Xerox 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 Annual Report

Table of contents

-

Page 1

2015 Annual Report -

Page 2

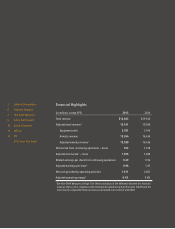

... of Directors Officers FYI 2015 Form 10-K Insert Financial Highlights (in millions, except EPS) Total revenue Adjusted total revenue* Equipment sales Annuity revenue Adjusted annuity revenue* Net income from continuing operations - Xerox Adjusted net income* - Xerox Diluted earnings per share from... -

Page 3

At Xerox, we engineer the ï¬,ow of work. We apply our expertise in business process, imaging, analytics, automation and user-centric insights to help clients become more productive, efï¬cient, secure and precise across a wide range of domains and industries. Xerox 2015 Annual Report 1 1 -

Page 4

..., in early 2016, one that we believe will deliver the highest valuecreating opportunity for shareholders, was our move to separate Xerox into two independent companies. This decision followed a comprehensive review of our structural options and provides us with increased strategic focus, ï¬nancial... -

Page 5

... also support business processes that touch the lives of millions of people: drivers, patients, shoppers, employees and beneï¬t recipients, just to name a few. Below are some examples of what I mean: • The State of Florida selected Xerox to implement a state-of-the-art customer service system for... -

Page 6

... in revenue in 2015. This business is the equipment share leader, and its managed print services offerings are widely recognized as best-of-breed by industry analysts. • The Business Process Outsourcing (BPO) company will continue to be a leading enterprise for the next generation of BPO. In 2015... -

Page 7

... to improve the value we deliver to customers and partners, increase returns for shareholders, and become the employer of choice in the document technology and BPO industries. I hope you share our excitement about our company's new path forward. Our efforts to transform Xerox are under way, and we... -

Page 8

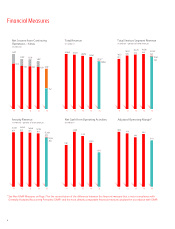

Financial Measures Net Income from Continuing Operations - Xerox (in millions) 1,470* 1,338* 1,328* 1,280* 1,219 1,152 1,139 1,128 1,076* 20,638 20,421 10,271 50% 10,479 52% 10,584 54% 10,253* 56% 10,137 56% Total Revenue (in millions) Total Services Segment Revenue (in millions - percent of total... -

Page 9

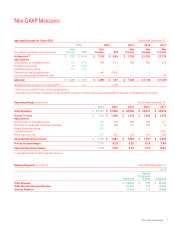

... EPS include 27 million shares associated with the Series A convertible preferred stock. Operating Margin (in millions) 2015 Total Revenues Pre-tax Income Adjustments: Amortization of intangible assets Restructuring and asset impairment charges Health Enterprise charge Curtailment gain Other... -

Page 10

... shareholder value. This resulted in our decision in early 2016 to separate Xerox into two independent companies, creating a new path forward. The work we have done to improve our core businesses enables us to take this next step. Document Technology Global leader in document management and... -

Page 11

... Business Process Outsourcing An industry leader with a combination of deep industry expertise, marketleading automation solutions and global delivery excellence. #2 BPO market share 90% Recurring revenues with high renewaB rates 5% AnnuaB BPO market growth 104K EmpBoyees Xerox 2015 Annual... -

Page 12

... Ursula M. Burns Chairman and Chief Executive Ofï¬cer Xerox Corporation Norwalk, CT Richard J. Harrington A Retired President and Chief Executive Ofï¬cer The Thomson Corporation Stamford, CT William Curt Hunter A, D Dean Emeritus, Tippie College of Business University of Iowa Iowa City, IA... -

Page 13

... Innovation Group Kevin M. Warren Vice President President, Commercial Business Group Xerox Services Susan A. Watts Vice President Chief Operating Ofï¬cer, Global Capabilities Xerox Services Douglas H. Marshall Assistant Secretary Carol A. McFate Chief Investment Ofï¬cer Xerox 2015 Annual Report... -

Page 14

....5111 Products and Services www.xerox.com or by phone: 800.ASK.XEROX (800.275.9376) Additional Information The Xerox Foundation www.xerox.com/foundation Mark Conlin, President 203.849.2453 [email protected] Global Diversity and Inclusion Programs and EE0-1 Reports www.xerox.com/diversity Damika... -

Page 15

...Commission File Number 001-04471 XEROX CORPORATION (Exact Name of Registrant as specified in its charter) New York (State of incorporation) 16-0468020 (IRS Employer Identification No.) P.O. Box 4505, 45 Glover Avenue, Norwalk, Connecticut 06856-4505 (Address of principal executive offices) Title... -

