Xerox 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

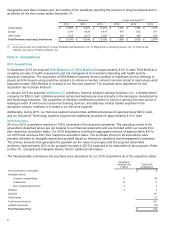

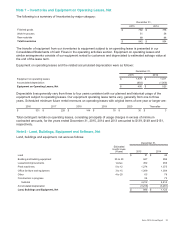

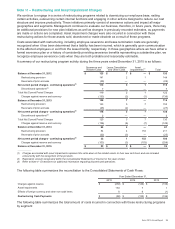

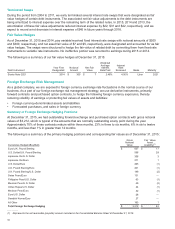

Depreciation expense and operating lease rent expense were as follows:

Year Ended December 31,

2015 2014 2013

Depreciation expense $ 277 $324 $ 332

Operating lease expense 553 560 513

We lease buildings and equipment, substantially all of which are accounted for as operating leases. Capital leased

assets were approximately $98 and $105 at December 31, 2015 and 2014, respectively.

Future minimum operating lease commitments that have initial or remaining non-cancelable lease terms in excess of

one year at December 31, 2015 were as follows:

2016 2017 2018 2019 2020 Thereafter

$ 378 $ 271 $ 178 $ 122 $ 78 $ 139

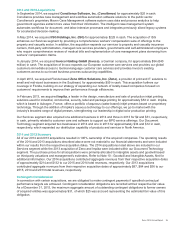

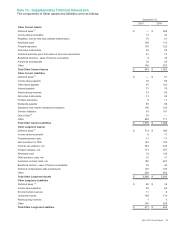

Internal Use and Product Software

Year Ended December 31,

Additions to: 2015 2014 2013

Internal use software $ 91 $ 82 $ 77

Product software 23 23 28

December 31,

Capitalized costs, net: 2015 2014

Internal use software $383 $ 434

Product software 115 307

Useful lives of our internal use and product software generally vary from three to ten years.

Included within product software at December 31, 2015 and 2014 is approximately $55 and $250, respectively, of

capitalized costs associated with software system platforms developed for use in certain of our government services

businesses. During 2015, as a result of our decision to discontinue certain future implementations of these software

system platforms (Government Healthcare Strategy Change), we recorded impairment charges associated with

these software platforms of approximately $160. Our impairment review of the remaining balance at December 31,

2015 indicated that the costs would be recoverable from estimated future operating profits; however, those future

operating profits are dependent on our ability to successfully complete existing contracts as well as obtain future

contracts.

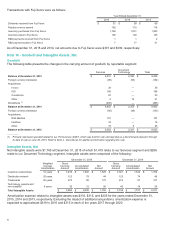

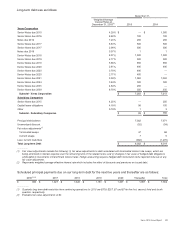

Note 9 – Investment in Affiliates, at Equity

Investments in corporate joint ventures and other companies in which we generally have a 20% to 50% ownership

interest were as follows:

December 31,

2015 2014

Fuji Xerox $1,315 $1,275

Other 74 63

Investments in Affiliates, at Equity $1,389 $1,338

Our equity in net income of our unconsolidated affiliates was as follows:

Year Ended December 31,

2015 2014 2013

Fuji Xerox $117 $147 $156

Other 18 13 13

Total Equity in Net Income of Unconsolidated Affiliates $135 $160 $169

93