Xerox 2015 Annual Report Download - page 96

Download and view the complete annual report

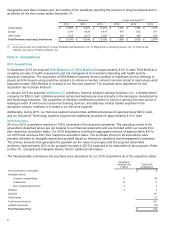

Please find page 96 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Impairment testing for goodwill is done at the reporting unit level. A reporting unit is an operating segment or one

level below an operating segment (a "component") if the component constitutes a business for which discrete

financial information is available, and segment management regularly reviews the operating results of that

component.

When testing goodwill for impairment, we may assess qualitative factors for some or all of our reporting units to

determine whether it is more likely than not (that is, a likelihood of more than 50 percent) that the fair value of a

reporting unit is less than its carrying amount, including goodwill. Alternatively, we may bypass this qualitative

assessment for some or all of our reporting units and perform a detailed quantitative test of impairment (Step 1). If

we perform the detailed quantitative impairment test and the carrying amount of the reporting unit exceeds its fair

value, we would perform an analysis (Step 2) to measure such impairment. In 2015, we elected to proceed to the

quantitative assessment of the recoverability of our goodwill balances for each of our reporting units in performing

our annual impairment test. Based on our quantitative assessments, we concluded that the fair values of each of our

reporting units in 2015 exceeded their carrying values and no impairments were identified.

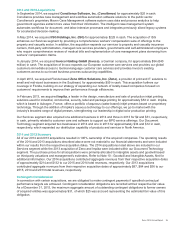

Other intangible assets primarily consist of assets obtained in connection with business acquisitions, including

installed customer base and distribution network relationships, patents on existing technology and trademarks. We

apply an impairment evaluation whenever events or changes in business circumstances indicate that the carrying

value of our intangible assets may not be recoverable. Other intangible assets are amortized on a straight-line basis

over their estimated economic lives. We believe that the straight-line method of amortization reflects an appropriate

allocation of the cost of the intangible assets to earnings in proportion to the amount of economic benefits obtained

annually by the Company.

Refer to Note 10 - Goodwill and Intangible Assets, Net for further information.

Impairment of Long-Lived Assets

We review the recoverability of our long-lived assets, including buildings, equipment, internal use software and other

intangible assets, when events or changes in circumstances occur that indicate that the carrying value of the asset

may not be recoverable. The assessment of possible impairment is based on our ability to recover the carrying value

of the asset from the expected future pre-tax cash flows (undiscounted and without interest charges) of the related

operations. If these cash flows are less than the carrying value of such asset, an impairment loss is recognized for

the difference between estimated fair value and carrying value. Our primary measure of fair value is based on

discounted cash flows.

Pension and Post-Retirement Benefit Obligations

We sponsor various forms of defined benefit pension plans in several countries covering employees who meet

eligibility requirements. Retiree health benefit plans cover U.S. and Canadian employees for retiree medical costs.

We employ a delayed recognition feature in measuring the costs of pension and post-retirement benefit plans. This

requires changes in the benefit obligations and changes in the value of assets set aside to meet those obligations to

be recognized not as they occur, but systematically and gradually over subsequent periods. All changes are

ultimately recognized as components of net periodic benefit cost, except to the extent they may be offset by

subsequent changes. At any point, changes that have been identified and quantified but not recognized as

components of net periodic benefit cost, are recognized in Accumulated Other Comprehensive Loss, net of tax.

Several statistical and other factors that attempt to anticipate future events are used in calculating the expense,

liability and asset values related to our pension and retiree health benefit plans. These factors include assumptions

we make about the discount rate, expected return on plan assets, rate of increase in healthcare costs, the rate of

future compensation increases and mortality. Actual returns on plan assets are not immediately recognized in our

income statement due to the delayed recognition requirement. In calculating the expected return on the plan asset

component of our net periodic pension cost, we apply our estimate of the long-term rate of return on the plan assets

that support our pension obligations, after deducting assets that are specifically allocated to Transitional Retirement

Accounts (which are accounted for based on specific plan terms).

79