Xerox 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Liquidity section as well as Note 6 - Finance Receivables, Net in the Consolidated Financial Statements for

additional information.

• Equipment sales revenue is reported primarily within our Document Technology segment and the Document

Outsourcing business within our Services segment. Equipment sales revenue decreased 10% from the prior

year, including a 4-percentage point negative impact from currency. The constant currency decline was driven

by developing markets with the remainder reflecting lower high-end and OEM sales as well as overall price

declines that continue to be within our historical range of 5% to 10%.These areas of decline were partially offset

by DO equipment sales growth.

Revenue 2014

Total revenues decreased 2% compared to the prior year with no impact from currency. Total revenues included the

following:

• Annuity revenue decreased 1% compared to the prior year with no impact from currency. Annuity revenue is

comprised of the following:

Outsourcing, maintenance and rentals revenue includes outsourcing revenue within our Services segment

and maintenance revenue (including bundled supplies) and rental revenue, both primarily within our

Document Technology segment. Revenues of $13,865 million decreased 1% from the prior year with a 1-

percentage point negative impact from currency. The decrease was due to a decline in the Document

Technology segment partially offset by growth in outsourcing revenue within our Services segment.

Supplies, paper and other sales includes unbundled supplies and other sales, primarily within our

Document Technology segment. Revenues of $2,184 million decreased 2% from the prior year with no

impact from currency. The decrease was primarily driven by moderately lower supplies demand and a

decline in other sales revenue.

Financing revenue is generated from financed sale transactions primarily within our Document Technology

segment. Financing revenues decreased 20% from the prior year due primarily to $40 million in pre-tax

gains on finance receivable sales in 2013 as well as a lower finance receivable balance mostly as a result

of prior period sales of finance receivables and lower originations due to decreased equipment sales. Refer

to the discussion on Sales of Finance Receivable in the "Capital Resources and Liquidity" section as well as

Note 6 - Finance Receivables, Net in the Consolidated Financial Statements for additional information.

• Equipment sales revenue is reported primarily within our Document Technology segment and the Document

Outsourcing business within our Services segment. Equipment sales revenue decreased 8% from the prior

year, including a 1-percentage point negative impact from currency. Lower installs across the majority of our

product groupings, lower sales in entry products due to product launch timing and overall price declines that

were at the low-end of our historical 5% to 10% range contributed to the decline. Equipment sales were also

impacted by lower sales in developing markets, and particularly lower sales in Russia due to economic

instability.

An analysis of the change in revenue for each business segment is included in the “Operations Review of Segment

Revenue and Profit” section.

Costs, Expenses and Other Income

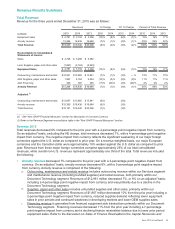

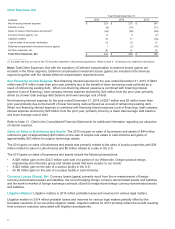

Summary of Key Financial Ratios

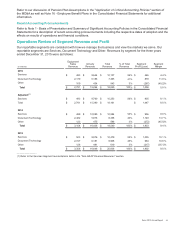

Year Ended December 31, Change

2015 2014 2013 2015 B/(W) 2014 B/(W)

2015

Adjusted(1)

2015

Adjusted(1)

B/(W) 2014

Total Gross Margin 29.2% 32.0% 32.4% (2.8) pts (0.4) pts 31.1%(0.9) pts

RD&E as a % of Revenue 3.1% 3.0% 3.0% (0.1) pts — pts 3.1% (0.1) pts

SAG as a % of Revenue 19.7% 19.4% 20.4% (0.3) pts 1.0 pts 19.6%(0.2) pts

Operating Margin(1) NM 9.6% 9.0% NM 0.6 pts 8.4% (1.2) pts

Pre-tax Income Margin 2.3% 6.2% 6.2% (3.9) pts — pts N/A N/A

_______________

(1) Refer to Key Financial Ratios reconciliation table in the "Non-GAAP Financial Measures" section.

37