Xerox 2015 Annual Report Download - page 92

Download and view the complete annual report

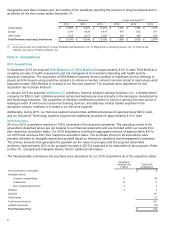

Please find page 92 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.certain of our low end products, we do not have any significant product warranty obligations, including any

obligations under customer satisfaction programs.

Bundled Lease Arrangements: We sell our products and services under bundled lease arrangements, which

typically include equipment, service, supplies and financing components for which the customer pays a single

negotiated fixed minimum monthly payment for all elements over the contractual lease term. These arrangements

also typically include an incremental, variable component for page volumes in excess of contractual page volume

minimums, which are often expressed in terms of price-per-page. The fixed minimum monthly payments are

multiplied by the number of months in the contract term to arrive at the total fixed minimum payments that the

customer is obligated to make (fixed payments) over the lease term. The payments associated with page volumes in

excess of the minimums are contingent on whether or not such minimums are exceeded (contingent payments). In

applying our lease accounting methodology, we only consider the fixed payments for purposes of allocating to the

relative fair value elements of the contract. Contingent payments, if any, are recognized as revenue in the period

when the customer exceeds the minimum copy volumes specified in the contract.

Revenues under bundled arrangements are allocated considering the relative selling prices of the lease and non-

lease deliverables included in the bundled arrangement. Lease deliverables include the equipment, financing,

maintenance and other executory costs, while non-lease deliverables generally consist of the supplies and non-

maintenance services. The allocation for the lease deliverables begins by allocating revenues to the maintenance

and other executory costs plus a profit thereon. These elements are generally recognized over the term of the lease

as service revenue. The remaining amounts are allocated to the equipment and financing elements which are

subjected to the accounting estimates noted below under “Leases.”

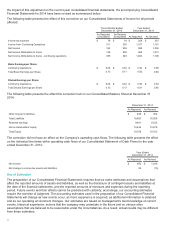

Our pricing interest rates, which are used in determining customer payments in a bundled lease arrangement, are

developed based upon a variety of factors including local prevailing rates in the marketplace and the customer’s

credit history, industry and credit class. We reassess our pricing interest rates quarterly based on changes in the

local prevailing rates in the marketplace. These interest rates have generally been adjusted if the rates vary by 25

basis points or more, cumulatively, from the rate last in effect. The pricing interest rates generally equal the implicit

rates within the leases, as corroborated by our comparisons of cash to lease selling prices.

Sales to distributors and resellers: We utilize distributors and resellers to sell many of our technology products,

supplies and services to end-user customers. We refer to our distributor and reseller network as our two-tier

distribution model. Sales to distributors and resellers are generally recognized as revenue when products are sold to

such distributors and resellers. However, revenue is only recognized when the distributor or reseller has economic

substance apart from the company, the sales price is not contingent upon resale or payment by the end user

customer and we have no further obligations related to bringing about the resale, delivery or installation of the

product.

Distributors and resellers participate in various rebate, price-protection, cooperative marketing and other programs,

and we record provisions for these programs as a reduction to revenue when the sales occur. Similarly, we account

for our estimates of sales returns and other allowances when the sales occur based on our historical experience.

In certain instances, we may provide lease financing to end-user customers who purchased equipment we sold to

distributors or resellers. We compete with other third-party leasing companies with respect to the lease financing

provided to these end-user customers.

Supplies: Supplies revenue generally is recognized upon shipment or utilization by customers in accordance with

the sales contract terms.

Software: Most of our equipment has both software and non-software components that function together to deliver

the equipment's essential functionality and therefore they are accounted for together as part of equipment sales

revenues. Software accessories sold in connection with our equipment sales, as well as free-standing software sales

are accounted for as separate deliverables or elements. In most cases, these software products are sold as part of

multiple element arrangements and include software maintenance agreements for the delivery of technical service,

as well as unspecified upgrades or enhancements on a when-and-if-available basis. In those software accessory and

free-standing software arrangements that include more than one element, we allocate the revenue among the

elements based on vendor-specific objective evidence (VSOE) of fair value. Revenue allocated to software is

normally recognized upon delivery while revenue allocated to the software maintenance element is recognized

ratably over the term of the arrangement.

Leases: As noted above, equipment may be placed with customers under bundled lease arrangements. The two

primary accounting provisions which we use to classify transactions as sales-type or operating leases are: (1) a

review of the lease term to determine if it is equal to or greater than 75% of the economic life of the equipment and

75