Page 16

...matters in the United States and in the foreign countries in which we do business; changes in foreign currency exchange rates; our ability to successfully develop new products, technologies and service offerings and to protect our intellectual property rights; the risk that multi-year contracts with... -

Page 17

... Disagreements with Accountants on Accounting and Financial Disclosure ...Controls and Procedures ...Other Information ...Directors, Executive Officers and Corporate Governance...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters... -

Page 18

... to help change the way the world works, and to create sustained shareholder value through growth in business services and continued leadership in document technology. We also create value through expanding margins and profits as well as a balanced capital allocation strategy that returns cash to... -

Page 19

... value for our customers and drive profitable revenue growth for our business. Drive Operational Excellence Across Our Businesses Our operational excellence model leverages our global delivery capabilities, production model, incentive-based compensation process, proprietary systems and financial... -

Page 20

... our strategy to expand our offerings and geographic reach through acquisitions and to actively manage our product portfolio, we acquired the following companies: • The learning services unit of Seattle-based Intrepid Learning Solutions (announced in 2014, closed January 2015). Healthy Communities... -

Page 21

.... 3. Personalization @ Scale - Augment humans by providing secure, real-time, context-aware personalized products, solutions and services: Whether business correspondence, personal communication, manufactured items or an information service, personalization increases the value to the recipient. Our... -

Page 22

... of total revenue. Services Segment We provide business services in global markets across major industries and to government agencies. These services help our clients improve the flow of work, providing them more time and resources to allocate to their core operations and enabling them to respond... -

Page 23

... including health, pension and retirement administration and outsourcing, private healthcare exchanges, employee service centers, learning solutions and welfare services, global mobility and relocation, payroll and others. Finance and Accounting: We serve clients in many industries by managing their... -

Page 24

... transactions. Customer Retention: We increased our renewal rate by 3-percentage points in 2015 to a rate of 84%. • • • Document Outsourcing We are the industry leader in document outsourcing services. We help companies assess and optimize their print infrastructure, secure and integrate... -

Page 25

...These products deliver good value to single users or small work teams through small footprints, mobility features, fast print speeds and high quality output. Adding wireless and mobile printing capabilities to any Ethernet-compatible printer or MFP, the Xerox Wireless Print Solutions Adapter enables... -

Page 26

... industry and large enterprises with high-volume printing requirements. Our High-End products comprised 24 percent of our total Document Technology segment revenue in 2015. Our High-End solutions enable full-color, ondemand printing of a wide range of applications, including variable data... -

Page 27

...the location of the unit reporting the revenue and include export sales. Patents, Trademarks and Licenses Xerox and its subsidiaries were awarded 938 U.S. utility patents in 2015. On that basis, we rank 37th on the list of companies that were awarded the most U.S. patents during the year. Including... -

Page 28

...the most valuable global brands. In Europe, Africa, the Middle East and parts of Asia, we distribute our products through Xerox Limited, a company established under the laws of England, as well as through related non-U.S. companies. Xerox Limited enters into distribution agreements with unaffiliated... -

Page 29

... locations are comprised of Customer Care Centers, Finance and Accounting Centers, Human Resource Centers and Document Process Centers. Our global production model is enabled by the use of proprietary technology, which allows us to securely distribute client transactions within data privacy limits... -

Page 30

... and generate the revenues required to provide desired returns. In developing these new technologies and products, we rely upon patent, copyright, trademark and trade secret laws in the United States and similar laws in other countries, and agreements with our employees, customers, suppliers and... -

Page 31

... Board of Directors approved management's plan to separate our BPO business from our Document Technology and Document Outsourcing business. Each of the businesses will operate as an independent, publicly-traded company. Our objective is to complete the separation by year-end 2016. The separation is... -

Page 32

... with us or were to offer their products to us with less advantageous prices and other terms than we previously had. In addition, a number of our facilities are located in jurisdictions outside of the United States where the provision of utility services, including electricity and water, may not be... -

Page 33

... operations and financial condition. In addition, in order to continually meet the service requirements of our customers, which often includes 24/7 service, and to optimize our employee cost base including our back-office support, we often locate our delivery service and back-office support centers... -

Page 34

...related software platforms. If we are unable to collect our receivables for unbilled services, our results of operations, financial condition and cash flows could be adversely affected. The profitability of certain of our large services contracts depends on our ability to successfully obtain payment... -

