 $619 $20,006

Depreciation and amortization(3) $536 $345 $14$

895

Interest expense 19 140 244 403

Segment profit (loss) 1,055 964 (217)1,802

Equity in net income of unconsolidated affiliates 34 135 — 169

____________________________

(1) Asset information on a segment basis is not disclosed as this information is not separately identified and internally reported to our Chief

Operating Decision Maker (CODM).

(2) Services segment results for 2015 include a charge of $389 related to our Health Enterprise platform implementations in California and

Montana. $116 of the charge was recorded as a reduction to revenues and the remainder of $273 was recorded to Cost of outsourcing,

maintenance and rentals.

(3) Depreciation and amortization excludes amortization of intangible assets - see reconciliation below.

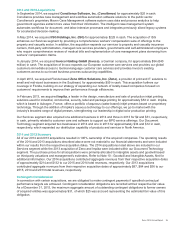

The following is a reconciliation of segment profit to pre-tax income:

Year Ended December 31,

Segment Profit Reconciliation to Pre-tax Income 2015 2014 2013

Total Segment Profit $1,058 $1,833 $1,802

Reconciling items:

Amortization of intangible assets (310)(315)(305)

Equity in net income of unconsolidated affiliates (135)(160)(169)

Restructuring and related costs(1) (196)(149)(115)

Restructuring charges of Fuji Xerox (4) (3) (9)

Litigation matters ——37

Other (1) —2

Pre-tax Income $412 $1,206 $1,243

____________________________

(1) Restructuring and asset impairment charges were $186, $128, and $115 for the three years ended December 31, 2015, 2014 and 2013,

respectively, and Business transformation costs were $10, $21 and $0, respectively. Business transformation costs represent incremental

costs incurred directly in support of our business transformation and restructuring initiatives such as compensation costs for overlapping

staff, consulting costs and training costs. Business transformation costs were not applicable in 2013.

Xerox 2015 Annual Report 82