Xerox 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Services Segment

Our Services segment is comprised of two service offerings: Business Process Outsourcing (BPO) and Document

Outsourcing (DO).

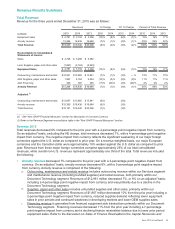

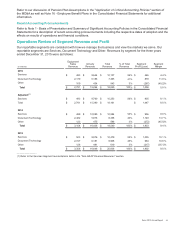

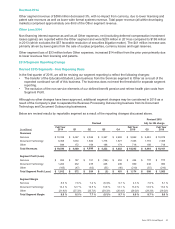

Services segment revenues for the three years ended December 31, 2015 were as follows:

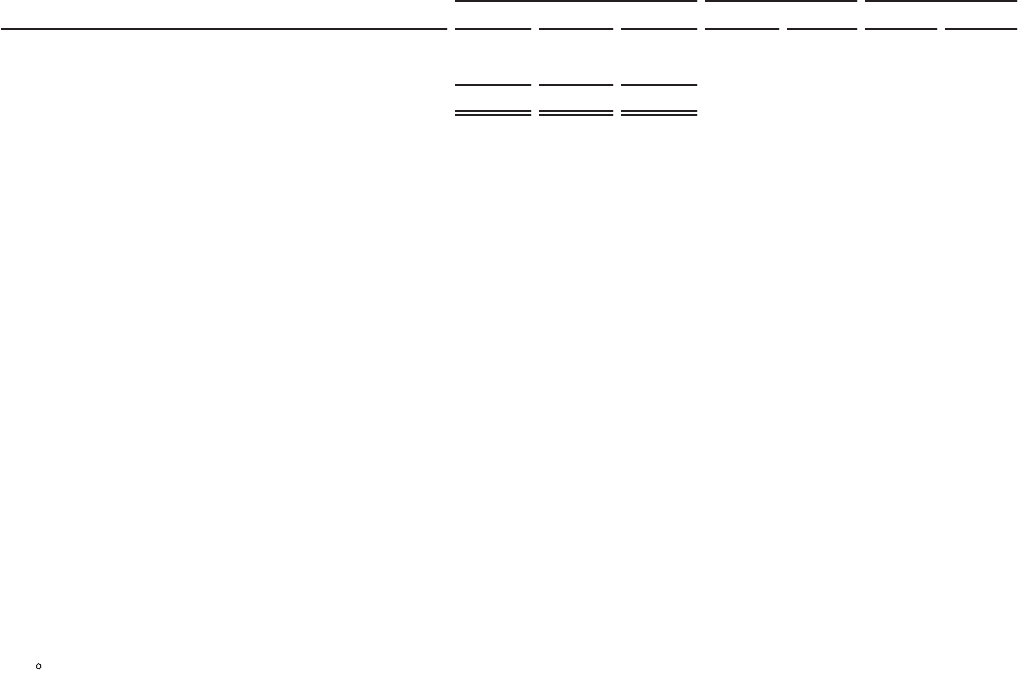

Revenue % Change CC % Change

(in millions) 2015 2014 2013 2015 2014 2015 2014

Business process outsourcing $ 6,872 $ 7,218 $ 7,161 (5)% 1% (3)% 1%

Document outsourcing 3,265 3,366 3,318 (3)% 1% 3 % 2%

Total Revenue $ 10,137 $ 10,584 $ 10,479 (4)% 1% (1)% 1%

Adjusted:(1)

Business process outsourcing $ 6,988 $ 7,218 $ 7,161 (3)% 1% (1)%

Total Revenue $ 10,253 $ 10,584 $ 10,479 (3)% 1% — %

_______________

(1) Refer to the Services Segment reconciliation table in the "Non-GAAP Financial Measures" section.

CC - See "Non-GAAP Financial Measures" section for description of Constant Currency

Note: The above table excludes intercompany revenue.

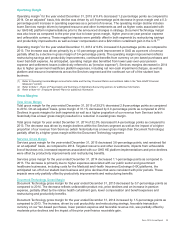

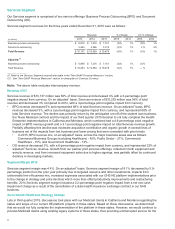

Revenue 2015

Services revenue of $10,137 million was 56% of total revenue and decreased 4% with a 3-percentage point

negative impact from currency. On an adjusted1 basis, Services revenue of $10,253 million was 56% of total

revenue and decreased 3% compared to 2014, with a 3-percentage point negative impact from currency.

• BPO revenue decreased 5% and represented 68% of total Services revenue. On an adjusted1 basis, BPO

revenue decreased 3%, with a 2-percentage point negative impact from currency, and represented 68% of

total Services revenue. The decline was primarily driven by the anticipated run-off of the student loan business,

the Texas Medicaid contract and the impact of our third quarter 2015 decision to not fully complete the Health

Enterprise implementations in California and Montana, which combined had a 4.6-percentage point negative

impact on BPO revenue growth and a 3.1-percentage point negative impact on total Services revenue growth.

Partially offsetting this decline was moderate acquisition contribution and organic growth in several lines of

business net of the impacts from lost business and lower pricing that were consistent with prior trends.

In 2015, BPO revenue mix, on an adjusted1 basis, across the major business areas was as follows:

Commercial Business Groups (excluding Healthcare) - 45%; Public Sector - 27%; Commercial

Healthcare - 15%; and Government Healthcare - 13%.

• DO revenue decreased 3%, with a 6-percentage point negative impact from currency, and represented 32% of

adjusted1 Services revenue. Growth from our partner print services offerings, reflected in both equipment and

annuity revenue, and from increased equipment sales due to higher signings, was partially offset by continued

declines in developing markets.

Segment Margin 2015

Services segment margin was 4.4%. On an adjusted1 basis, Services segment margin of 8.1% decreased by 0.9-

percentage points from the prior year primarily due to targeted resource and other investments, impacts from

unfavorable line-of-business mix, increased expenses associated with our GHS HE platform implementations prior

to the change in strategy and price declines which more than offset productivity improvements and restructuring

benefits. 2014 Services segment margin included a 0.2-percentage point negative impact from a net non-cash

impairment charge as a result of the cancellation of a state health insurance exchange contract in our GHS

business.

Government Healthcare Strategy Change

Late in third quarter 2015, discussions took place with our Medicaid clients in California and Montana regarding the

status and scope of our current HE platform projects in those states. Based on those discussions, we determined

that we would not fully complete the implementation of the platform in these states. However, we would continue to

process Medicaid claims using existing legacy systems in these states, thus providing uninterrupted service for the

45