Page 35

...product life cycle communications, enterprise managed print services and document content and imaging. The ability to achieve growth in our equipment placements is subject to the successful implementation of our initiatives to provide advanced systems, industry-oriented global solutions and services... -

Page 36

...involved in a variety of claims, lawsuits, investigations and proceedings concerning: securities law; governmental entity contracting, servicing and procurement laws; intellectual property law; environmental law; employment law; the Employee Retirement Income Security Act (ERISA); and other laws and... -

Page 37

... principal research facilities are located in California, New York, Canada, France and India. The research activities in our principal research centers benefit all of our operating segments. We lease and own several facilities worldwide to support our Services segment with larger concentrations of... -

Page 38

...own or lease numerous facilities globally, which house general offices, sales offices, service locations, data centers, call centers and distribution centers. The size of our property portfolio at December 31, 2015 was approximately 30 million square feet at an annual operating cost of approximately... -

Page 39

... (XRX) is listed on the New York Stock Exchange and the Chicago Stock Exchange. Xerox Common Stock Prices and Dividends New York Stock Exchange composite prices * 2015 High Low Dividends declared per share 2014 High Low Dividends declared per share _____ First Quarter $ 14.00 12.59 0.07 $ Second... -

Page 40

... a sale by an issuer not involving a public offering. Issuer Purchases of Equity Securities During the Quarter Ended December 31, 2015 Repurchases of Xerox Common Stock, par value $1 per share include the following: Board Authorized Share Repurchase Program: Total Number of Shares Purchased as Part... -

Page 41

Repurchases Related to Stock Compensation Programs(1): Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs n/a n/a n/a Maximum Number (or Approximate Dollar Value) of Shares That May Yet Be Purchased under the Plans or Programs n/a n/a n/a Total Number of Shares ... -

Page 42

... FINANCIAL DATA FIVE YEARS IN REVIEW (in millions, except per-share data) 2015 Per-Share Data Income from continuing operations Basic Diluted Net Income Attributable to Xerox Basic Diluted Common stock dividends declared Operations Revenues Sales Outsourcing, maintenance and rentals Financing... -

Page 43

... technology and related supplies, technical service and equipment financing (excluding contracts related to document outsourcing). Our product groups within this segment include Entry, Mid-Range and High-End products. Annuity-Based Business Model In 2015, 85% of our total revenue was annuity... -

Page 44

... in our Consolidated Financial Statements for additional information regarding our 2015 acquisitions. In December 2014, we announced an agreement to sell our Information Technology Outsourcing (ITO) business to Atos and began reporting it as a Discontinued Operation. The sale was completed on... -

Page 45

... $300 million in 2016, which is in line with prior year as share repurchases effectively self-fund the increase. • Debt - we will manage our debt to maintain our investment grade rating. • Acquisitions - we expect to invest between $100 and $400 million, focusing on acquiring companies that will... -

Page 46

... in 2015 would have increased the negative impact from currency by about 1% for both the Total Company and the Document Technology segment revenues. The impact of this change was not material for 2014. Application of Critical Accounting Policies In preparing our Consolidated Financial Statements... -

Page 47

...values of each element. Sales to Distributors and Resellers: We utilize distributors and resellers to sell many of our technology products, supplies and services to end-user customers. Sales to distributors and resellers are generally recognized as revenue when products are sold to such distributors... -

Page 48

... the expense, liability and asset values related to our defined benefit pension plans. These factors include assumptions we make about the expected return on plan assets, discount rate, lump-sum settlement rates, the rate of future compensation increases and mortality. Differences between these... -

Page 49

... U.S. retiree health curtailment gain. Our estimated 2016 defined benefit pension plan cost is expected to be approximately $38 million higher than 2015, primarily driven by higher projected U.S. settlement losses. The increase in expense associated with Retiree health Xerox 2015 Annual Report 32 -

Page 50

... Retiree health benefit plan during 2015. Benefit plan costs are included in several income statement components based on the related underlying employee costs. The following is a summary of our benefit plan funding for the three years ended December 31, 2015 as well as estimated amounts for 2016... -

Page 51

...annual impairment test of goodwill was performed in the fourth quarter of 2015. Consistent with 2014, we elected to utilize a quantitative assessment of the recoverability of our goodwill balances for each of our reporting units. In our quantitative test, we estimate the fair value of each reporting... -

Page 52

... services and pricing pressures not being matched with cost reductions from productivity and restructuring actions. However, both of these reporting units operate in key growth segments of the business process outsourcing market, and the 2016 expectation is that through an increased focus on revenue... -

Page 53

... revenues decreased 11% from the prior year including a 7-percentage point negative impact from currency and a declining finance receivables balance due to lower prior period equipment sales. Refer to the discussion on Sales of Finance Receivable in the Capital Resources and Xerox 2015 Annual Report... -

