Xerox 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

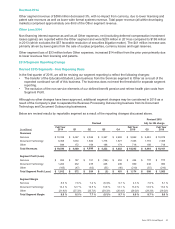

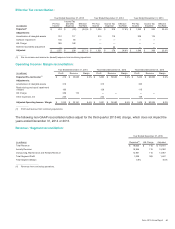

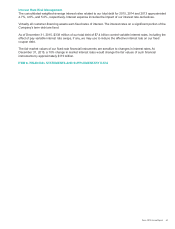

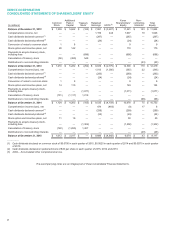

Effective Tax reconciliation:

Year Ended December 31, 2015 Year Ended December 31, 2014 Year Ended December 31, 2013

(in millions)

Pre-Tax

Income

Income Tax

(Benefit)

Expense

Effective

Tax Rate

Pre-Tax

Income

Income Tax

Expense

Effective

Tax Rate

Pre-Tax

Income

Income Tax

Expense

Effective

Tax Rate

Reported(1) $ 412 $ (23) (5.6)% $ 1,206 $ 215 17.8% $ 1,243 $ 253 20.4%

Adjustments:

Amortization of intangible assets 310 117 315 119 305 116

Software Impairment 146 56 — — — —

HE Charge 389 148 — — — —

Deferred tax liability adjustment —— —44 ——

Adjusted $ 1,257 $ 298 23.7 % $ 1,521 $ 378 24.9% $ 1,548 $ 369 23.8%

__________

(1) Pre-tax income and income tax (benefit) expense from continuing operations.

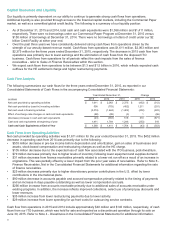

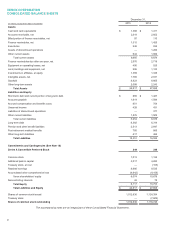

Operating Income / Margin reconciliation:

Year Ended December 31, 2015 Year Ended December 31, 2014 Year Ended December 31, 2013

(in millions) Profit Revenue Margin Profit Revenue Margin Profit Revenue Margin

Reported Pre-tax Income(1) $ 412 $ 18,045 2.3% $ 1,206 $ 19,540 6.2% $ 1,243 $ 20,006 6.2%

Adjustments:

Amortization of intangible assets 310 315 305

Restructuring and asset impairment

charges 186 128 115

HE Charge 389 116 — — — —

Other expenses, net 233 232 146

Adjusted Operating Income / Margin $ 1,530 $ 18,161 8.4% $ 1,881 $ 19,540 9.6% $ 1,809 $ 20,006 9.0%

____________

(1) Profit and revenue from continuing operations.

The following non-GAAP reconciliation tables adjust for the third quarter 2015 HE charge, which does not impact the

years ended December 31, 2014 or 2013.

Revenue / Segment reconciliation:

Year Ended December 31, 2015

(in millions) Reported(1) HE Charge Adjusted

Total Revenue $ 18,045 $ 116 $ 18,161

Annuity Revenue 15,264 116 15,380

Outsourcing, Maintenance and Rentals Revenue 12,951 116 13,067

Total Segment Profit 1,058 389 1,447

Total Segment Margin 5.9% 8.0%

__________________________

(1) Revenue from continuing operations.

Xerox 2015 Annual Report 60