Xerox 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 4 – Divestitures

Information Technology Outsourcing (ITO)

In December 2014, we announced an agreement to sell our ITO business to Atos and began reporting it as a

Discontinued Operation. All prior periods were accordingly revised to conform to this presentation. The sale was

completed on June 30, 2015. The final sale price of approximately $940 ($930 net of cash sold) reflects closing

adjustments, including an adjustment for changes in net asset values and additional proceeds for the condition of

certain assets at the closing. Atos also assumed approximately $85 of capital lease obligations and pension

liabilities. Net after-tax proceeds are estimated to be approximately $850, which reflects expected cash taxes as

well as our transaction and transition costs associated with the disposal. The ITO business included approximately

9,600 employees in 42 countries, who were transferred to Atos upon closing.

In 2014, we recorded a net pre-tax loss of $181 related to the pending sale, reflecting the write-down of the carrying

value of the ITO disposal group, inclusive of goodwill, to its estimated fair value less costs to sell. In 2015, we

recorded an additional net pre-tax loss of $77 primarily at closing related to an adjustment of the sales price and

related expenses associated with the disposal, as well as reserves for certain obligations and indemnifications we

retained as part of the final closing negotiations. In addition, we recorded additional tax expense of $52 primarily

related to the difference between the book basis and tax basis of allocated goodwill, which could only be recorded

upon final disposal of the business.

In February 2016, we reached an agreement with Atos on the final adjustments to the closing balance of net assets

sold as well as the settlement of certain indemnifications and recorded an additional pre-tax loss on the disposal in

2015 of $24 ($14 after-tax). The additional loss was recorded in 2015 as the financial statements had not yet been

issued when the agreement was reached with Atos. We expect to make a payment in 2016 to Atos of approximately

$52, representing a $28 adjustment to the final sales price as a result of this agreement and a payment of $24 due

from closing. The payment will be reflected in Investing cash flows as an adjustment of the sales proceeds.

Other Discontinued Operations

During the third quarter 2014, we completed the closure of Xerox Audio Visual Solutions, Inc. (XAV), a small

audio visual business within our Global Imaging Systems subsidiary, and recorded a net pre-tax loss on disposal of

$1. XAV provided audio visual equipment and services to enterprise and government customers.

In May 2014 we sold our Truckload Management Services, Inc. (TMS) business for $15 and recorded a net pre-

tax loss on disposal of $1. TMS provided document capture and submission solutions as well as campaign

management, media buying and digital marketing services to the long haul trucking and transportation industry.

In 2013, in connection with our decision to exit from the Paper distribution business, we completed the sale of our

North American and European Paper businesses. We recorded a net pre-tax loss on disposal of $25 in 2013 for

the disposition of these businesses.

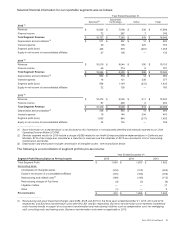

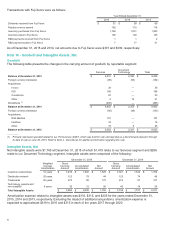

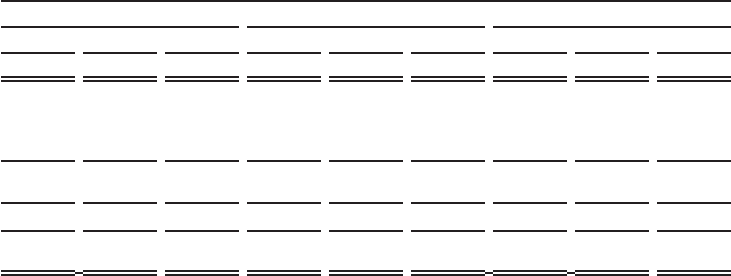

Summarized financial information for our Discontinued Operations is as follows:

Year Ended December 31,

2015 2014 2013

ITO Other Total ITO Other Total ITO Other Total

Revenues $ 619 $ — $ 619 $ 1,320 $ 45 $ 1,365 $ 1,335 $ 497 $ 1,832

Income (loss) from operations (1),(2) $ 104 $ — $ 104 $ 74 $ (1) $ 73 $ 70 $ 2 $ 72

Loss on disposal (101) — (101) (181) (1) (182) — (25) (25)

Net income (loss) before income

taxes $ 3 $ — $ 3 $ (107) $ (2) $ (109) $ 70 $ (23) $ 47

Income tax expense (81) — (81) (5) (1) (6) (24) (3) (27)

(Loss) income from discontinued

operations, net of tax $ (78) $ — $ (78) $ (112) $ (3) $ (115) $ 46 $ (26) $ 20

(1) ITO income from operations for the year ended December 31, 2015, excludes approximately $80 of depreciation and amortization expense

(including $14 for intangible amortization) since the business was held for sale.

(2) ITO Income from operations for the year ended December 31, 2014 includes approximately $161 of depreciation and amortization expense

(including $27 for intangible amortization).

85