Page 54

... change in revenue for each business segment is included in the "Operations Review of Segment Revenue and Profit" section. Costs, Expenses and Other Income Summary of Key Financial Ratios Year Ended December 31, Change 2015 Adjusted(1) 31.1% 3.1% 19.6% 8.4% N/A 2015 Adjusted(1) B/(W) 2014 (0.9) pts... -

Page 55

... lower bad debt expense. As anticipated, operating margin also benefited from lower year-over-year pension expense and settlement losses (collectively referred to as "pension expense"). Services margins decreased in 2014 due to higher government healthcare platform expenses, including net non-cash... -

Page 56

...and software. During 2015 we managed our investments in R&D to align with growth opportunities in areas like business services, color printing and customized communication. Our R&D is also strategically coordinated with Fuji Xerox. RD&E as a percent of revenue for the year ended December 31, 2014 of... -

Page 57

... restructuring reductions and productivity improvements. Worldwide employment was approximately 137,900 and 133,300 at December 2014 and 2013, respectively (NOTE: prior year employment amounts are adjusted to exclude employees associated with the divested ITO business). Xerox 2015 Annual Report 40 -

Page 58

...), net Litigation matters Loss on sales of accounts receivables Deferred compensation investment losses (gains) All other expenses, net Total Other Expenses, Net _____ $ 233 (1) Excludes the loss on sale of the ITO business reported in discontinued operations. Refer to Note 4 - Divestitures for... -

Page 59

... quarter and full year 2016. _____ (1) (2) See the "Non-GAAP Financial Measures" section for an explanation of the adjusted effective tax rate non-GAAP financial measure. Refer to Note 1 - Basis of Presentation and Summary of Significant Accounting policies for additional information. Xerox 2015... -

Page 60

... of the ITO business. As previously noted, in the fourth quarter 2014, we announced an agreement to sell the ITO business to Atos and began reporting it as a Discontinued Operation. The sale was completed on June 30, 2015. Refer to Note 4 - Divestitures in the Consolidated Financial Statements for... -

Page 61

... of operations and financial conditions. Operations Review of Segment Revenue and Profit Our reportable segments are consistent with how we manage the business and view the markets we serve. Our reportable segments are Services, Document Technology and Other. Revenues by segment for the three years... -

Page 62

... benefits. 2014 Services segment margin included a 0.2-percentage point negative impact from a net non-cash impairment charge as a result of the cancellation of a state health insurance exchange contract in our GHS business. Government Healthcare Strategy Change Late in third quarter 2015... -

Page 63

... for the Company, and we are committed to the business over the longer-term. We have a diverse portfolio of healthcare solutions and will focus on the more profitable market segments from which we derive over two thirds of GHS's revenues. We will continue to assess and modify our GHS strategy as the... -

Page 64

... associated with our government healthcare Medicaid and Health Insurance Exchange (HIX) platforms, net non-cash impairment charges for the HIX platform, higher compensation expenses, the anticipated run-off of the student loan business and price declines consistent with prior years. The gross margin... -

Page 65

... The gross margin decrease reflects unfavorable revenue-stream mix, price declines and an increase in pension expense, partially offset by the retiree health curtailment gain, lower compensation and benefit expenses and benefits from restructuring and productivity actions. SAG increased as a percent... -

Page 66

... Fuji Xerox growth in digital front-end (DFE) sales, high-end color installs increased 6% with growth in iGen and the new Versant product. • 13% decrease in installs of high-end black-and-white systems, reflecting continued declines in the overall market. Other Revenue 2015 Other segment revenue... -

Page 67

... non-service elements of our defined-benefit pension and retiree-health plan costs from Segment Profit. Although no other changes have been approved, additional segment changes may be considered in 2016 as a result of the Company's plan to separate the Business Processing Outsourcing business from... -

Page 68

... increase from lower spending for up-front costs for outsourcing service contracts. Cash flow from operations in 2015 and 2014 include approximately $40 million and $145 million, respectively, of cash flows from our ITO business, which was held for sale and reported as a discontinued operation... -

Page 69

... internal use software) in 2014 and 2013 include approximately $100 million in each year associated with our ITO business, which was held for sale and reported as a discontinued operation through its sale on June 30, 2015. Refer to Note 4 - Divestitures in the Consolidated Financial Statements for... -

Page 70

... date of installation. Our investment in these contracts is reflected in Total finance assets, net. We primarily fund our customer financing activity through cash generated from operations, cash on hand, commercial paper borrowings, sales and securitizations of finance receivables and proceeds from... -

