Xerox 2015 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

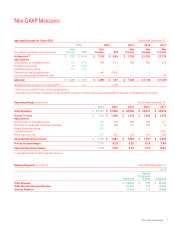

Non-GAAP Measures

Xerox 2015 Annual Report 7

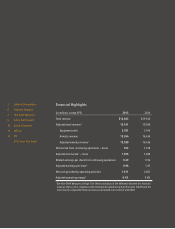

Adjusted Earnings Per Share (EPS) Year Ended December 31,

2015 2014 2013 2012 2011

Net Net Net Net Net

(in millions, except per share amounts) Income EPS Income EPS Income Income Income

As Reported(1) $ 552 $ 0.49 $ 1,128 $ 0.94 $ 1,139 $ 1,152 $ 1,219

Adjustments:

Amortization of intangible assets 193 0.18 196 0.17 189 186 231

Software impairment 90 0.08 – – – – –

Health Enterprise charge 241 0.23 – – – – –

Deferred tax liability adjustment – – (44) (0.04) – – –

Loss on early extinguishment of debt – – – – – – 20

Adjusted $ 1,076 $ 0.98 $ 1,280 $ 1.07 $ 1,328 $ 1,338 $ 1,470

Weighted average shares for adjusted EPS(2) 1,103 1,199

(1) Net income and EPS from continuing operations.

(2) Average shares for the calculation of adjusted EPS include 27 million shares associated with the Series A convertible preferred stock.

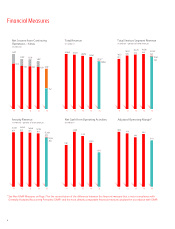

Operating Margin (in millions) Year Ended December 31,

2015(1) 2014 2013 2012 2011

Total Revenues $ 18,161 $ 19,540 $ 20,006 $ 20,421 $ 20,638

Pre-tax Income $ 412 $ 1,206 $ 1,243 $ 1,284 $ 1,450

Adjustments:

Amortization of intangible assets 310 315 305 301 371

Restructuring and asset impairment charges 186 128 115 149 31

Health Enterprise charge 389 – – – –

Curtailment gain – – – – (107)

Other expenses, net 233 232 146 257 320

Adjusted Operating Income $ 1,530 $ 1,881 $ 1,809 $ 1,991 $ 2,065

Pre-tax Income Margin 2.3% 6.2% 6.2% 6.3% 7.0%

Adjusted Operating Margin 8.4% 9.6% 9.0% 9.7% 10.0%

(1) See table below for 2015 adjusted revenue.

Revenue/Segment (in millions) Year Ended December 31,

2015

Health

Enterprise

Reported Charge Adjusted

Total Revenue $ 18,045 $ 116 $ 18,161

Total Services Segment Revenue 10,137 116 10,253

Annuity Revenue 15,264 116 15,380