Xerox 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Instruments - Classification and Measurement

In January 2016, the FASB issued ASU 2016-01, Financial Instruments - Recognition and Measurement of Financial

Instruments and Financial Liabilities. This update requires that equity investment (except those accounted for under

the equity method of accounting or those that result in consolidation of the investee) be measured at fair value with

changes in fair value recognized in net income. The amendments in this update also simplify the impairment

assessment of equity investments without readily determinable fair values. In addition, the amendments in this

update require disclosure of fair value for financial instruments held at amortized cost. The amendments also require

separate presentation of financial assets and financial liabilities by measurement category and form of financial asset

(that is, securities or loans and receivables). This update is effective for our fiscal year beginning January 1, 2018.

The provisions within the update relate to instrument-specific credit risk when the fair value option is elected maybe

early adopted. We are currently evaluating the impact of our pending adoption of ASU 2016-01 on our consolidated

financial statements.

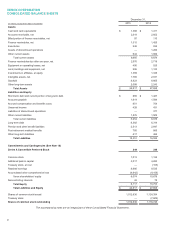

Accounting for Income Taxes: Balance Sheet Presentation of Deferred Taxes

In November 2015, the FASB issued ASU 2015-17, Income Taxes: Balance Sheet Classification of Deferred Taxes.

This update, which simplifies the presentation of deferred income taxes, requires that deferred tax liabilities and

assets be classified as non-current in a classified statement of financial position. As allowed by the update, we early

adopted ASU 2015-17 effective December 31, 2015 on a prospective basis. Adoption of this update resulted in a

reclassification of our net current deferred tax asset and liabilities to the net non-current deferred tax asset and

liabilities in our Consolidated Balance Sheet as of December 31, 2015. Prior periods were not retrospectively

adjusted. The current requirement that deferred tax liabilities and assets of a tax-paying component (jurisdiction) of

an entity be offset and presented as a single amount is not affected by this update.

Interest

In April 2015, the FASB issued ASU 2015-03, Interest - Imputation of Interest (Subtopic 835-30): Simplifying the

Presentation of Debt Issuance Costs. This update requires that debt issuance costs related to a recognized debt

liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability,

consistent with debt discounts. In August 2015, the FASB issued ASU 2015-15, which indicated that the SEC staff

would not object to an entity deferring and presenting debt issuance costs associated with a line-of-credit

arrangement as an asset and subsequently amortizing those costs ratably over the term of the line-of-credit

arrangement, regardless of whether there are any outstanding borrowings. All of our debt issuance costs are

currently reported as deferred charges in Other long-term assets and were $32 at December 31, 2015, $4 of which is

related to our credit agreement. This update was effective for our fiscal year beginning January 1, 2016. Upon

adoption of this update, we will reclassify approximately $28 of debt issuance costs to long-term debt. Prior periods

will be retroactively revised. The costs associated with our credit agreement will continue to be reported as a

deferred charge in Other long-term assets. The adoption of this standard is not expected to have a material effect on

our financial condition, results of operations or cash flows.

Discontinued Operations

In April 2014, the FASB issued ASU 2014-08, Presentation of Financial Statements (Topic 205) and Property, Plant,

and Equipment (Topic 360): Reporting Discontinued Operations and Disclosures of Disposals of Components of an

Entity. The update changes the requirements for reporting discontinued operations in Subtopic 205-20. A

discontinued operation may include a component of an entity or a group of components of an entity, or a business. A

disposal of a component of an entity or a group of components of an entity is required to be reported in discontinued

operations if the disposal represents a strategic shift that has (or will have) a major effect on an entity’s operations

and financial results. Examples include a disposal of a major geographic area, a major line of business or a major

equity method investment. Additionally, the update requires expanded disclosures about discontinued operations that

will provide financial statement users with more information about the assets, liabilities, income and expenses of

discontinued operations. This update was effective prospectively for our fiscal year beginning January 1, 2015. The

standard primarily involves presentation and disclosure and, therefore, is not expected to have a material impact on

our financial condition, results of operations or cash flows.

Service Concession Arrangements

In January 2014, the FASB issued ASU 2014-05, Service Concession Arrangements (Topic 853). This update

specifies that an entity should not account for a service concession arrangement within the scope of this update as a

lease in accordance with Topic 840, Leases. The update was effective for our fiscal year beginning January 1, 2015.

The adoption of this standard did not have a material effect on our financial condition, results of operation or cash

flows.

73