Xerox 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

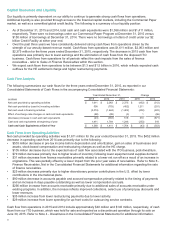

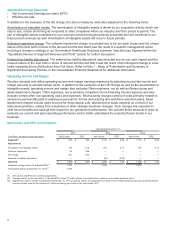

(1) Financing debt includes $3,490 million and $3,722 million as of December 31, 2015 and December 31, 2014, respectively, of debt associated

with Total finance receivables, net and is the basis for our calculation of “Equipment financing interest” expense. The remainder of the

financing debt is associated with Equipment on operating leases.

In 2015, we expect to continue the leveraging of our finance assets at an assumed 7:1 ratio of debt to equity. The

following summarizes our total debt at December 31, 2015 and 2014:

December 31,

(in millions) 2015 2014

Principal debt balance(1) $7,365 $ 7,722

Net unamortized discount (52)(54)

Fair value adjustments(2)

- terminated swaps 47 68

- current swaps 75

Total Debt $7,367 $ 7,741

_________

(1) Balance at December 31, 2015 and 2014 includes $3 million and $1 million of Notes Payable and $0 million and $150 of Commercial Paper,

respectively.

(2) Fair value adjustments include the following: (i) fair value adjustments to debt associated with terminated interest rate swaps, which are

being amortized to interest expense over the remaining term of the related notes; and (ii) changes in fair value of hedged debt obligations

attributable to movements in benchmark interest rates. Hedge accounting requires hedged debt instruments to be reported inclusive of any

fair value adjustment.

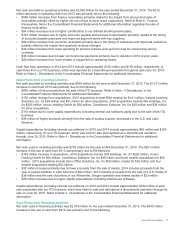

Sales of Accounts Receivable

Accounts receivable sales arrangements are utilized in the normal course of business as part of our cash and

liquidity management. We have financial facilities in the U.S., Canada and several countries in Europe that enable us

to sell certain accounts receivables without recourse to third-parties. The accounts receivables sold are generally

short-term trade receivables with payment due dates of less than 60 days.

Refer to Note 5 - Accounts Receivable, Net in the Consolidated Financial Statements for additional information.

Sales of Finance Receivables

In 2013 and 2012, we transferred our entire interest in certain groups of lease finance receivables to third-party

entities. The transfers were accounted for as sales and resulted in the de-recognition of lease receivables with a net

carrying value of $676 million in 2013 and $682 million in 2012, and associated pre-tax gains of $40 million and $44

million, respectively. There have been no sales since 2013. We continue to service the sold receivables and record

servicing fee income over the expected life of the associated receivables.

Refer to Note 6 - Finance Receivables, Net in the Consolidated Financial Statements for additional information.

Capital Market Activity

Refer to Note 13 - Debt in the Consolidated Financial Statements for additional information.

Financial Instruments

Refer to Note 14 - Financial Instruments in the Consolidated Financial Statements for additional information.

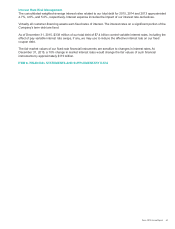

Share Repurchase Programs - Treasury Stock

During 2015, we repurchased 115.2 million shares of our common stock for an aggregate cost of $1.3 billion,

including fees.

Refer to Note 20 - Shareholders’ Equity – Treasury Stock in the Consolidated Financial Statements for additional

information regarding our share repurchase programs.

Dividends

The Board of Directors declared aggregate dividends of $299 million, $293 million and $287 million on common

stock in 2015, 2014 and 2013, respectively. The increase in 2015 as compared to prior years is primarily due to the

Xerox 2015 Annual Report 54