Xerox 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Unbilled amounts include amounts associated with percentage-of-completion accounting and other earned

revenues not currently billable due to contractual provisions. Amounts to be invoiced in the subsequent month for

current services provided are included in amounts billable, and at December 31, 2015 and 2014 were approximately

$849 and $945, respectively.

We perform ongoing credit evaluations of our customers and adjust credit limits based upon customer payment

history and current creditworthiness. The allowance for uncollectible accounts receivables is determined principally

on the basis of past collection experience as well as consideration of current economic conditions and changes in

our customer collection trends.

Accounts Receivable Sales Arrangements

Accounts receivable sales arrangements are utilized in the normal course of business as part of our cash and

liquidity management. We have facilities in the U.S., Canada and several countries in Europe that enable us to sell

certain accounts receivable without recourse to third-parties. The accounts receivables sold are generally short-term

trade receivables with payment due dates of less than 60 days.

All of our arrangements involve the sale of our entire interest in groups of accounts receivable for cash. In most

instances a portion of the sales proceeds are held back by the purchaser and payment is deferred until collection of

the related receivables sold. Such holdbacks are not considered legal securities nor are they certificated. We report

collections on such receivables as operating cash flows in the Consolidated Statements of Cash Flows because

such receivables are the result of an operating activity and the associated interest rate risk is de minimis due to their

short-term nature. Our risk of loss following the sales of accounts receivable is limited to the outstanding deferred

purchase price receivable. These receivables are included in the caption "Other current assets" in the

accompanying Consolidated Balance Sheets and were $61 and $73 at December 31, 2015 and 2014, respectively.

Under most of the agreements, we continue to service the sold accounts receivable. When applicable, a servicing

liability is recorded for the estimated fair value of the servicing. The amounts associated with the servicing liability

were not material.

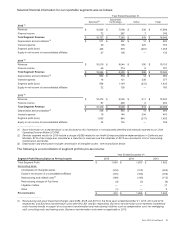

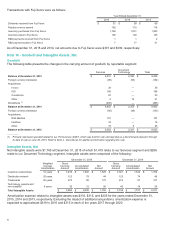

Of the accounts receivables sold and derecognized from our balance sheet, $660 and $580 remained uncollected

as of December 31, 2015 and 2014, respectively. Accounts receivable sales were as follows:

Year Ended December 31,

2015 2014 2013

Accounts receivable sales $2,467 $2,906 $3,401

Deferred proceeds 247 387 486

Loss on sale of accounts receivable 13 15 17

Estimated increase (decrease) to operating cash flows(1) 120 (68)(55)

__________

(1) Represents the difference between current and prior year fourth quarter receivable sales adjusted for the effects of: (i) the deferred

proceeds, (ii) collections prior to the end of the year and (iii) currency.

Note 6 – Finance Receivables, Net

Finance receivables include sales-type leases, direct financing leases and installment loans arising from the

marketing of our equipment. These receivables are typically collateralized by a security interest in the underlying

assets. Finance receivables, net were as follows:

December 31,

2015 2014

Gross receivables $4,683 $5,009

Unearned income (577)(624)

Subtotal 4,106 4,385

Residual values ——

Allowance for doubtful accounts (118)(131)

Finance Receivables, Net 3,988 4,254

Less: Billed portion of finance receivables, net 97 110

Less: Current portion of finance receivables not billed, net 1,315 1,425

Finance Receivables Due After One Year, Net $2,576 $2,719

87