Xerox 2015 Annual Report Download - page 59

Download and view the complete annual report

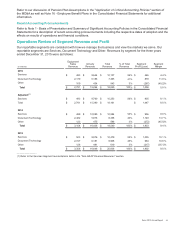

Please find page 59 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Refer to Note 18 - Contingencies and Litigation, in the Consolidated Financial Statements for additional information

regarding litigation against the Company.

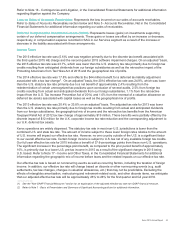

Loss on Sales of Accounts Receivables: Represents the loss incurred on our sales of accounts receivables.

Refer to Sales of Accounts Receivables section below and Note 5 - Accounts Receivables, Net in the Consolidated

Financial Statements for additional information regarding our sales of receivables.

Deferred Compensation Investment Losses (Gains): Represents losses (gains) on investments supporting

certain of our deferred compensation arrangements. These gains or losses are offset by an increase or decrease,

respectively, in compensation expense recorded in SAG in our Services segment as a result of the increase or

decrease in the liability associated with these arrangements.

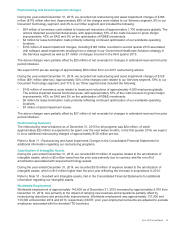

Income Taxes

The 2015 effective tax rate was (5.6)% and was negative primarily due to the discrete tax benefit associated with

the third quarter 2015 HE charge and the second quarter 2015 software impairment charges. On an adjusted1 basis,

the 2015 effective tax rate was 23.7%, which was lower than the U.S. statutory tax rate primarily due to foreign tax

credits resulting from anticipated dividends from our foreign subsidiaries as well as the retroactive impact of the

Protecting Americans from Tax Hikes Act of 2015 and the geographical mix of profits.

The 2014 effective tax rate was 17.8% and reflects the $44 million benefit for a deferred tax liability adjustment

associated with a tax law change2. On an adjusted1 basis, the 2014 effective tax rate was 24.9%, which was lower

than the U.S. statutory tax rate primarily due to a net benefit of approximately 2.4% resulting from the

redetermination of certain unrecognized tax positions upon conclusion of several audits, 2.5% from foreign tax

credits resulting from actual and anticipated dividends from our foreign subsidiaries, 1.1% from the retroactive

impact from the U.S. Tax Increase Prevention Act of 2014, and 1.0% from the reversal of a valuation allowance on

deferred tax assets associated with capital losses as well as the geographical mix of profits.

The 2013 effective tax rate was 20.4% or 23.8% on an adjusted1 basis. The adjusted tax rate for 2013 was lower

than the U.S. statutory tax rate primarily due to foreign tax credits resulting from actual and anticipated dividends

from our foreign subsidiaries, the geographical mix of income and the retroactive tax benefits from the American

Taxpayer Relief Act of 2012 tax law change of approximately $19 million. These benefits were partially offset by the

discrete impact of $12 million for the U.K. corporate income tax rate reduction and the corresponding adjustment to

our U.K. deferred tax assets.

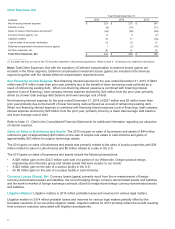

Xerox operations are widely dispersed. The statutory tax rate in most non-U.S. jurisdictions is lower than the

combined U.S. and state tax rate. The amount of income subject to these lower foreign rates relative to the amount

of U.S. income will impact our effective tax rate. However, no one country outside of the U.S. is a significant factor

to our overall effective tax rate. Certain foreign income is subject to U.S. tax net of any available foreign tax credits.

Our full year effective tax rate for 2015 includes a benefit of 37.6-percentage points from these non-U.S. operations.

The significant increase in the percentage point benefit, as compared to the prior period benefit of approximately

10%, is primarily due to a lower U.S. pre-tax income in 2015 as a result of the significant charges in 2015 being

U.S. based. Refer to Note 17 - Income and Other Taxes, in the Consolidated Financial Statements for additional

information regarding the geographic mix of income before taxes and the related impacts on our effective tax rate.

Our effective tax rate is based on nonrecurring events as well as recurring factors, including the taxation of foreign

income. In addition, our effective tax rate will change based on discrete or other nonrecurring events (e.g. audit

settlements, tax law changes, changes in valuation allowances, etc.) that may not be predictable. Excluding the

effects of intangibles amortization, restructuring and retirement-related costs, and other discrete items, we anticipate

that our adjusted effective tax rate will be approximately 26% to 28% for the first quarter and full year 2016.

_____________

(1) See the "Non-GAAP Financial Measures" section for an explanation of the adjusted effective tax rate non-GAAP financial measure.

(2) Refer to Note 1 - Basis of Presentation and Summary of Significant Accounting policies for additional information.

Xerox 2015 Annual Report 42