Page 71

... value adjustment. Sales of Accounts Receivable Accounts receivable sales arrangements are utilized in the normal course of business as part of our cash and liquidity management. We have financial facilities in the U.S., Canada and several countries in Europe that enable us to sell certain accounts... -

Page 72

... acquisition of ACS. In January 2016, the Board of Directors approved an increase in the Company's quarterly cash dividend from 7.00 cents per share to 7.75 cents per share, beginning with the dividend payable on April 29, 2016. Liquidity and Financial Flexibility We manage our worldwide liquidity... -

Page 73

... health benefit plans are non-funded and are almost entirely related to domestic operations. The unfunded balance of our retiree health plans was $855 million at December 31, 2015. Cash contributions are made each year to cover medical claims costs incurred during the year. The amounts reported... -

Page 74

... involved in a variety of claims, lawsuits, investigations and proceedings concerning: securities law; governmental entity contracting, servicing and procurement law; intellectual property law; environmental law; employment law; the Employee Retirement Income Security Act (ERISA); and other laws and... -

Page 75

... in the U.S., Canada and several countries in Europe that enable us to sell to thirdparties certain accounts receivable without recourse. In most instances, a portion of the sales proceeds are held back by the purchaser and payment is deferred until collection of the related sold receivables. Refer... -

Page 76

...of the item both in terms of the amount and the fact that it was the result of a specific management action involving a change in strategy in our Government Healthcare Solutions business. See Services Segment within the "Operations Review of Segment Revenue and Profit" section for further discussion... -

Page 77

... quarter 2015 HE charge, which does not impact the years ended December 31, 2014 or 2013. Revenue / Segment reconciliation: Year Ended December 31, 2015 (in millions) Total Revenue Annuity Revenue Outsourcing, Maintenance and Rentals Revenue Total Segment Profit Total Segment Margin _____ Reported... -

Page 78

... portion of equity of approximately $557 million. The net amount invested in foreign subsidiaries and affiliates, primarily Xerox Limited, Fuji Xerox and Xerox Canada Inc. and translated into U.S. Dollars using the year-end exchange rates, was approximately $5.6 billion at December 31, 2015. 61 -

Page 79

...-rate financial instruments are sensitive to changes in interest rates. At December 31, 2015, a 10% change in market interest rates would change the fair values of such financial instruments by approximately $115 million. ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA Xerox 2015 Annual Report... -

Page 80

... the financial position of Xerox Corporation and its subsidiaries at December 31, 2015 and 2014, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2015 in conformity with accounting principles generally accepted in the United States... -

Page 81

..., management has concluded that our internal control over financial reporting was effective as of December 31, 2015. /s/ URSULA M. BURNS /s/ LESLIE F. VARON /s/ JOSEPH H. MANCINI, JR. Chief Accounting Officer Chief Executive Officer Interim Chief Financial Officer Xerox 2015 Annual Report 64 -

Page 82

... 20 1,179 20 1,159 Revenues Sales Outsourcing, maintenance and rentals Financing Total Revenues Costs and Expenses Cost of sales Cost of outsourcing, maintenance and rentals Cost of financing Research, development and engineering expenses Selling, administrative and general expenses Restructuring... -

Page 83

... (Loss) Income for gross components of Other Comprehensive (Loss) Income, reclassification adjustments out of Accumulated Other Comprehensive Loss and related tax effects. The accompanying notes are an integral part of these Consolidated Financial Statements. Xerox 2015 Annual Report 66 -

Page 84

... of long-term debt Accounts payable Accrued compensation and benefits costs Unearned income Liabilities of discontinued operations Other current liabilities Total current liabilities Long-term debt Pension and other benefit liabilities Post-retirement medical benefits Other long-term liabilities... -

Page 85

...gain) on sales of businesses and assets Undistributed equity in net income of unconsolidated affiliates Stock-based compensation Restructuring and asset impairment charges Payments for restructurings Contributions to defined benefit pension plans Decrease (increase) in accounts receivable and billed... -

Page 86

... 2014 Comprehensive income (loss), net Cash dividends declared-common(1) Cash dividends declared-preferred(2) Stock option and incentive plans, net Payments to acquire treasury stock, including fees Cancellation of treasury stock Distributions to noncontrolling interests Balance at December 31, 2015... -

Page 87

... agreement and having met applicable accounting requirements, we reported the ITO business as held for sale and a discontinued operation up through its date of sale, which was completed on June 30, 2015. In 2014 we also completed the disposal of two smaller businesses - Xerox Audio Visual Solutions... -

