Xerox 2015 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

__________

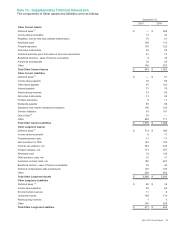

(1) As discussed in Note 1 - Basis of Presentation and Summary of Significant Accounting Policies, we early adopted ASU 2015-17, Income

Taxes: Balance Sheet Classification of Deferred Taxes, which requires that deferred tax liabilities and assets be classified as non-current in

a classified statement of financial position. Adoption of this update resulted in a reclassification of our net current deferred tax asset and

liabilities to the net non-current deferred tax asset and liabilities in our Consolidated Balance Sheet as of December 31, 2015. Prior periods

were not retrospectively adjusted.

(2) Refer to Note 4 - Divestitures for additional information.

Restricted Cash

As more fully discussed in Note 18 - Contingencies and Litigation, various litigation matters in Brazil require us to

make cash deposits to escrow as a condition of continuing the litigation. In addition, as more fully discussed in Note

5 - Accounts Receivable, Net and Note 6 - Finance Receivables, Net, we continue to service the receivables sold

under most of our receivable sale agreements. As servicer, we may collect cash related to sold receivables prior to

year-end that will be remitted to the purchaser the following year. Since we are acting on behalf of the purchaser in

our capacity as servicer, such cash collected is reported as restricted cash. Restricted cash amounts are classified

in our Consolidated Balance Sheets based on when the cash will be contractually or judicially released.

Restricted cash amounts were as follows:

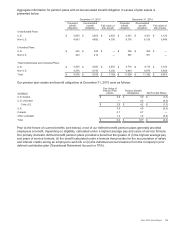

December 31,

2015 2014

Tax and labor litigation deposits in Brazil $ 71 $ 135

Escrow and cash collections related to receivable sales 93 107

Other restricted cash 810

Total Restricted Cash $172 $252

Net Investment in TRG

At December 31, 2015, our net investment in The Resolution Group (TRG) primarily consisted of a $157

performance-based instrument relating to the 1997 sale of TRG, net of remaining liabilities associated with our

discontinued operations of $15. The recovery of the performance-based instrument is dependent on the sufficiency

of TRG's available cash flows, as guaranteed by TRG's ultimate parent, which are expected to be recovered in

annual cash distributions through 2017. The performance-based instrument is pledged as security for our future

funding obligations to our U.K. Pension Plan for salaried employees.

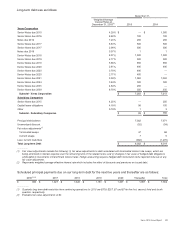

Note 13 – Debt

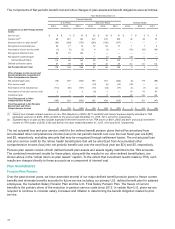

Short-term borrowings were as follows:

December 31,

2015 2014

Commercial paper $—$150

Notes Payable 31

Current maturities of long-term debt 982 1,276

Total Short-term Debt $985 $1,427

We classify our debt based on the contractual maturity dates of the underlying debt instruments or as of the earliest

put date available to the debt holders. We defer costs associated with debt issuance over the applicable term, or to

the first put date in the case of convertible debt or debt with a put feature. These costs are amortized as interest

expense in our Consolidated Statements of Income.

99