Xerox 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

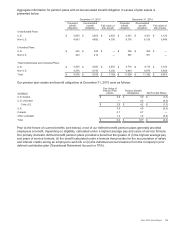

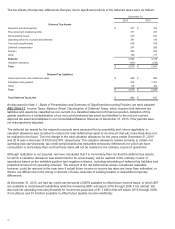

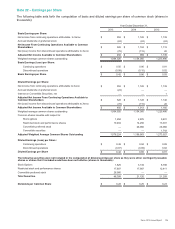

The tax effects of temporary differences that give rise to significant portions of the deferred taxes were as follows:

December 31,

2015 2014

Deferred Tax Assets

Research and development $377 $475

Post-retirement medical benefits 311 341

Net operating losses 415 531

Operating reserves, accruals and deferrals 351 318

Tax credit carryforwards 678 579

Deferred compensation 247 286

Pension 563 672

Other 138 177

Subtotal 3,080 3,379

Valuation allowance (410)(538)

Total $2,670 $2,841

Deferred Tax Liabilities

Unearned income and installment sales $ 928 $883

Intangibles and goodwill 972 1,161

Other 116 160

Total $2,016 $2,204

Total Deferred Taxes, Net $654 $637

As discussed in Note 1 - Basis of Presentation and Summary of Significant Accounting Policies, we early adopted

ASU 2015-17, Income Taxes: Balance Sheet Classification of Deferred Taxes, which requires that deferred tax

liabilities and assets be classified as non-current in a classified statement of financial position. Adoption of this

update resulted in a reclassification of our net current deferred tax asset and liabilities to the net non-current

deferred tax asset and liabilities in our Consolidated Balance Sheet as of December 31, 2015. Prior periods were

not retrospectively adjusted.

The deferred tax assets for the respective periods were assessed for recoverability and, where applicable, a

valuation allowance was recorded to reduce the total deferred tax asset to an amount that will, more-likely-than-not,

be realized in the future. The net change in the total valuation allowance for the years ended December 31, 2015

and 2014 was a decrease of $128 and $76, respectively. The valuation allowance relates primarily to certain net

operating loss carryforwards, tax credit carryforwards and deductible temporary differences for which we have

concluded it is more-likely-than-not that these items will not be realized in the ordinary course of operations.

Although realization is not assured, we have concluded that it is more-likely-than-not that the deferred tax assets,

for which a valuation allowance was determined to be unnecessary, will be realized in the ordinary course of

operations based on the available positive and negative evidence, including scheduling of deferred tax liabilities and

projected income from operating activities. The amount of the net deferred tax assets considered realizable,

however, could be reduced in the near term if actual future income or income tax rates are lower than estimated, or

if there are differences in the timing or amount of future reversals of existing taxable or deductible temporary

differences.

At December 31, 2015, we had tax credit carryforwards of $678 available to offset future income taxes, of which $97

are available to carryforward indefinitely while the remaining $581 will expire 2016 through 2036 if not utilized. We

also had net operating loss carryforwards for income tax purposes of $1.1 billion that will expire 2016 through 2036,

if not utilized, and $1.6 billion available to offset future taxable income indefinitely.

117