Xerox 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Senior Notes

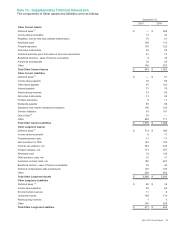

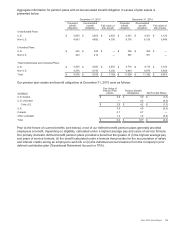

We issued the following Senior Notes in 2015:

• In August 2015 we issued $400 of 3.50% Senior Notes due 2020 (the "2020 Senior Notes") at 99.113% of par,

resulting in aggregate net proceeds of approximately $396.

• In March 2015, we issued $400 of 2.75% Senior Notes due 2020 (the "2020 Senior Notes") at 99.879% of par

and $250 of 4.80% Senior Notes due 2035 (the "2035 Senior Notes") at 99.428% of par, resulting in aggregate

net proceeds of approximately $648.

Interest on these Senior Notes is payable semi-annually. Debt issuance costs of $9 were paid and deferred in

connection with the issuances of these Senior Notes. The proceeds were used for general corporate purposes,

which included repayment of a portion of our outstanding borrowings.

In 2015 we also repaid the following Senior Notes due in 2015 - $1,000 of 4.29% Senior Notes and $250 of 4.25%

Senior Notes.

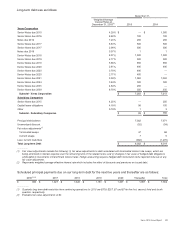

Commercial Paper

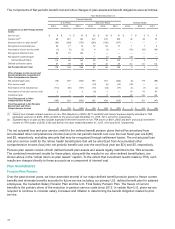

We have a private placement commercial paper (CP) program in the U.S. under which we may issue CP up to a

maximum amount of $2.0 billion outstanding at any time. Aggregate CP and Credit Facility borrowings may not

exceed $2.0 billion outstanding at any time. The maturities of the CP Notes will vary, but may not exceed 390 days

from the date of issue. The CP Notes are sold at a discount from par or, alternatively, sold at par and bear interest at

market rates. CP outstanding at December 31, 2015 and 2014, was $0 and $150, respectively.

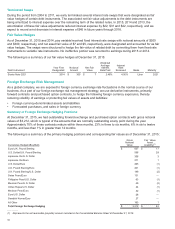

Credit Facility

We have a $2.0 billion unsecured revolving Credit Facility with a group of lenders, which matures in 2019. The

Credit Facility contains a $300 letter of credit sub-facility, and also includes an accordion feature that would allow us

to increase (from time to time, with willing lenders) the overall size of the facility up to an aggregate amount not to

exceed $2.75 billion.

The Credit Facility provides a backstop to our $2.0 billion CP program. Proceeds from any borrowings under the

Credit Facility can be used to provide working capital for the Company and its subsidiaries and for general

corporate purposes. At December 31, 2015 we had no outstanding borrowings or letters of credit under the Credit

Facility.

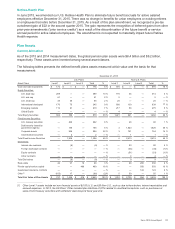

The Credit Facility is available, without sublimit, to certain of our qualifying subsidiaries. Our obligations under the

Credit Facility are unsecured and are not currently guaranteed by any of our subsidiaries. Any domestic subsidiary

that guarantees more than $100 of Xerox Corporation debt must also guaranty our obligations under the Credit

Facility. In the event that any of our subsidiaries borrows under the Credit Facility, its borrowings thereunder would

be guaranteed by us.

Borrowings under the Credit Facility bear interest at our choice, at either (a) a Base Rate as defined in our Credit

Facility agreement, plus a spread that varies between 0.00% and 0.45% depending on our credit rating at the time

of borrowing, or (b) LIBOR plus an all-in spread that varies between 0.90% and 1.45% depending on our credit

rating at the time of borrowing. Based on our credit rating as of December 31, 2015, the applicable all-in spreads for

the Base Rate and LIBOR borrowing were 0.10% and 1.10%, respectively.

An annual facility fee is payable to each lender in the Credit Facility at a rate that varies between 0.10% and 0.30%

depending on our credit rating. Based on our credit rating as of December 31, 2015, the applicable rate is 0.15%.

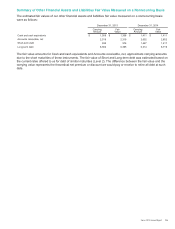

The Credit Facility contains various conditions to borrowing and affirmative, negative and financial maintenance

covenants. Certain of the more significant covenants are summarized below:

(a) Maximum leverage ratio (a quarterly test that is calculated as principal debt divided by consolidated EBITDA, as

defined) of 3.75x.

(b) Minimum interest coverage ratio (a quarterly test that is calculated as consolidated EBITDA divided by

consolidated interest expense) may not be less than 3.00x.

101