Xerox 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

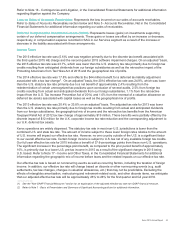

2015. The total actuarial loss at December 31, 2015 is subject to offsetting gains or losses in the future due to

changes in actuarial assumptions and will be recognized in future periods through amortization or settlement losses.

We used a consolidated weighted average expected rate of return on plan assets of 6.0% for 2015, 6.7% for 2014

and 6.7% for 2013, on a worldwide basis. During 2015, the actual return on plan assets was $(89) million as

compared to an expected return of $376 million, with the difference largely due to negative returns in the equity

markets in 2015. When estimating the 2016 expected rate of return, in addition to assessing recent performance,

we considered the historical returns earned on plan assets, the rates of return expected in the future, particularly in

light of current economic conditions, and our investment strategy and asset mix with respect to the plans' funds. The

weighted average expected rate of return on plan assets we will use in 2016 is 5.8%. The decline in the 2016 rate

primarily reflects the increased investment in fixed income securities as we reposition our investment portfolios in

light of the freeze of plan benefits.

Another significant assumption affecting our defined benefit pension obligations and the net periodic benefit cost is

the rate that we use to discount our future anticipated benefit obligations. In the U.S. and the U.K., which comprise

approximately 77% of our projected benefit obligation, we consider the Moody's Aa Corporate Bond Index and the

International Index Company's iBoxx Sterling Corporate AA Cash Bond Index, respectively, in the determination of

the appropriate discount rate assumptions. The consolidated weighted average discount rate we used to measure

our pension obligations as of December 31, 2015 and to calculate our 2016 expense was 3.7%; the rate used to

calculate our obligations as of December 31, 2014 and our 2015 expense was 3.4%. The weighted average

discount rate we used to measure our retiree health obligation as of December 31, 2015 and to calculate our 2016

expense was 4.1%; the rate used to calculate our obligation at December 31, 2014 and our 2015 expense was

3.8%.

Holding all other assumptions constant, a 0.25% increase or decrease in the discount rate would change the 2016

projected net periodic pension cost by approximately $30 million. Likewise, a 0.25% increase or decrease in the

expected return on plan assets would change the 2016 projected net periodic pension cost by $19 million.

One of the most significant and volatile elements of our net periodic defined benefit pension plan expense is

settlement losses. Our primary domestic plans allow participants the option of settling their vested benefits through

the receipt of a lump-sum payment. We recognize the losses associated with these settlements immediately upon

the settlement of the vested benefits. Settlement accounting requires us to recognize a pro rata portion of the

aggregate unamortized net actuarial losses upon settlement. As noted above, cumulative unamortized net actuarial

losses were $3.1 billion at December 31, 2015, of which the U.S. primary domestic plans represented

approximately $1,101 million. The pro rata factor is computed as the percentage reduction in the projected benefit

obligation due to the settlement of a participant's vested benefit. Settlement accounting is only applied when the

event of settlement occurs - i.e. the lump-sum payment is made. Since settlement is dependent on an employee's

decision and election, the level of settlements and the associated losses can fluctuate significantly from period to

period. During the three years ended December 31, 2015, U.S. plan settlements were $340 million, $250 million

and $838 million, respectively, and the associated settlement losses on those plan settlements were $88 million,

$51 million and $162 million, respectively. In 2016, on average, approximately $100 million of plan settlements will

result in settlement losses of approximately $25 million.

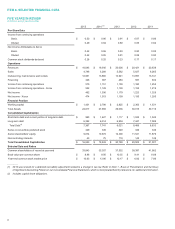

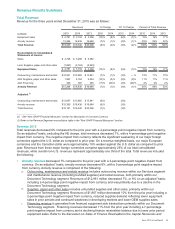

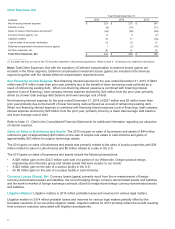

The following is a summary of our benefit plan costs for the three years ended December 31, 2015 as well as

estimated amounts for 2016:

Estimated Actual

(in millions) 2016 2015 2014 2013

Defined benefit pension plans(1) $ 56$ 54$ 31$ 105

U.S. settlement losses 124 88 51 162

Defined contribution plans 106 100 102 89

Retiree health benefit plans(2) 37 24 31

U.S. Retiree health curtailment gain — (22)— —

Total Benefit Plan Expense $323 $244 $187 $357

___________

(1) Excludes U.S. settlement losses.

(2) Excludes U.S. retiree health curtailment gain.

Our estimated 2016 defined benefit pension plan cost is expected to be approximately $38 million higher than 2015,

primarily driven by higher projected U.S. settlement losses. The increase in expense associated with Retiree health

Xerox 2015 Annual Report 32