Xerox 2015 Annual Report Download - page 57

Download and view the complete annual report

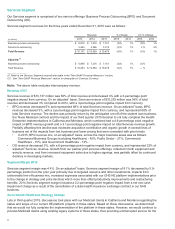

Please find page 57 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Restructuring and Asset Impairment Charges

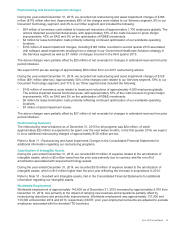

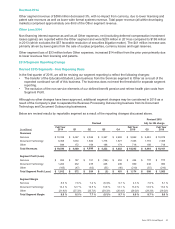

During the year ended December 31, 2015, we recorded net restructuring and asset impairment charges of $186

million ($118 million after-tax). Approximately 88% of the charges were related to our Services segment, 8% to our

Document Technology segment, and 4% to our Other segment and included the following:

• $54 million of severance costs related to headcount reductions of approximately 1,700 employees globally. The

actions impacted several functional areas, with approximately 53% of the costs focused on gross margin

improvements, 42% on SAG and 5% on the optimization of RD&E investments.

• $4 million for lease termination costs primarily reflecting continued optimization of our worldwide operating

locations.

• $153 million of asset impairment charges, including $146 million recorded in second quarter 2015 associated

with software asset impairments resulting from a change in our Government Healthcare Solutions strategy in

the Services segment as well as $7 million of charges incurred in the third quarter 2015.

The above charges were partially offset by $25 million of net reversals for changes in estimated reserves from prior

period initiatives.

We expect 2016 pre-tax savings of approximately $50 million from our 2015 restructuring actions.

During the year ended December 31, 2014, we recorded net restructuring and asset impairment charges of $128

million ($91 million after-tax). Approximately 30% of the charges were related to our Services segment, 59% to our

Document Technology segment, and 11% to our Other segment and included the following:

• $143 million of severance costs related to headcount reductions of approximately 4,000 employees globally.

The actions impacted several functional areas, with approximately 53% of the costs focused on gross margin

improvements, 42% on SAG and 5% on the optimization of RD&E investments.

• $5 million for lease termination costs primarily reflecting continued optimization of our worldwide operating

locations.

• $7 million of asset impairment losses.

The above charges were partially offset by $27 million of net reversals for changes in estimated reserves from prior

period initiatives.

Restructuring Summary

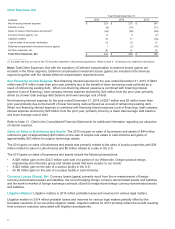

The restructuring reserve balance as of December 31, 2015 for all programs was $24 million, of which

approximately $23 million is expected to be spent over the next twelve months. In the first quarter 2016, we expect

to incur additional restructuring charges of approximately $100 million pre-tax.

Refer to Note 11 - Restructuring and Asset Impairment Charges in the Consolidated Financial Statements for

additional information regarding our restructuring programs.

Amortization of Intangible Assets

During the year ended December 31, 2015, we recorded $310 million of expense related to the amortization of

intangible assets, which is $5 million lower than the prior year primarily due to currency and the run-off of

amortization associated with acquired technology assets.

During the year ended December 31, 2014, we recorded $315 million of expense related to the amortization of

intangible assets, which is $10 million higher than the prior year reflecting the increase in acquisitions in 2014.

Refer to Note 10 - Goodwill and Intangible assets, Net in the Consolidated Financial Statements for additional

information regarding our intangible assets.

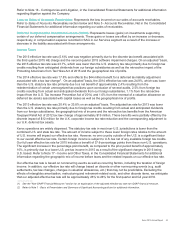

Worldwide Employment

Worldwide employment of approximately 143,600 as of December 31, 2015 increased by approximately 5,700 from

December 31, 2014, due primarily to the impact of ramping new business and acquisitions partially offset by

restructuring reductions and productivity improvements. Worldwide employment was approximately 137,900 and

133,300 at December 2014 and 2013, respectively (NOTE: prior year employment amounts are adjusted to exclude

employees associated with the divested ITO business).

Xerox 2015 Annual Report 40