Xerox 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

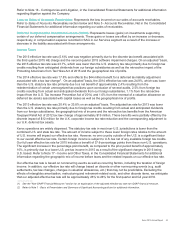

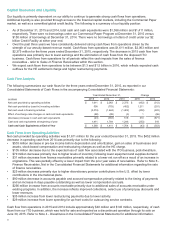

due to economic instability and, price declines of approximately 5%. 2013 benefited from the ConnectKey mid-

range product launch, and the refresh cycle for several large accounts. Equipment sales in 2014 were

negatively impacted by lower sales in Russia due to economic instability.

• Annuity revenue decreased by 5%, with no impact from currency. The decrease reflects a modest decline in

total pages, weakness in developing markets and entry products due to product launch timing, a continued

decline in financing revenue as a result of prior period sales of finance receivables and lower receivables

balance due to lower originations. The overall decrease in Financing revenue from prior year contributed 1-

percentage point to the Annuity revenue decline and 1-percentage point impact to the overall Document

Technology revenue decline. Annuity revenue was also impacted by the continued migration of customers to

our partner print services offerings (included in our Services segment). Total digital page volumes declined 4%

despite a 2% increase in digital MIF.

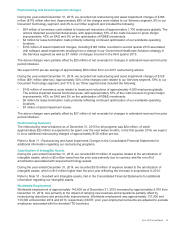

Segment Margin 2014

Document Technology segment margin of 13.7% increased 2.9-percentage points from prior year. The increase

was primarily driven by a 1.5-percentage point increase in gross margin as the benefits from restructuring and

productivity, lower pension expense, and favorable currency on Yen-based purchases and revenue mix more than

offset moderate price declines and the impact of lower financing revenues. SAG decreased as a percent of

revenue as lower pension and bad debt expense as well as benefits from restructuring and productivity

improvements more than offset the impact of overall lower revenues.

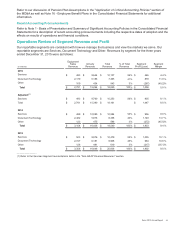

Installs 2014

Entry

• 7% decrease in color multifunction devices.

• Entry color printers flat.

• 23% decrease in entry black-and-white multifunction devices driven by declines in all geographies.

Mid-Range

• 1% increase in installs of mid-range color devices reflects benefits from the newly launched WorkCentre 7970

and entry production devices partially offset by timing of large account sales.

• 13% decrease in installs of mid-range black-and-white devices is consistent with overall market declines.

High-End

• 7% decrease in installs of high-end color systems. Excluding Fuji Xerox growth in digital front-end (DFE)

sales, high-end color installs increased 6% with growth in iGen and the new Versant product.

• 13% decrease in installs of high-end black-and-white systems, reflecting continued declines in the overall

market.

Other

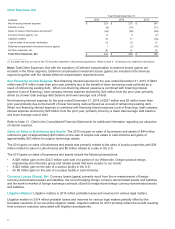

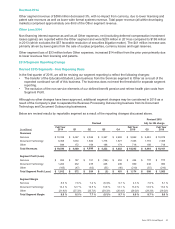

Revenue 2015

Other segment revenue of $543 million decreased 9%, with no impact from currency, due primarily to lower wide

format revenues, paper sales as well as networking hardware and integration services revenues. Total paper

revenue (all within developing markets) comprised nearly 40% of the Other segment revenue.

Other Loss 2015

Non-financing interest expense as well as all Other expenses, net (excluding deferred compensation investment

losses (gains)) are reported within the Other segment and were $232 million in 2015 as compared to $239 million

in 2014. The $7 million decrease from the prior year was primarily due to lower non-financing interest expense.

Other segment loss of $35 million before Other expenses, increased $2 million from the prior year.

49