Xerox 2015 Annual Report Download - page 69

Download and view the complete annual report

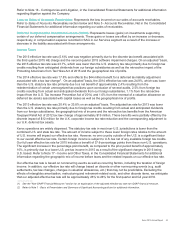

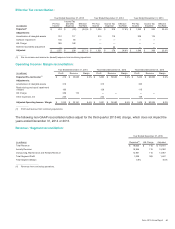

Please find page 69 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net cash provided by operating activities was $2,063 million for the year ended December 31, 2014. The $312

million decrease in operating cash from 2013 was primarily due to the following:

• $598 million decrease from finance receivables primarily related to the impact from prior period sales of

receivables partially offset by higher net run-off due to lower lease originations. Refer to Note 6 - Finance

Receivables, Net in the Consolidated Financial Statements for additional information regarding the sale of

finance receivables.

• $54 million decrease due to higher contributions to our defined benefit pension plans.

• $157 million increase due to higher accounts payable and accrued compensation primarily related to the timing

of accounts payable payments and improved payment terms with key suppliers.

• $92 million increase from accounts receivable primarily due to the timing of collections and improved collections

partially offset by the impact from quarterly revenue changes.

• $42 million increase from lower spending for product software and up-front costs for outsourcing service

contracts.

• $34 million increase due to lower net income tax payments primarily due to refunds in 2014 of prior years.

• $20 million increase from lower installs of equipment on operating leases.

Cash flow from operations in 2014 and 2013 include approximately $145 million and $130 million, respectively, of

cash flows from our ITO business, which was reported as a discontinued operation through its sale June 30, 2015.

Refer to Note 4 - Divestitures in the Consolidated Financial Statements for additional information.

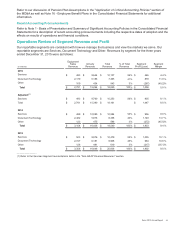

Cash Flows from Investing Activities

Net cash provided by investing activities was $508 million for the year ended December 31, 2015. The $1,211 million

increase in cash from 2014 was primarily due to the following:

• $936 million of net proceeds from the sale of the ITO business. Refer to Note - 4 Divestitures, in the

Consolidated Financial Statements for additional information.

• $130 million change from acquisitions. 2015 acquisitions include RSA medical for $141 million, Intrepid Learning

Solutions, Inc. for $28 million and $41 million for other acquisitions. 2014 acquisitions include ISG Holdings, Inc.

for $225 million, Invoco Holding GmbH for $54 million, Consilience Software, Inc. for $25 million and $36 million

for other acquisitions.

• $110 million due to lower capital expenditures (including internal use software) partly due to the sale of the ITO

business.

• $39 million of higher proceeds primarily from the sale of surplus property and assets in the U.S. and Latin

America.

Capital expenditures (including internal use software) in 2015 and 2014 include approximately $40 million and $100

million, respectively, for our ITO business, which was held for sale and reported as a discontinued operation

through June 30, 2015. Refer to Note 4 - Divestitures in the Consolidated Financial Statements for additional

information.

Net cash used in investing activities was $703 million for the year ended December 31, 2014. The $251 million

increase in the use of cash from 2013 was primarily due to the following:

• $185 million increase in acquisitions. 2014 acquisitions include ISG Holdings, Inc. for $225 million, Invoco

Holding GmbH for $54 million, Consilience Software, Inc. for $25 million and three smaller acquisitions for $36

million. 2013 acquisitions include Zeno Office Solutions, Inc. for $59 million, Impika for $53 million and four

smaller acquisitions totaling $43 million.

• $32 million increase primarily due to lower proceeds from the sale of assets. 2014 includes proceeds from the

sale of surplus facilities in Latin America of $42 million. 2013 includes proceeds from the sale of a U.S. facility of

$38 million and the sale of portions of our Wilsonville, Oregon operation and related assets of $33 million.

• $25 million increase due to higher capital expenditures (including internal use software).

Capital expenditures (including internal use software) in 2014 and 2013 include approximately $100 million in each

year associated with our ITO business, which was held for sale and reported as a discontinued operation through its

sale on June 30, 2015. Refer to Note 4 - Divestitures in the Consolidated Financial Statements for additional

information.

Cash Flows from Financing Activities

Net cash used in financing activities was $2,074 million for the year ended December 31, 2015. The $450 million

increase in the use of cash from 2014 was primarily due to the following:

Xerox 2015 Annual Report 52