Xerox 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

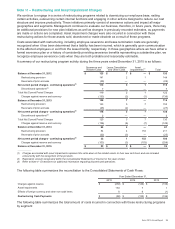

Fuji Xerox

Fuji Xerox is headquartered in Tokyo and operates in Japan, China, Australia, New Zealand, Vietnam and other

areas of the Pacific Rim. Our investment in Fuji Xerox of $1,315 at December 31, 2015, differs from our implied

25% interest in the underlying net assets, or $1,399, due primarily to our deferral of gains resulting from sales of

assets by us to Fuji Xerox.

Equity in net income of Fuji Xerox is affected by certain adjustments to reflect the deferral of profit associated with

intercompany sales. These adjustments may result in recorded equity income that is different from that implied by our

25% ownership interest.

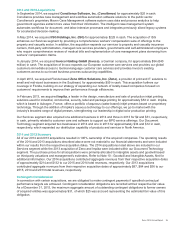

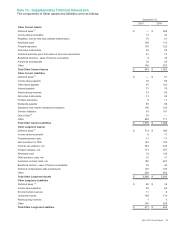

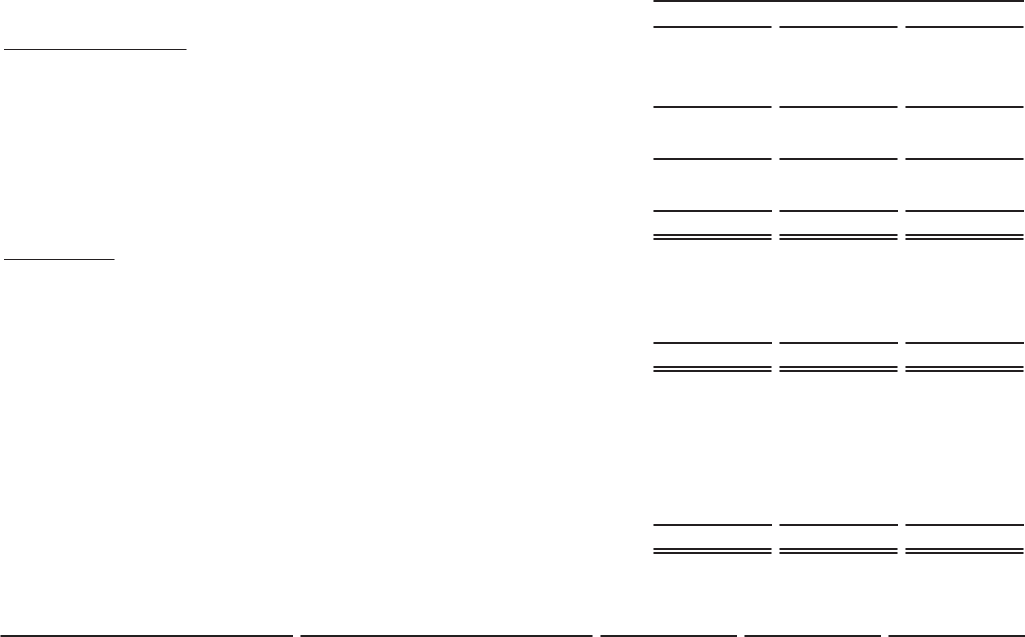

Summarized financial information for Fuji Xerox is as follows:

Year Ended December 31,

2015 2014 2013

Summary of Operations

Revenues $9,925 $11,112 $11,415

Costs and expenses 9,198 10,242 10,479

Income before income taxes 727 870 936

Income tax expense 233 262 276

Net Income 494 608 660

Less: Net income - noncontrolling interests 7 45

Net Income - Fuji Xerox $487 $604 $655

Balance Sheet

Assets:

Current assets $ 4,585 $4,801 $4,955

Long-term assets 4,946 4,742 5,160

Total Assets $9,531 $9,543 $10,115

Liabilities and Equity:

Current liabilities $2,808 $2,982 $3,114

Long-term debt 584 580 978

Other long-term liabilities 511 482 680

Noncontrolling interests 31 30 28

Fuji Xerox shareholders' equity 5,597 5,469 5,315

Total Liabilities and Equity $9,531 $9,543 $10,115

Yen/U.S. Dollar exchange rates used to translate are as follows:

Financial Statement Exchange Basis 2015 2014 2013

Summary of Operations Weighted average rate 121.01 105.58 97.52

Balance Sheet Year-end rate 120.49 119.46 105.15

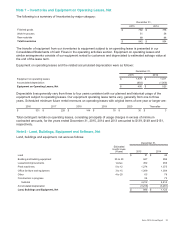

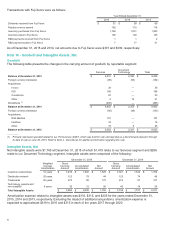

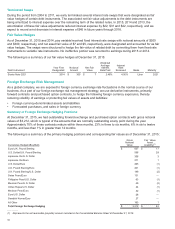

Transactions with Fuji Xerox

We receive dividends from Fuji Xerox, which are reflected as a reduction in our investment. Additionally, we have a

Technology Agreement with Fuji Xerox whereby we receive royalty payments for their use of our Xerox brand

trademark, as well as rights to access our patent portfolio in exchange for access to their patent portfolio. These

payments are included in Outsourcing, maintenance and rental revenues in the Consolidated Statements of

Income. We also have arrangements with Fuji Xerox whereby we purchase inventory from and sell inventory to Fuji

Xerox. Pricing of the transactions under these arrangements is based upon terms the Company believes to be

negotiated at arm's length. Our purchase commitments with Fuji Xerox are in the normal course of business and

typically have a lead time of three months. In addition, we pay Fuji Xerox and they pay us for unique research and

development costs.

Xerox 2015 Annual Report 94