Xerox 2015 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Services (“HHSC”). The State alleges that the Company made false representations of material facts regarding the

processes, procedures, implementation and results regarding the prior authorization of orthodontic claims. The

State seeks recovery of actual damages, two times the amount of any overpayments made as a result of unlawful

acts, civil penalties, pre- and post-judgment interest and all costs and attorneys’ fees. The State references the

amount in controversy as exceeding hundreds of millions of dollars. Xerox filed its Answer in June, 2014 denying all

allegations. Xerox will continue to vigorously defend itself in this matter. We do not believe it is probable that we will

incur a material loss in excess of the amount accrued for this matter. In the course of litigation, we periodically

engage in discussions with plaintiff’s counsel for possible resolution of the matter. Should developments cause a

change in our determination as to an unfavorable outcome, or result in a final adverse judgment or settlement for a

significant amount, there could be a material adverse effect on our results of operations, cash flows and financial

position in the period in which such change in determination, judgment or settlement occurs.

Other Matters:

On January 5, 2016, the Consumer Financial Protection Bureau (CFPB) notified Xerox Education Services, Inc.

(XES) that, in accordance with the CFPB’s discretionary Notice and Opportunity to Respond and Advise (NORA)

process, the CFPB’s Office of Enforcement is considering recommending that the CFPB take legal action against

XES, alleging that XES violated the Consumer Financial Protection Act’s prohibition of unfair practices. Should the

CFPB commence an action, it may seek restitution, civil monetary penalties, injunctive relief, or other corrective

action. The purpose of a NORA letter is to provide a party being investigated an opportunity to present its position to

the CFPB before an enforcement action is recommended or commenced. This notice stems from an inquiry that

commenced in 2014 when the Company, through XES, received and responded to a Civil Investigative Demand

containing a broad request for information. During this process, XES self-disclosed to the Department of Education

and the CFPB certain adjustments it had become aware that had not been timely made relating to its servicing of a

small percentage of third-party student loans under outsourcing arrangements for various financial institutions. The

CFPB and the Department of Education, as well as certain state’s attorney general offices and other regulatory

agencies, began similar reviews. The Company has cooperated and continues to fully cooperate with all regulatory

agencies, and XES has submitted its NORA response. The Company cannot provide assurance that the CFPB or

another party will not ultimately commence a legal action against XES in this matter nor is the Company able to

predict the likely outcome of the investigations into this matter.

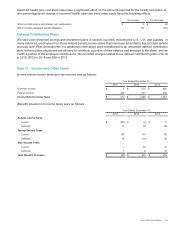

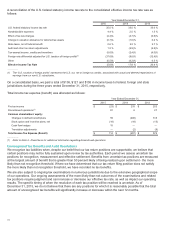

Guarantees, Indemnifications and Warranty Liabilities

Indemnifications Provided as Part of Contracts and Agreements

Acquisitions/Divestitures:

We have indemnified, subject to certain deductibles and limits, the purchasers of businesses or divested assets for

the occurrence of specified events under certain of our divestiture agreements. In addition, we customarily agree to

hold the other party harmless against losses arising from a breach of representations and covenants, including such

matters as adequate title to assets sold, intellectual property rights, specified environmental matters and certain

income taxes arising prior to the date of acquisition. Where appropriate, an obligation for such indemnifications is

recorded as a liability at the time of the acquisition or divestiture. Since the obligated amounts of these types of

indemnifications are often not explicitly stated and/or are contingent on the occurrence of future events, the overall

maximum amount of the obligation under such indemnifications cannot be reasonably estimated. Other than

obligations recorded as liabilities at the time of divestiture, we have not historically made significant payments for

these indemnifications. Additionally, under certain of our acquisition agreements, we have provided for additional

consideration to be paid to the sellers if established financial targets are achieved post-closing. We have recognized

liabilities for these contingent obligations based on an estimate of the fair value of these contingencies at the time of

acquisition. Contingent obligations related to indemnifications arising from our divestitures and contingent

consideration provided for by our acquisitions are not expected to be material to our financial position, results of

operations or cash flows.

Other Agreements:

We are also party to the following types of agreements pursuant to which we may be obligated to indemnify the

other party with respect to certain matters:

• Guarantees on behalf of our subsidiaries with respect to real estate leases. These lease guarantees may

remain in effect subsequent to the sale of the subsidiary.

119