Page 88

...Balance Sheet at December 31, 2014: December 31, 2014 As Reported Other long-term liabilities Total Liabilities Retained earnings Xerox shareholders' equity Total Equity $ 498 16,600 9,491 10,634 10,709 As Revised $ 454 16,556 9,535 10,678 10,753 The correction did not have an effect on the Company... -

Page 89

...(1) Amortization of product software Amortization of acquired intangible assets Amortization of customer contract costs (1) Defined pension benefits - net periodic benefit cost Retiree health benefits - net periodic benefit cost Income tax (benefit) expense - continuing operations Income tax expense... -

Page 90

... costs are currently reported as deferred charges in Other long-term assets and were $32 at December 31, 2015, $4 of which is related to our credit agreement. This update was effective for our fiscal year beginning January 1, 2016. Upon adoption of this update, we will reclassify approximately... -

Page 91

... Compensation: ASU 2014-12, Compensation - Stock Compensation (Topic 718): Accounting for Share-Based Payments When the Terms of an Award Provide that a Performance Target Could be Achieved after the Requisite Service Period, which is effective for our fiscal year beginning January 1, 2016. Summary... -

Page 92

... distributors or resellers. We compete with other third-party leasing companies with respect to the lease financing provided to these end-user customers. Supplies: Supplies revenue generally is recognized upon shipment or utilization by customers in accordance with the sales contract terms. Software... -

Page 93

... on unit-price contracts are recognized at the contractual selling prices as work is completed and accepted by the customer. Revenues on time and material contracts are recognized at the contractual rates as the labor hours and direct expenses are incurred. Revenues on certain fixed price contracts... -

Page 94

...We report revenue net of any revenue-based taxes assessed by governmental authorities that are imposed on and concurrent with specific revenue-producing transactions. The primary revenue-based taxes are sales tax and value-added tax (VAT). Other Significant Accounting Policies Shipping and Handling... -

Page 95

... life of the software. Amounts expended for Product Software are included in Cash Flows from Operations. We perform periodic reviews to ensure that unamortized Product Software costs remain recoverable from estimated future operating profits (net realizable value or NRV). Costs to support or service... -

Page 96

... and asset values related to our pension and retiree health benefit plans. These factors include assumptions we make about the discount rate, expected return on plan assets, rate of increase in healthcare costs, the rate of future compensation increases and mortality. Actual returns on plan assets... -

Page 97

...In estimating our discount rate, we consider rates of return on high-quality fixed-income investments adjusted to eliminate the effects of call provisions, as well as the expected timing of pension and other benefit payments. Each year, the difference between the actual return on plan assets and the... -

Page 98

...sized businesses to large enterprises. Customers also include graphic communication enterprises as well as channel partners including distributors and resellers. Segment revenues reflect the sale of document systems and supplies, technical services and product financing. Other includes several units... -

Page 99

... costs represent incremental costs incurred directly in support of our business transformation and restructuring initiatives such as compensation costs for overlapping staff, consulting costs and training costs. Business transformation costs were not applicable in 2013. Xerox 2015 Annual Report 82 -

Page 100

... 2015 we acquired RSA Medical LLC (RSA Medical) for approximately $141 in cash. RSA Medical is a leading provider of health assessment and risk management for members interacting with health and life insurance companies. The acquisition of RSA Medical expands Xerox's portfolio of healthcare service... -

Page 101

..., managed care services providers, governments and self-administered employers who require comprehensive reviews of medical bills and implementation of care management plans stemming from workers' compensation claims. In January 2014, we acquired Invoco Holding GmbH (Invoco), a German company... -

Page 102

... 2014, we announced an agreement to sell our ITO business to Atos and began reporting it as a Discontinued Operation. All prior periods were accordingly revised to conform to this presentation. The sale was completed on June 30, 2015. The final sale price of approximately $940 ($930 net of cash sold... -

Page 103

... of the ITO business for the three years ended December 31, 2015: Year Ended December 31, 2015 Expenses: Depreciation of buildings and equipment(1) Amortization of internal use software(1) Amortization of acquired intangible assets(1) Amortization of customer contract costs(1) Operating lease rent... -

Page 104

...of business as part of our cash and liquidity management. We have facilities in the U.S., Canada and several countries in Europe that enable us to sell certain accounts receivable without recourse to third-parties. The accounts receivables sold are generally short-term trade receivables with payment... -

Page 105

... balance sheet was $238 and $549 at December 31, 2015 and 2014, respectively (sales value of approximately $256 and $596, respectively). Summary Finance Receivable Sales The lease portfolios transferred and sold were all from our Document Technology segment and the gains on these sales were reported... -

