Xerox 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

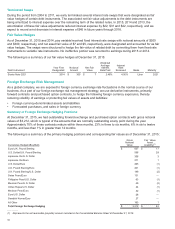

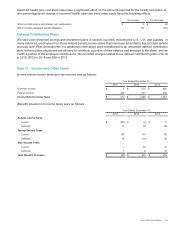

As of December 31, 2015, net after-tax losses of $1 were recorded in accumulated other comprehensive loss

associated with our cash flow hedging activity. The entire balance is expected to be reclassified into net income

within the next 12 months, providing an offsetting economic impact against the underlying anticipated transactions.

Non-Designated Derivative Instruments Losses

Non-designated derivative instruments are primarily instruments used to hedge foreign currency-denominated assets

and liabilities. They are not designated as hedges since there is a natural offset for the re-measurement of the

underlying foreign currency-denominated asset or liability.

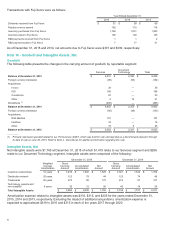

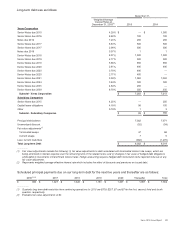

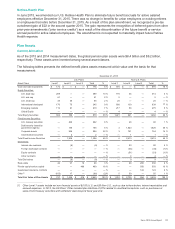

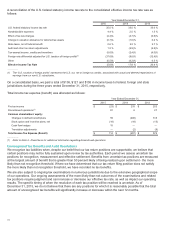

The following table provides a summary of losses on non-designated derivative instruments:

Year Ended December 31,

Derivatives NOT Designated as

Hedging Instruments Location of Derivative Loss 2015 2014 2013

Foreign exchange contracts – forwards Other expense – Currency losses, net $ 14 $ (10)$ (86)

During the three years ended December 31, 2015, we recorded Currency (losses) gains, net of $(6), $(5) and $7,

respectively. Currency (losses) gains, net includes the mark-to-market adjustments of the derivatives not designated

as hedging instruments and the related cost of those derivatives, as well as the re-measurement of foreign currency-

denominated assets and liabilities.

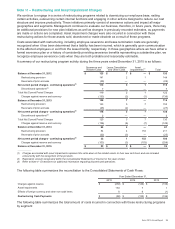

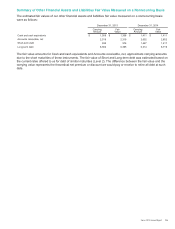

Note 15 – Fair Value of Financial Assets and Liabilities

The following table represents assets and liabilities fair value measured on a recurring basis. The basis for the

measurement at fair value in all cases is Level 2 – Significant Other Observable Inputs.

As of December 31,

2015 2014

Assets:

Foreign exchange contracts - forwards $55$20

Foreign currency options —2

Interest rate swaps 75

Deferred compensation investments in cash surrender life insurance 92 94

Deferred compensation investments in mutual funds 33 32

Total $187 $153

Liabilities:

Foreign exchange contracts - forwards $12$58

Foreign currency options 1—

Deferred compensation plan liabilities 125 135

Total $138 $193

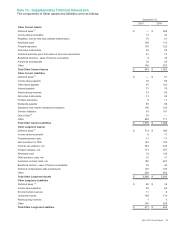

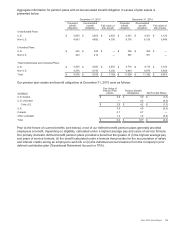

We utilize the income approach to measure the fair value for our derivative assets and liabilities. The income

approach uses pricing models that rely on market observable inputs such as yield curves, currency exchange rates

and forward prices, and therefore are classified as Level 2.

Fair value for our deferred compensation plan investments in Company-owned life insurance is reflected at cash

surrender value. Fair value for our deferred compensation plan investments in mutual funds is based on quoted

market prices for actively traded investments similar to those held by the plan. Fair value for deferred compensation

plan liabilities is based on the fair value of investments corresponding to employees’ investment selections, based

on quoted prices for similar assets in actively traded markets.

105