Xerox 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

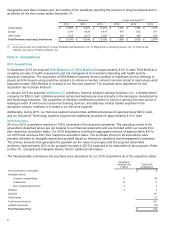

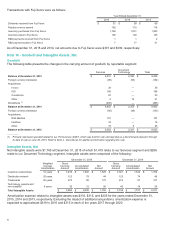

• Non-investment grade: This rating includes accounts with average credit risk that are more susceptible to

loss in the event of adverse business or economic conditions. This rating generally equates to a BB S&P

rating. Although we experience higher loss rates associated with this customer class, we believe the risk is

somewhat mitigated by the fact that our leases are fairly well dispersed across a large and diverse customer

base. In addition, the higher loss rates are largely offset by the higher rates of return we obtain with such

leases. Loss rates in this category are generally in the range of 2% to 4%.

• Substandard: This rating includes accounts that have marginal credit risk such that the customer’s ability to

make repayment is impaired or may likely become impaired. We use numerous strategies to mitigate risk

including higher rates of interest, prepayments, personal guarantees, etc. Accounts in this category include

customers who were downgraded during the term of the lease from investment and non-investment grade

evaluation when the lease was originated. Accordingly there is a distinct possibility for a loss of principal and

interest or customer default. The loss rates in this category are around 10%.

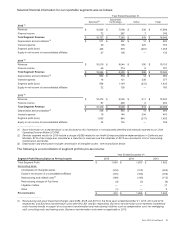

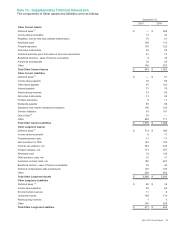

Credit quality indicators are updated at least annually, and the credit quality of any given customer can change

during the life of the portfolio. Details about our finance receivables portfolio based on industry and credit quality

indicators are as follows:

December 31, 2015 December 31, 2014

Investment

Grade

Non-

investment

Grade

Sub-

standard

Tot al

Finance

Receivables

Investment

Grade

Non-

investment

Grade

Sub-

standard

Tot al

Finance

Receivables

Finance and other services $ 191 $ 184 $ 58 $433 $195 $159 $55$ 409

Government and education 536 13 4 553 589 13 3 605

Graphic arts 145 86 119 350 148 79 90 317

Industrial 84 44 18 146 92 41 18 151

Healthcare 83 24 13 120 84 26 14 124

Other 52 48 29 129 55 38 29 122

Total United States 1,091 399 241 1,731 1,163 356 209 1,728

Finance and other services 55 35 9 99 54 31 12 97

Government and education 59 7 2 68 76 8 286

Graphic arts 45 35 21 101 58 49 36 143

Industrial 23 12 3 38 24 13 441

Other 33 23 3 59 34 19 457

Total Canada(1) 215 112 38 365 246 120 58 424

France 203 207 101 511 253 234 129 616

U.K/Ireland 235 91 3 329 255 101 6 362

Central(2) 206 186 25 417 230 278 30 538

Southern(3) 36 138 17 191 60 148 36 244

Nordic(4) 24 35 2 61 25 49 175

Total Europe 704 657 148 1,509 823 810 202 1,835

Other 165 257 79 501 195 163 40 398

Total $ 2,175 $ 1,425 $ 506 $ 4,106 $2,427 $1,449 $509 $4,385

__________

(1) Historically, the Company had included certain Canadian customers with graphic arts activity in their industry sector. In 2014, these

customers were reclassified to Graphic Arts to better reflect their primary business activity.

(2) Switzerland, Germany, Austria, Belgium and Holland.

(3) Italy, Greece, Spain and Portugal.

(4) Sweden, Norway, Denmark and Finland.

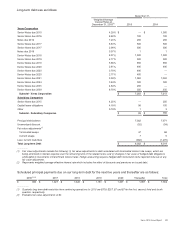

The aging of our receivables portfolio is based upon the number of days an invoice is past due. Receivables that

are more than 90 days past due are considered delinquent. Receivable losses are charged against the allowance

when management believes the uncollectibility of the receivable is confirmed and is generally based on individual

credit evaluations, results of collection efforts and specific circumstances of the customer. Subsequent recoveries,

if any, are credited to the allowance.

Xerox 2015 Annual Report 90