Page 106

... the risk factors associated with the economies of those countries/regions. Loss rates declined in the U.S. reflecting the effects of improved collections during 2015 and 2014 as well as the lower balance of finance receivables primarily due to sales in 2013 and 2012. Since Europe is comprised of... -

Page 107

...the life of the portfolio. Details about our finance receivables portfolio based on industry and credit quality indicators are as follows: • December 31, 2015 Investment Grade Finance and other services $ Government and education Graphic arts Industrial Healthcare Other Total United States Finance... -

Page 108

... receivables is as follows: December 31, 2015 31-90 Days Past Due 7 11 12 4 3 2 39 3 - 1 3 8 1 13 19 $ 74 $ (1) Current Finance and other services Government and education Graphic arts Industrial Healthcare Other Total United States Canada France U.K./Ireland Central Southern(2) Nordic(3) Total... -

Page 109

... leases with original terms of one year or longer are: 2016 $ 331 $ 2017 228 $ 2018 144 $ 2019 78 $ 2020 30 $ Thereafter 3 Total contingent rentals on operating leases, consisting principally of usage charges in excess of minimum contracted amounts, for the years ended December 31, 2015, 2014... -

Page 110

...vary from three to ten years. Included within product software at December 31, 2015 and 2014 is approximately $55 and $250, respectively, of capitalized costs associated with software system platforms developed for use in certain of our government services businesses. During 2015, as a result of our... -

Page 111

... used to translate are as follows: Financial Statement Summary of Operations Balance Sheet Exchange Basis Weighted average rate Year-end rate 2015 121.01 120.49 2014 105.58 119.46 2013 97.52 105.15 Transactions with Fuji Xerox We receive dividends from Fuji Xerox, which are reflected as a reduction... -

Page 112

... with Fuji Xerox were as follows: Year Ended December 31, 2015 Dividends received from Fuji Xerox Royalty revenue earned Inventory purchases from Fuji Xerox Inventory sales to Fuji Xerox R&D payments received from Fuji Xerox R&D payments paid to Fuji Xerox $ 51 102 1,728 108 1 7 $ 2014 58... -

Page 113

... severance benefits representing a substantive plan, we recognize employee severance costs when they are both probable and reasonably estimable. A summary of our restructuring program activity during the three years ended December 31, 2015 is as follows: Severance and Related Costs Balance at... -

Page 114

Year Ended December 31, 2015 Services Document Technology Other Total Net Restructuring Charges $ $ 163 15 8 186 $ $ 2014 38 76 14 128 $ $ 2013 38 77 - 115 97 -

Page 115

... pension costs Net investment in TRG Internal use software, net Product software, net Restricted cash Debt issuance costs, net Customer contract costs, net Beneficial interest - sales of finance receivables Deferred compensation plan investments Other Total Other Long-term Assets Other Long-term... -

Page 116

... be recovered in annual cash distributions through 2017. The performance-based instrument is pledged as security for our future funding obligations to our U.K. Pension Plan for salaried employees. Note 13 - Debt Short-term borrowings were as follows: December 31, 2015 Commercial paper Notes Payable... -

Page 117

...161 $ 2020 1,207 $ Thereafter 1,967 $ Total 7,362 980 (1) (2) Quarterly long-term debt maturities from continuing operations for 2016 are $709, $257, $7 and $7 for the first, second, third and fourth quarters, respectively. Excludes fair value adjustments of $2. Xerox 2015 Annual Report 100 -

Page 118

... rating as of December 31, 2015, the applicable rate is 0.15%. The Credit Facility contains various conditions to borrowing and affirmative, negative and financial maintenance covenants. Certain of the more significant covenants are summarized below: (a) Maximum leverage ratio (a quarterly test... -

Page 119

...We use interest rate swap agreements to manage our interest rate exposure and to achieve a desired proportion of variable and fixed rate debt. These derivatives may be designated as fair value hedges or cash flow hedges depending on the nature of the risk being hedged. Xerox 2015 Annual Report 102 -

Page 120

... Designated 2014 $ Notional Amount 300 $ Net Fair Value Basis Libor Maturity 2021 Foreign Exchange Risk Management As a global company, we are exposed to foreign currency exchange rate fluctuations in the normal course of our business. As a part of our foreign exchange risk management strategy... -

Page 121

... tables provide a summary of gains (losses) on derivative instruments: Year Ended December 31, Derivatives in Fair Value Relationships Interest rate contracts Location of Gain (Loss) Recognized in Income Interest expense $ Derivative Gain (Loss) Recognized in Income 2015 7 $ 2014 5 $ 2013 - $ Hedged... -

