Xerox 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

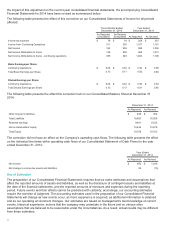

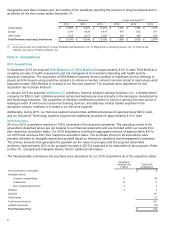

Other Updates

In 2015 and 2014, the FASB also issued the following Accounting Standards Updates which are not expected to

have a material impact on our financial condition, results of operations or cash flows when adopted in future periods.

Those updates are as follows:

• Business Combinations: ASU 2015-16, Accounting for Measurement Period Adjustments in a Business

Combination, which is effective for our fiscal year beginning January 1, 2016.

• Inventory: ASU 2015-11, Simplifying the Subsequent Measurement of Inventory, which is effective for our

fiscal year beginning January 1, 2017.

• Fair Value Measurements: ASU 2015-07, Disclosures for Investments in Certain Entities That Calculate

Net Asset Value per Share (or its Equivalent), which is effective for our fiscal year beginning January 1,

2016.

• Intangibles - Goodwill and Other - Internal Use Software: ASU 2015-05, Intangibles-Goodwill and Other-

Internal Use Software - Customer's Accounting for Fees Paid in a Cloud Computing Arrangement, which is

effective for our fiscal year beginning January 1, 2016.

• Consolidation: ASU 2015-02, Consolidation (Topic 810): Amendments to the Consolidation Analysis. This

update is effective for our fiscal year beginning January 1, 2016 with early adoption permitted, and is applied

on a modified retrospective basis.

• Income Statement: ASU 2015-01, Income Statement - Extraordinary and Unusual Items (Subtopic

225-20) - Simplifying Income Statement Presentation by Eliminating the Concept of Extraordinary Items. The

standard primarily involves presentation and disclosure.

• Derivatives and Hedging: ASU 2014-16, Derivatives and Hedging (Topic 815) - Determining Whether the

Host Contract in a Hybrid Financial Instrument Issued in the Form of a Share Is More Akin to Debt or to

Equity, which is effective for our fiscal year beginning January 1, 2016.

• Disclosures of Going Concern Uncertainties: ASU 2014-15, Presentation of Financial Statements -

Going Concern (Subtopic 205-40); Disclosure of Uncertainties about an Entity’s Ability to Continue as a

Going Concern, which is effective for our fiscal year beginning January 1, 2016.

• Stock Compensation: ASU 2014-12, Compensation - Stock Compensation (Topic 718): Accounting for

Share-Based Payments When the Terms of an Award Provide that a Performance Target Could be Achieved

after the Requisite Service Period, which is effective for our fiscal year beginning January 1, 2016.

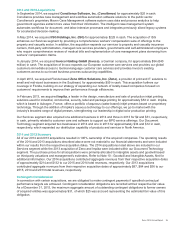

Summary of Accounting Policies

Revenue Recognition

We generate revenue through services, the sale and rental of equipment, supplies and income associated with the

financing of our equipment sales. Revenue is recognized when it is realized or realizable and earned. We consider

revenue realized or realizable and earned when we have persuasive evidence of an arrangement, delivery has

occurred, the sales price is fixed or determinable and collectibility is reasonably assured. Delivery does not occur

until equipment has been shipped or services have been provided to the customer, risk of loss has transferred to the

customer, and either customer acceptance has been obtained, customer acceptance provisions have lapsed, or the

company has objective evidence that the criteria specified in the customer acceptance provisions have been

satisfied. The sales price is not considered to be fixed or determinable until all contingencies related to the sale have

been resolved. More specifically, revenue related to services and sales of our products is recognized as follows:

Equipment-Related Revenues

Equipment: Revenues from the sale of equipment, including those from sales-type leases, are recognized at the

time of sale or at the inception of the lease, as appropriate. For equipment sales that require us to install the product

at the customer location, revenue is recognized when the equipment has been delivered and installed at the

customer location. Sales of customer installable products are recognized upon shipment or receipt by the customer

according to the customer's shipping terms. Revenues from equipment under other leases and similar arrangements

are accounted for by the operating lease method and are recognized as earned over the lease term, which is

generally on a straight-line basis.

Technical Services: Technical service revenues are derived primarily from maintenance contracts on the equipment

sold to our customers and are recognized over the term of the contracts. A substantial portion of our products are

sold with full service maintenance agreements for which the customer typically pays a base service fee plus a

variable amount based on usage. As a consequence, other than the product warranty obligations associated with

Xerox 2015 Annual Report 74