Xerox 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

resolution rates, the aging of receivables, credit quality indicators and the financial health of specific customer

classes or groups. The allowance for doubtful finance receivables is inherently more difficult to estimate than the

allowance for trade accounts receivable because the underlying lease portfolio has an average maturity, at any

time, of approximately two to three years and contains past due billed amounts, as well as unbilled amounts. We

consider all available information in our quarterly assessments of the adequacy of the allowance for doubtful

accounts. The identification of account-specific exposure is not a significant factor in establishing the allowance for

doubtful finance receivables. Our policy and methodology used to establish our allowance for doubtful accounts

has been consistently applied over all periods presented.

Since our allowance for doubtful finance receivables is determined by country, the risk characteristics in our

finance receivable portfolio segments will generally be consistent with the risk factors associated with the

economies of those countries/regions. Loss rates declined in the U.S. reflecting the effects of improved collections

during 2015 and 2014 as well as the lower balance of finance receivables primarily due to sales in 2013 and 2012.

Since Europe is comprised of various countries and regional economies, the risk profile within our European

portfolio segment is somewhat more diversified due to the varying economic conditions among and within the

countries. Charge-offs in Europe were $17 in 2015 as compared to $29 in the prior year, reflecting a significant

improvement from the credit issues that began back in 2011. Loss rates peaked in 2011 as a result of the

European economic challenges particularly for countries in the southern region.

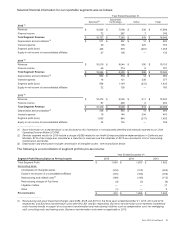

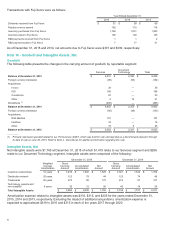

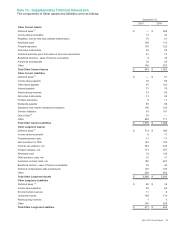

The following table is a rollforward of the allowance for doubtful finance receivables as well as the related investment

in finance receivables:

Allowance for Credit Losses: United States Canada Europe Other(3) Total

Balance at December 31, 2013 $ 45$ 22$ 81$ 6$154

Provision —915933

Charge-offs (5) (14)(29)(3)

(51)

Recoveries and other(1) 1 3 (9) — (5)

Balance at December 31, 2014 41 20 58 12 131

Provision 5 6 10 728

Charge-offs (5) (10)(17)(4)

(36)

Recoveries and other(1) 1 1 (6) (1) (5)

Balance at December 31, 2015 $ 42$ 17$ 45$ 14$ 118

Finance Receivables Collectively Evaluated for

Impairment:

December 31, 2014(2) $1,728 $424 $1,835 $398 $4,385

December 31, 2015(2) $1,731 $365 $1,509 $501 $4,106

__________

(1) Includes the impacts of foreign currency translation and adjustments to reserves necessary to reflect events of non-payment such as

customer accommodations and contract terminations.

(2) Total Finance receivables exclude the allowance for credit losses of $118 and $131 at December 31, 2015 and 2014, respectively.

(3) Includes developing market countries and smaller units.

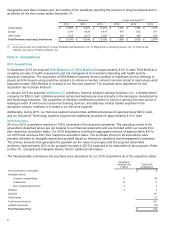

In the U.S. and Canada, customers are further evaluated or segregated by class based on industry sector. The

primary customer classes are Finance & Other Services, Government & Education; Graphic Arts; Industrial;

Healthcare and Other. In Europe, customers are further grouped by class based on the country or region of the

customer. The primary customer classes include the U.K./Ireland, France and the following European regions -

Central, Nordic and Southern. These groupings or classes are used to understand the nature and extent of our

exposure to credit risk arising from finance receivables.

We evaluate our customers based on the following credit quality indicators:

• Investment grade: This rating includes accounts with excellent to good business credit, asset quality and the

capacity to meet financial obligations. These customers are less susceptible to adverse effects due to shifts in

economic conditions or changes in circumstance. The rating generally equates to a Standard & Poors (S&P)

rating of BBB- or better. Loss rates in this category are normally minimal at less than 1%.

89