Xerox 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

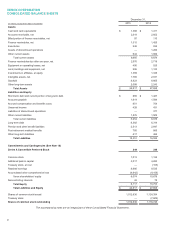

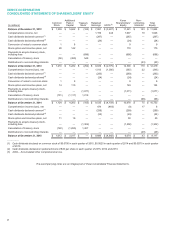

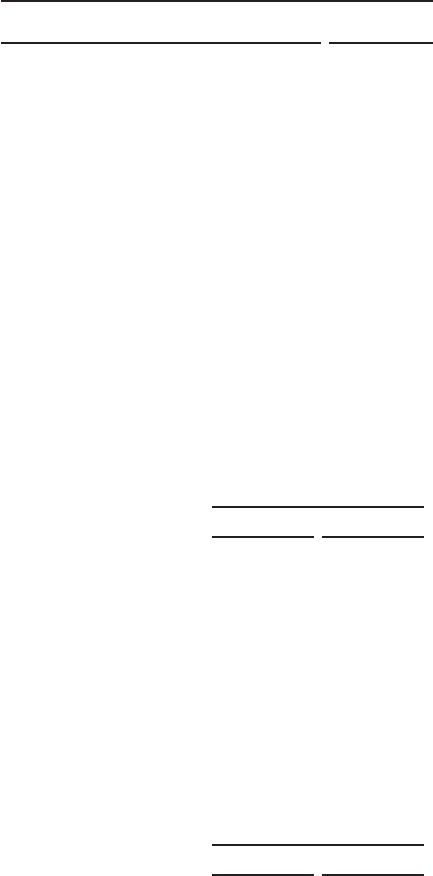

the impact of this adjustment on the current year consolidated financial statements, the accompanying Consolidated

Financial Statements for 2014 have been revised as summarized below:

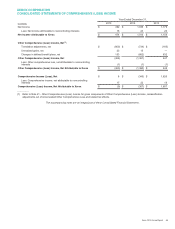

The following table presents the effect of this correction on our Consolidated Statements of Income for all periods

affected:

Three Months Ended

December 31, 2014

Year Ended

December 31, 2014

As Reported

(Unaudited)

As Revised

(Unaudited) As Reported As Revised

Income tax expense $ 78 $ 34 $ 259 $ 215

Income from Continuing Operations 311 355 1,107 1,151

Net Income 162 206 992 1,036

Net Income Attributable to Xerox 156 200 969 1,013

Net Income Attributable to Xerox - continuing operations 305 349 1,084 1,128

Basic Earnings per Share:

Continuing Operations $ 0.26 $0.30 $0.92 $0.96

Total Basic Earnings per Share 0.13 0.17 0.82 0.86

Diluted Earnings per Share:

Continuing Operations $ 0.26 $0.30 $0.90 $0.94

Total Diluted Earnings per Share 0.13 0.17 0.81 0.85

The following table presents the effect this correction had on our Consolidated Balance Sheet at December 31,

2014:

December 31, 2014

As Reported As Revised

Other long-term liabilities $498 $454

Total Liabilities 16,600 16,556

Retained earnings 9,491 9,535

Xerox shareholders' equity 10,634 10,678

Total Equity 10,709 10,753

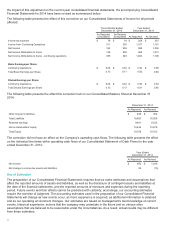

The correction did not have an effect on the Company’s operating cash flows. The following table presents the effect

on the individual line items within operating cash flows of our Consolidated Statement of Cash Flows for the year

ended December 31, 2014:

Year Ended

December 31, 2014

As Reported As Revised

Net income $992 $1,036

Net change in income tax assets and liabilities 29 (15)

Use of Estimates

The preparation of our Consolidated Financial Statements requires that we make estimates and assumptions that

affect the reported amounts of assets and liabilities, as well as the disclosure of contingent assets and liabilities at

the date of the financial statements, and the reported amounts of revenues and expenses during the reporting

period. Future events and their effects cannot be predicted with certainty; accordingly, our accounting estimates

require the exercise of judgment. The accounting estimates used in the preparation of our Consolidated Financial

Statements will change as new events occur, as more experience is acquired, as additional information is obtained

and as our operating environment changes. Our estimates are based on management's best knowledge of current

events, historical experience, actions that the company may undertake in the future and on various other

assumptions that are believed to be reasonable under the circumstances. As a result, actual results may be different

from these estimates.

71