Xerox 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

benefit plans is primarily due to lower prior service credits as a result of a curtailment of our U.S. Retiree health

benefit plan during 2015. Benefit plan costs are included in several income statement components based on the

related underlying employee costs.

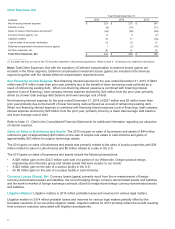

The following is a summary of our benefit plan funding for the three years ended December 31, 2015 as well as

estimated amounts for 2016:

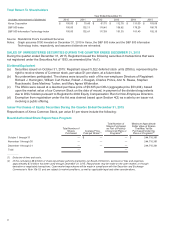

Estimated Actual

(in millions) 2016 2015 2014 2013

Defined benefit pension plans: $ 140 $309 $284 $230

Defined contribution plans 106 100 102 89

Retiree health benefit plans 70 63 70 77

Total Benefit Plan Funding $316 $472 $456 $396

The decrease in contributions to our worldwide defined benefit pension plans in 2016 is largely due to not including

any planned contribution for our domestic tax-qualified defined benefit plans because none are required to meet the

minimum funding requirements. However, once the January 1, 2016 actuarial valuations and projected results as of

the end of the 2016 measurement year are available, the desirability of additional contributions will be reassessed.

Based on these results, we may voluntarily decide to contribute to these plans.

Refer to Note 16 - Employee Benefit Plans in the Consolidated Financial Statements for additional information

regarding defined benefit pension plan assumptions, expense and funding.

Income Taxes

We are subject to income taxes in the U.S. and numerous foreign jurisdictions. Significant judgments are required in

determining the consolidated provision for income taxes. Our provision is based on nonrecurring events as well as

recurring factors, including the taxation of foreign income. In addition, our provision will change based on discrete or

other nonrecurring events such as audit settlements, tax law changes, changes in valuation allowances, etc., that

may not be predictable.

We record the estimated future tax effects of temporary differences between the tax bases of assets and liabilities

and amounts reported in our Consolidated Balance Sheets, as well as operating loss and tax credit carryforwards.

We follow very specific and detailed guidelines in each tax jurisdiction regarding the recoverability of any tax assets

recorded in our Consolidated Balance Sheets and provide valuation allowances as required. We regularly review

our deferred tax assets for recoverability considering historical profitability, projected future taxable income, the

expected timing of the reversals of existing temporary differences and tax planning strategies. Adjustments to our

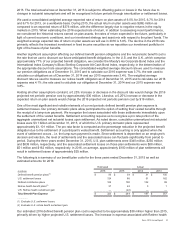

valuation allowance, through (credits)/charges to income tax expense, were $(3) million, $(20) million and $2 million

for the years ended December 31, 2015, 2014 and 2013, respectively. There were other decreases to our valuation

allowance, including the effects of currency, of $125 million, $56 million and $42 million for the years ended

December 31, 2015, 2014 and 2013, respectively. These did not affect income tax expense in total as there was a

corresponding adjustment to deferred tax assets or other comprehensive income. Gross deferred tax assets of $3.1

billion and $3.4 billion had valuation allowances of $410 million and $538 million at December 31, 2015 and 2014,

respectively.

We are subject to ongoing tax examinations and assessments in various jurisdictions. Accordingly, we may incur

additional tax expense based upon our assessment of the more-likely-than-not outcomes of such matters. In

addition, when applicable, we adjust the previously recorded tax expense to reflect examination results. Our

ongoing assessments of the more-likely-than-not outcomes of the examinations and related tax positions require

judgment and can materially increase or decrease our effective tax rate, as well as impact our operating results.

Unrecognized tax benefits were $247 million, $240 million and $267 million at December 31, 2015, 2014 and 2013,

respectively.

Refer to Note 17 - Income and Other Taxes in the Consolidated Financial Statements for additional information

regarding deferred income taxes and unrecognized tax benefits.

33