Xerox 2015 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

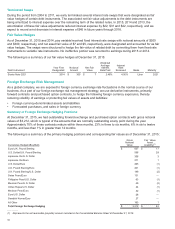

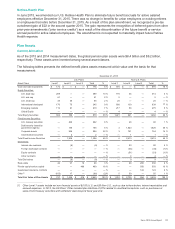

Retiree-Health Plan

In June 2015, we amended our U.S. Retiree Health Plan to eliminate future benefit accruals for active salaried

employees effective December 31, 2015. There was no change in benefits for union employees or existing retirees

or employees that retire before December 31, 2015. As a result of this plan amendment, we recognized a pre-tax

curtailment gain of $22 in the second quarter 2015. The gain represents the recognition of deferred gains from other

prior-year amendments (“prior service credits”) as a result of the discontinuation of the future benefit or service

accrual period for active salaried employees. The amendment is not expected to materially impact future Retiree

Health expense.

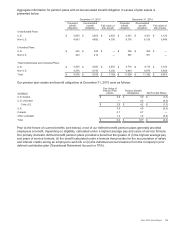

Plan Assets

Current Allocation

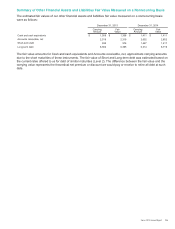

As of the 2015 and 2014 measurement dates, the global pension plan assets were $8.4 billion and $9.2 billion,

respectively. These assets were invested among several asset classes.

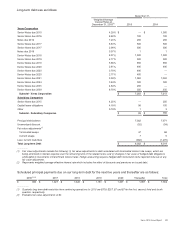

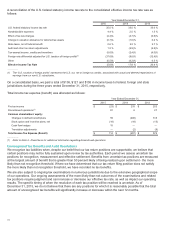

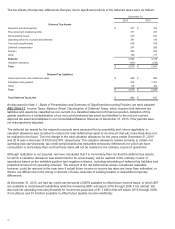

The following tables presents the defined benefit plans assets measured at fair value and the basis for that

measurement:

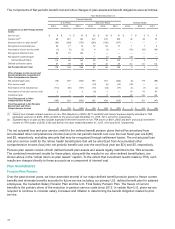

December 31, 2015

U.S. Plans Non-U.S. Plans

Asset Class Level 1 Level 2 Level 3 Total % Level 1 Level 2 Level 3 Total %

Cash and cash equivalents $ 174 $ — $ — $ 174 6 % $ 578 $ — $ — $ 578 10 %

Equity Securities:

U.S. large cap 289 — — 289 10 % 170 44 — 214 4 %

U.S. mid cap 61 — — 61 2% 5 — — 5 —%

U.S. small cap 45 20 — 65 2% 25 — — 25 —%

International developed 170 75 — 245 9 % 800 139 — 939 17 %

Emerging markets 119 91 — 210 7 % 217 58 — 275 5 %

Global Equity — — — — — % 4 — — 4 — %

Total Equity Securities 684 186 — 870 30 % 1,221 241 — 1,462 26 %

Fixed Income Securities:

U.S. treasury securities — 222 — 222 8 % — 48 — 48 1%

Debt security issued by

government agency — 156 — 156 5 % 3 1,623 — 1,626 30 %

Corporate bonds — 926 — 926 32 % 3 741 — 744 14 %

Asset backed securities — 2 — 2 — % — 1 — 1 — %

Total Fixed Income Securities — 1,306 — 1,306 45 % 6 2,413 — 2,419 45 %

Derivatives:

Interest rate contracts — (8) — (8) — % — 90 — 90 2%

Foreign exchange contracts — — — — — % — (34) — (34) (1)%

Equity contracts — — — — — % — (51) — (51) (1)%

Other contracts — — — — — % —4—4—%

Total Derivatives — (8) — (8) — % — 9 — 9 — %

Real estate 42 37 19 98 3 % — 26 280 306 6 %

Private equity/venture capital — — 499 499 18 % — — 550 550 10 %

Guaranteed insurance contracts — — — — — % — — 124 124 2 %

Other(1) (103) 17 — (86) (2)% 5 50 — 55 1%

Total Fair Value of Plan Assets $ 797 $ 1,538 $ 518 $ 2,853 100 % $ 1,810 $ 2,739 $ 954 $ 5,503 100 %

_____________________________

(1) Other Level 1 assets include net non-financial assets of $(103) U.S. and $5 Non-U.S., such as due to/from broker, interest receivables and

accrued expenses. In 2015, the US Plans' Other included plan liabilities of $116 related to unsettled transactions such as purchases or

sales of US Treasury securities with settlement dates beyond fiscal year-end.

Xerox 2015 Annual Report 110