Xerox 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

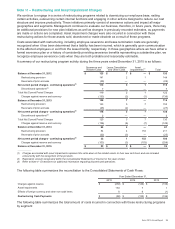

Note 11 – Restructuring and Asset Impairment Charges

We continue to engage in a series of restructuring programs related to downsizing our employee base, exiting

certain activities, outsourcing certain internal functions and engaging in other actions designed to reduce our cost

structure and improve productivity. These initiatives primarily consist of severance actions and impact all major

geographies and segments. Management continues to evaluate our business, therefore, in future years, there may

be additional provisions for new plan initiatives as well as changes in previously recorded estimates, as payments

are made or actions are completed. Asset impairment charges were also incurred in connection with these

restructuring actions for those assets sold, abandoned or made obsolete as a result of these programs.

Costs associated with restructuring, including employee severance and lease termination costs are generally

recognized when it has been determined that a liability has been incurred, which is generally upon communication

to the affected employees or exit from the leased facility, respectively. In those geographies where we have either a

formal severance plan or a history of consistently providing severance benefits representing a substantive plan, we

recognize employee severance costs when they are both probable and reasonably estimable.

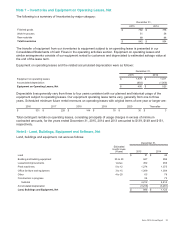

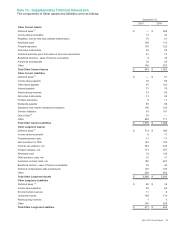

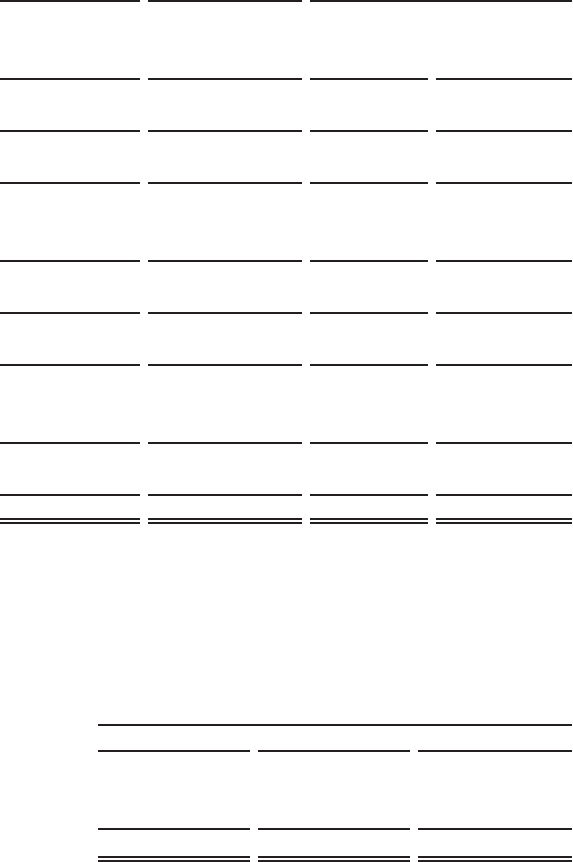

A summary of our restructuring program activity during the three years ended December 31, 2015 is as follows:

Severance and

Related Costs

Lease Cancellation

and Other Costs

Asset

Impairments(1) Total

Balance at December 31, 2012 $ 123 $7$—$ 130

Restructuring provision 141 2 1 144

Reversals of prior accruals (29)——(29)

Net current period charges - continuing operations(2) 112 2 1 115

Discontinued operations(3) 7——7

Total Net Current Period Charges 119 2 1 122

Charges against reserve and currency (133) (2) (1) (136)

Balance at December 31, 2013 109 7 —116

Restructuring provision 143 5 7 155

Reversals of prior accruals (25)(2)—

(27)

Net current period charges - continuing operations(2) 118 3 7 128

Discontinued operations(3) 2——2

Total Net Current Period Charges 120 3 7 130

Charges against reserve and currency (136) (6) (7) (149)

Balance at December 31, 2014 93 4—97

Restructuring provision 54 4 153 211

Reversals of prior accruals (22)(3)—

(25)

Net current period charges - continuing operations(2) 32 1 153 186

Charges against reserve and currency (103)(3)

(153)(259)

Balance at December 31, 2015 $22$ 2$—$ 24

________________

(1) Charges associated with asset impairments represent the write-down of the related assets to their new cost basis and are recorded

concurrently with the recognition of the provision.

(2) Represents amount recognized within the Consolidated Statements of Income for the years shown.

(3) Refer to Note 4 - Divestitures for additional information regarding discontinued operations.

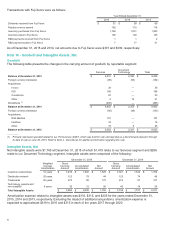

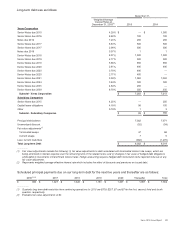

The following table summarizes the reconciliation to the Consolidated Statements of Cash Flows:

Year Ended December 31,

2015 2014 2013

Charges against reserve $(259)$ (149)$ (136)

Asset impairments 153 7 1

Effects of foreign currency and other non-cash items 89

(1)

Restructuring Cash Payments $(98)$ (133)$ (136)

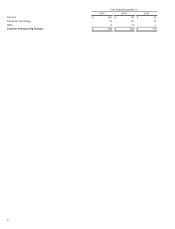

The following table summarizes the total amount of costs incurred in connection with these restructuring programs

by segment:

Xerox 2015 Annual Report 96