Xerox 2015 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

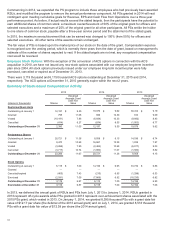

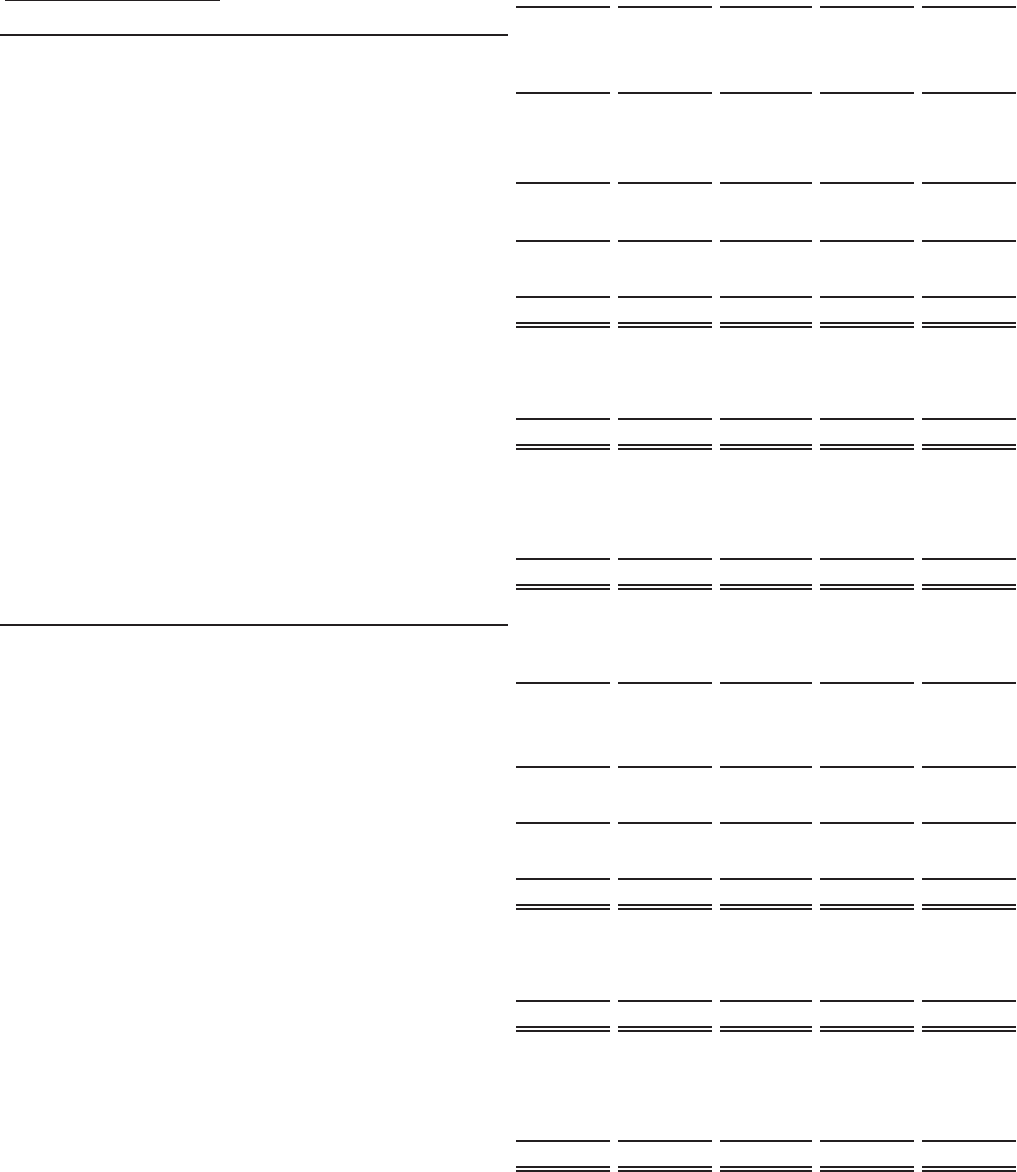

QUARTERLY RESULTS OF OPERATIONS (Unaudited)

(in millions, except per-share data)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Full

Year

2015

Revenues $4,469 $4,590 $4,333 $4,653 $18,045

Costs and Expenses 4,268 4,516 4,506 4,343 17,633

Income (Loss) before Income Taxes and Equity Income 201 74 (173)310 412

Income tax expense (benefit) 39 (9) (105)52(23)

Equity in net income of unconsolidated affiliates 34 29 40 32 135

Income (Loss) from Continuing Operations 196 112 (28)290 570

Income (loss) from discontinued operations, net of tax 34 (95)(3)

(14)(78)

Net Income (Loss) 230 17 (31)276 492

Less: Net income - noncontrolling interests 5 5 3 518

Net Income (Loss) Attributable to Xerox $225 $12$

(34)$ 271 $474

Basic Earnings (Loss) per Share(2):

Continuing operations $ 0.17 $0.09 $(0.04)$ 0.28 0.50

Discontinued operations 0.03 (0.08)—

(0.02)(0.08)

Total Basic Earnings (Loss) per Share $0.20 $0.01 $(0.04)$ 0.26 $0.42

Diluted Earnings (Loss) per Share(2):

Continuing operations $ 0.16 $0.09 $(0.04)$ 0.27 0.49

Discontinued operations 0.03 (0.08)—

(0.01)(0.07)

Total Diluted Earnings (Loss) per Share $0.19 $0.01 $(0.04)$ 0.26 $0.42

2014 (1)

Revenues $4,771 $4,941 $4,795 $5,033 $19,540

Costs and Expenses 4,500 4,640 4,509 4,685 18,334

Income before Income Taxes and Equity Income 271 301 286 348 1,206

Income tax expense 42 73 66 34 215

Equity in net income of unconsolidated affiliates 42 33 44 41 160

Income from Continuing Operations 271 261 264 355 1,151

Income (loss) from discontinued operations, net of tax 15 11 8 (149)(115)

Net Income 286 272 272 206 1,036

Less: Net income - noncontrolling interests 5 6 6 623

Net Income Attributable to Xerox $281 $266 $266 $200 $1,013

Basic Earnings per Share(2):

Continuing operations $ 0.22 $0.21 $0.22 $0.30 $0.96

Discontinued operations 0.01 0.01 0.01 (0.13)(0.10)

Total Basic Earnings per Share: $0.23 $0.22 $0.23 $0.17 $0.86

Diluted Earnings per Share(2):

Continuing operations $ 0.22 $0.21 $0.21 $0.30 $0.94

Discontinued operations 0.01 0.01 0.01 (0.13)(0.09)

Total Diluted Earnings per Share $0.23 $0.22 $0.22 $0.17 $0.85

_________________

(1) Fourth Quarter and Full Year 2014 were revised for a deferred tax liability adjustment related to a change in tax law. Refer to Note 1 -

Basis of Presentation and Summary of Significant Accounting Policies in our Consolidated Financial Statements, which is incorporated

here by reference, for additional information.

(2) The sum of quarterly earnings per share may differ from the full-year amounts due to rounding, or in the case of diluted earnings per

share, because securities that are anti-dilutive in certain quarters may not be anti-dilutive on a full-year basis.

Xerox 2015 Annual Report 128