Xerox 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

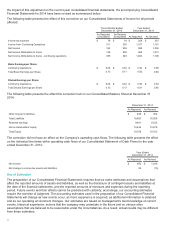

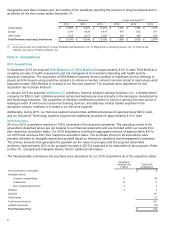

The capitalized amount of customer contract costs at December 31, 2015 and 2014 were as follows:

Year Ended December 31,

2015 2014

Capitalized customer contract costs (1) 180 227

__________

(1) The balance at December 31, 2015 of $180 is expected to be amortized over a weighted average period of approximately 8 years, and

amortization expense in 2016 is expected to be approximately $76.

Long-lived assets used in the fulfillment of the arrangements are capitalized and depreciated over the shorter of their

useful life or the term of the contract if an asset is contract specific.

Our outsourcing services contracts may also include the sale of equipment and software. In these instances we

follow the policies noted above under Equipment-Related Revenues.

Other Revenue Recognition Policies

Multiple Element Arrangements: As described above, we enter into the following revenue arrangements that may

consist of multiple deliverables:

• Bundled lease arrangements, which typically include both lease deliverables and non-lease deliverables as

described above.

• Contracts for multiple types of outsourcing services, as well as professional and value-added services. For

instance, we may contract for an implementation or development project and also provide services to operate

the system over a period of time; or we may contract to scan, manage and store customer documents.

In substantially all of our multiple element arrangements, we are able to separate the deliverables since we normally

will meet both of the following criteria:

• The delivered item(s) has value to the customer on a stand-alone basis; and

• If the arrangement includes a general right of return relative to the delivered item(s), delivery or performance of

the undelivered item(s) is considered probable and substantially in our control.

Consideration in a multiple-element arrangement is allocated at the inception of the arrangement to all deliverables

on the basis of the relative selling price. When applying the relative selling price method, the selling price for each

deliverable is primarily determined based on VSOE or third-party evidence (TPE) of the selling price. The above

noted revenue policies are then applied to each separated deliverable, as applicable.

Revenue-based Taxes: We report revenue net of any revenue-based taxes assessed by governmental authorities

that are imposed on and concurrent with specific revenue-producing transactions. The primary revenue-based taxes

are sales tax and value-added tax (VAT).

Other Significant Accounting Policies

Shipping and Handling

Costs related to shipping and handling are recognized as incurred and included in Cost of sales in the Consolidated

Statements of Income.

Research, Development and Engineering (RD&E)

Research, development and engineering costs are expensed as incurred. Sustaining engineering costs are incurred

with respect to on-going product improvements or environmental compliance after initial product launch. Sustaining

engineering costs were $126, $132 and $122 in 2015, 2014 and 2013, respectively.

Cash and Cash Equivalents

Cash and cash equivalents consist of cash on hand, including money market funds, and investments with original

maturities of three months or less.

77