Xerox 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.XEROX CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in millions, except per-share data and where otherwise noted)

Note 1 – Basis of Presentation and Summary of Significant Accounting Policies

References herein to “we,” “us,” “our,” the “Company” and “Xerox” refer to Xerox Corporation and its consolidated

subsidiaries unless the context suggests otherwise.

Description of Business and Basis of Presentation

Xerox is an $18.0 billion global enterprise for business process and document management solutions. We are one of

the largest diversified business process outsourcing companies worldwide, with an expertise in managing

transaction-intensive processes. This includes services that support enterprises through multi-industry offerings such

as customer care, transaction processing, finance and accounting, and human resources, as well as industry

focused offerings in areas such as healthcare, transportation, financial services, retail and telecommunications. We

also provide extensive leading-edge document technology, services, software and genuine Xerox supplies for

graphic communication and office printing environments of any size.

Basis of Consolidation

The Consolidated Financial Statements include the accounts of Xerox Corporation and all of our controlled

subsidiary companies. All significant intercompany accounts and transactions have been eliminated. Investments in

business entities in which we do not have control, but we have the ability to exercise significant influence over

operating and financial policies (generally 20% to 50% ownership) are accounted for using the equity method of

accounting. Operating results of acquired businesses are included in the Consolidated Statements of Income from

the date of acquisition.

We consolidate variable interest entities if we are deemed to be the primary beneficiary of the entity. Operating

results for variable interest entities in which we are determined to be the primary beneficiary are included in the

Consolidated Statements of Income from the date such determination is made.

For convenience and ease of reference, we refer to the financial statement caption “Income before Income Taxes

and Equity Income” as “pre-tax income” throughout the Notes to the Consolidated Financial Statements.

Discontinued Operations

In 2014, we announced an agreement to sell our Information Technology Outsourcing (ITO) business to Atos SE

(Atos). As a result of this agreement and having met applicable accounting requirements, we reported the ITO

business as held for sale and a discontinued operation up through its date of sale, which was completed on June 30,

2015. In 2014 we also completed the disposal of two smaller businesses - Xerox Audio Visual Solutions, Inc. (XAV)

and Truckload Management Services (TMS) - that were also reported as discontinued operations. In 2013 we

completed the sale of our U.S. and Canadian (North American or N.A.) and Western European (European) Paper

businesses. Results from these businesses are reported as Discontinued Operations and all prior period results have

been reclassified to conform to this presentation. Refer to Note 4 - Divestitures for additional information regarding

discontinued operations.

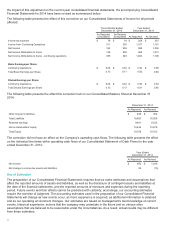

Prior Period Adjustments

During third quarter 2015, we recorded a $16 out-of-period adjustment associated with the over-accrual of an

employee benefit liability account. The impact of this adjustment was not material to any individual prior quarter or

year and is not material to our 2015 results.

During second quarter 2015, in connection with Fuji Xerox’s (FX) payment of its semi-annual dividend, we

determined that the dividends were no longer subject to an additional tax as a result of a change in the U.K. - Japan

Tax Treaty in December 2014. As of December 31, 2014, we had a deferred tax liability of $44 associated with this

additional tax on the undistributed earnings of FX through that date. This deferred tax liability was no longer required

as a result of the change in the Tax Treaty and, therefore, should have been reversed in December 2014. There was

no impact on operating cash flows from this adjustment. We assessed the materiality of this error on our 2014

financial statements and concluded that it was not material to the fourth quarter or annual period. However, due to

Xerox 2015 Annual Report 70