Xerox 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

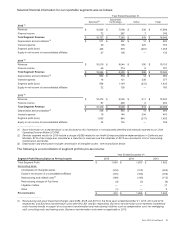

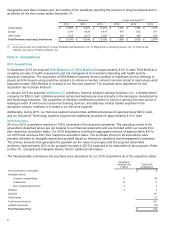

Geographic area data is based upon the location of the subsidiary reporting the revenue or long-lived assets and is

as follows for the three years ended December 31:

Revenues Long-Lived Assets

(1)

2015 2014 2013 2015 2014 2013

United States $ 12,557 $ 13,041 $13,272 $1,279 $1,758 $1,870

Europe 3,783 4,428 4,414 476 632 761

Other areas 1,705 2,071 2,320 234 240 243

Total Revenues and Long-Lived Assets $ 18,045 $ 19,540 $20,006 $1,989 $2,630 $2,874

________________

(1) Long-lived assets are comprised of (i) Land, buildings and equipment, net, (ii) Equipment on operating leases, net, (iii) Internal use

software, net and (iv) Product software, net.

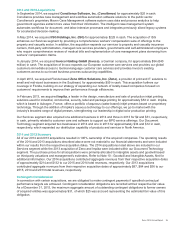

Note 3 – Acquisitions

2015 Acquisitions

In September 2015 we acquired RSA Medical LLC (RSA Medical) for approximately $141 in cash. RSA Medical is

a leading provider of health assessment and risk management for members interacting with health and life

insurance companies. The acquisition of RSA Medical expands Xerox's portfolio of healthcare service offerings to

payers and life insurers using predictive analytics to enhance member outreach services aimed at improving overall

population health. RSA Medical is included in our Services segment. The purchase price adjustment for this

acquisition has not been finalized.

In January 2015 we acquired Intellinex LLC (Intellinex), formerly Intrepid Learning Solutions, Inc., a Seattle-based

company, for $28 in cash. Intellinex provides outsourced learning services primarily in the aerospace manufacturing

and technology industries. The acquisition of Intellinex solidifies the position of Xerox's Learning Services unit as a

leading provider of end-to-end outsourced learning services, and adds key vertical market expertise in the

aerospace industry. Intellinex is included in our Services segment.

Additionally, during 2015, our Services segment acquired two additional business for approximately $28 in cash,

and our Document Technology segment acquired two additional business for approximately $13 in cash.

2015 Summary

All of our 2015 acquisitions resulted in 100% ownership of the acquired companies. The operating results of the

acquisitions described above are not material to our financial statements and are included within our results from

their respective acquisition dates. Our 2015 acquisitions contributed aggregate revenues of approximately $43 to

our 2015 total revenues from their respective acquisition dates. The purchase prices for all acquisitions were

primarily allocated to intangible assets and goodwill based on third-party valuations and management's estimates.

The primary elements that generated the goodwill are the value of synergies and the acquired assembled

workforce. Approximately 63% of the goodwill recorded in 2015 is expected to be deductible for tax purposes. Refer

to Note 10 - Goodwill and Intangible Assets, Net for additional information.

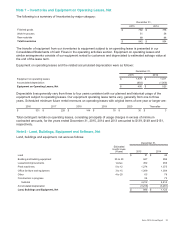

The following table summarizes the purchase price allocations for our 2015 acquisitions as of the acquisition dates:

Weighted-

Average Life

(Years)

Total 2015

Acquisitions

Accounts/finance receivables $8

Intangible assets:

Customer relationships 949

Trademarks 12 2

Non-compete agreements 42

Software 4 7

Goodwill 151

Other assets 12

Total Assets Acquired 231

Liabilities assumed (21)

Total Purchase Price $210

83