Xerox 2015 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

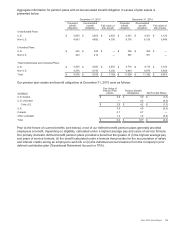

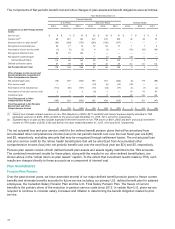

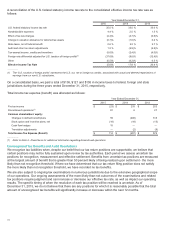

December 31, 2014

U.S. Plans Non-U.S. Plans

Asset Class Level 1 Level 2 Level 3 Total % Level 1 Level 2 Level 3 Total %

Cash and cash equivalents $ 52 $ — $ — $ 52 2% $ 608 $ — $ — $ 608 10%

Equity Securities:

U.S. large cap 332 15 — 347 11% 253 52 — 305 5%

U.S. mid cap 73 — — 73 2% 10 — — 10 —%

U.S. small cap 52 39 — 91 3% 28 — — 28 —%

International developed 195 92 — 287 9% 1,065 162 — 1,227 20%

Emerging markets 140 113 — 253 8% 276 69 — 345 6%

Global Equity 2 7 — 9 —% 4 6 — 10 —%

Total Equity Securities 794 266 — 1,060 33% 1,636 289 — 1,925 31%

Fixed Income Securities:

U.S. treasury securities — 145 — 145 5% 7 26 — 33 1%

Debt security issued by

government agency — 225 — 225 7% 25 1,536 — 1,561 26%

Corporate bonds — 988 — 988 32% 23 850 — 873 15%

Asset backed securities — 10 — 10 —%—1—1—%

Total Fixed Income Securities — 1,368 — 1,368 44% 55 2,413 — 2,468 42%

Derivatives:

Interest rate contracts — (1) — (1) —% — 128 — 128 2%

Foreign exchange

contracts — 1 — 1 —% — (5) — (5) —%

Equity contracts —————%—————%

Other contracts —————%—14—14 —%

Total Derivatives —————%—137—1372%

Real estate 46 39 25 110 4% — 29 279 308 5%

Private equity/venture capital — — 497 497 16% — — 499 499 8%

Guaranteed insurance

contracts —————%——1291292%

Other(1) (1) 40 — 39 1% 6 8 — 14 —%

Total Fair Value of Plan

Assets $ 891 $ 1,713 $ 522 $ 3,126 100% $ 2,305 $ 2,876 $ 907 $ 6,088 100%

_____________________________

(1) Other Level 1 assets include net non-financial liabilities of $(1) U.S. and $6 Non-U.S., such as due to/from broker, interest receivables and

accrued expenses.

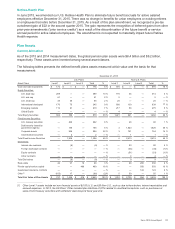

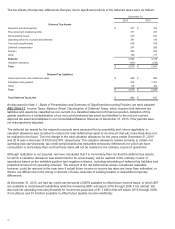

The following tables represents a roll-forward of the defined benefit plans assets measured using significant

unobservable inputs (Level 3 assets):

Fair Value Measurement Using Significant Unobservable Inputs (Level 3)

U.S. Defined Benefit Plans Assets Non-U.S. Defined Benefit Plans Assets

Real

Estate

Private

Equity/

Venture

Capital Total

Real

Estate

Private

Equity/

Venture

Capital

Guaranteed

Insurance

Contracts Total

Balance at December 31, 2013 $29 $451 $480 $269 $212 $135 $616

Purchases 1 44 45 74 279 22 375

Sales (6)(59)(65)(64)—(25)(89)

Realized (losses) gains (7) 41 34 20 — 15 35

Unrealized gains (losses) 8 20 28 (1) 38 — 37

Currency translation — — — (19)(30)(18)(67)

Balance at December 31, 2014 25 497 522 279 499 129 907

Purchases — 48 48 10 56 22 88

Sales (16) (67)(83)(7) — (21)(28)

Realized gains (losses) 1 52 53 (1) — 65

Unrealized gains (losses) 9 (31)(22)14 21 136

Currency translation — — — (15)(26)(13)(54)

Balance at December 31, 2015 $19 $499 $518 $280 $550 $124 $954

111