Xerox 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Planned Company Separation

On January 29, 2016, we announced that our Board of Directors had approved management’s plan to separate

the Company's Business Process Outsourcing business from its Document Technology and Document Outsourcing

businesses. Each of the businesses will operate as an independent, publicly-traded company. Leadership and the

names of the two companies will be determined as the process progresses. The transaction is intended to be

tax-free for Xerox shareholders for federal income tax purposes.

Xerox will begin the process to separate while we finalize the transaction structure. Our objective is to complete the

separation by year-end 2016, subject to customary regulatory approvals, the effectiveness of a Form 10 filing with

the U.S. Securities and Exchange Commission, tax considerations, securing any necessary financing and final

approval of the Xerox Board of Directors. Until the separation is complete, we will continue to operate and report as

a single company, and it will continue to be business as usual for our customers and employees.

As part of the planned separation, Xerox also announced that we will implement a three-year strategic

transformation program targeting incremental savings of $600 million across all segments for a cumulative cost

reduction of $2.4 billion over the three years when combined with savings from on-going programs.

Acquisitions and Divestitures

Consistent with our strategy to enhance our Services offerings and global presence and to expand our distribution

capabilities in Document Technology, we completed several acquisitions during 2015. Refer to Acquisitions and

Divestitures section in Item 1. Business in this Form 10-K as well as Note 3 - Acquisitions in our Consolidated

Financial Statements for additional information regarding our 2015 acquisitions.

In December 2014, we announced an agreement to sell our Information Technology Outsourcing (ITO) business to

Atos and began reporting it as a Discontinued Operation. The sale was completed on June 30, 2015. Refer to Note

4 - Divestitures in our Consolidated Financial Statements for additional information.

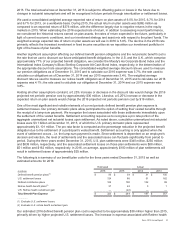

Significant 2015 Charges

During 2015, we announced several changes regarding the strategic direction of our Government Healthcare

Solutions (GHS) business, specifically with respect to the implementation of our Health Enterprise (HE) Medicaid

platform. In October 2015, we determined that we would not fully complete the implementation of the platform in

California and Montana. This determination resulted in recording a pre-tax charge (HE charge) of $389 million ($241

million after-tax) in the third quarter 2015. $116 million of the charge was recorded as a reduction to revenues and

the remaining $273 million was recorded to Cost of outsourcing, maintenance and rentals. This development

followed the GHS strategy change announced in July 2015, regarding our decision to focus our future HE

implementations on current Medicaid customers and to discontinue investment in and sales of the Xerox Integrated

Eligibility System. This change in strategy resulted in pre-tax non-cash software platform impairment charges of

$146 million in the second quarter 2015. Refer to the "Government Healthcare Strategy Change" section of the

"Services Segment" review for further details of these decisions and charges.

As a result of the significant impact of the HE charge and the software impairment charges on our reported

revenues, earnings and key metrics for the period, we are also discussing our results excluding the impact of these

charges. These adjusted results are noted as “adjusted1” in the discussion below. Refer to the "Non-GAAP Financial

Measures" section for an explanation of these non-GAAP financial measures.

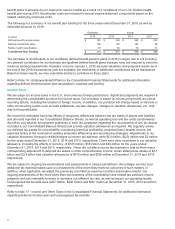

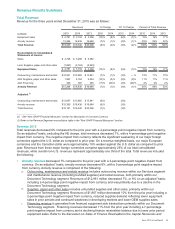

Financial Overview

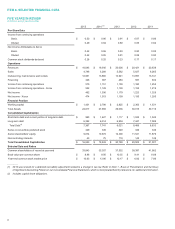

Total revenue of $18.0 billion in 2015 declined 8% from the prior year, with a 4-percentage point negative impact

from currency. On an adjusted1 basis, excluding the HE charge, total revenues decreased 7%, with a 4-percentage

point negative impact from currency. Services segment revenues decreased 4%, with a 3-percentage point negative

impact from currency. On an adjusted1 basis Services segment revenues decreased 3%, with a 3-percentage point

negative impact from currency, reflecting a 1% constant currency decrease in BPO revenues offset by a 3%

increase in DO revenues. Services segment margin of 4.4% decreased 4.6-percentage points. On an adjusted1

basis segment margin was 8.1% and decreased 0.9-percentage points primarily due to targeted resource and other

investments and increased expenses associated with our GHS HE platform implementations prior to the change in

strategy. Document Technology segment revenues declined 12%, with a 4-percentage point negative impact from

currency reflecting lower sales of entry products particularly in developing markets and to OEM customers and

27