Page 122

..., currency exchange rates and forward prices, and therefore are classified as Level 2. Fair value for our deferred compensation plan investments in Company-owned life insurance is reflected at cash surrender value. Fair value for our deferred compensation plan investments in mutual funds is based on... -

Page 123

... Long-term debt was estimated based on the current rates offered to us for debt of similar maturities (Level 2). The difference between the fair value and the carrying value represents the theoretical net premium or discount we would pay or receive to retire all debt at such date. Xerox 2015 Annual... -

Page 124

... rate changes Benefits paid/settlements Other Fair Value of Plan Assets, December 31 Net Funded Status at December 31(1) Amounts Recognized in the Consolidated Balance Sheets: Other long-term assets Accrued compensation and benefit costs Pension and other benefit liabilities Post-retirement medical... -

Page 125

... the benefit calculated under a formula that provides for the accumulation of salary and interest credits during an employee's work life or (iii) the individual account balance from the Company's prior defined contribution plan (Transitional Retirement Account or TRA). Xerox 2015 Annual Report 108 -

Page 126

... benefit plan for salaried employees, the Canadian Salary Pension Plan and the U.K. Final Salary Pension Plan. The freeze of current benefits is the primary driver of the reduction in pension service costs since 2012. In certain Non-U.S. plans we are required to continue to consider salary increases... -

Page 127

... agency Corporate bonds Asset backed securities Total Fixed Income Securities Derivatives: Interest rate contracts Foreign exchange contracts Equity contracts Other contracts Total Derivatives Real estate Private equity/venture capital Guaranteed insurance contracts Other(1) Total Fair Value of Plan... -

Page 128

... agency Corporate bonds Asset backed securities Total Fixed Income Securities Derivatives: Interest rate contracts Foreign exchange contracts Equity contracts Other contracts Total Derivatives Real estate Private equity/venture capital Guaranteed insurance contracts Other(1) Total Fair Value of Plan... -

Page 129

... our worldwide defined benefit pension plans were: 2015 U.S. Equity investments Fixed income investments Real estate Private equity Other Total Investment Strategy 34% 43% 6% 9% 8% 100% Non-U.S. 29% 47% 6% 10% 8% 100% U.S. 33% 43% 8% 9% 7% 100% 2014 Non-U.S. 34% 47% 9% 6% 4% 100% We employ a total... -

Page 130

... 2.6% Retiree Health 2016 Discount rate _____ 2015 3.8% 2014 4.5% 2013 3.6% 4.09% Note: Expected return on plan assets is not applicable to retiree health benefits as these plans are not funded. Rate of compensation increase is not applicable to retiree health benefits as compensation levels... -

Page 131

...effect on the amounts reported for the health care plans. A one-percentage-point change in assumed health care cost trend rates would have the following effects: 1% increase Effect on total service and interest cost components Effect on post-retirement benefit obligation $ 4 62 $ 1% decrease (4) (54... -

Page 132

... geographical scope of our operations. Our ongoing assessments of the more-likely-than-not outcomes of the examinations and related tax positions require judgment and can increase or decrease our effective tax rate, as well as impact our operating results. The specific timing of when the resolution... -

Page 133

...unrecognized tax benefits is as follows: 2015 Balance at January 1 Additions related to current year Additions related to prior years positions Reductions related to prior years positions Settlements with taxing authorities(1) Reductions related to lapse of statute of limitations Currency Balance at... -

Page 134

... and Summary of Significant Accounting Policies, we early adopted ASU 2015-17, Income Taxes: Balance Sheet Classification of Deferred Taxes, which requires that deferred tax liabilities and assets be classified as non-current in a classified statement of financial position. Adoption of this update... -

Page 135

...The lawsuit alleges that Xerox Corporation, Xerox State Healthcare, LLC and ACS State Healthcare (collectively "Xerox" or the "Company") violated the Texas Medicaid Fraud Prevention Act in the administration of its contract with the Texas Department of Health and Human Xerox 2015 Annual Report 118 -

Page 136

... had not been timely made relating to its servicing of a small percentage of third-party student loans under outsourcing arrangements for various financial institutions. The CFPB and the Department of Education, as well as certain state's attorney general offices and other regulatory agencies, began... -

Page 137

...full service maintenance agreement with the customer. The agreements generally extend over a period equivalent to the lease term or the expected useful life of the equipment under a cash sale. The service agreements involve the payment of fees in return for our performance of repairs and maintenance... -

Page 138

... $300 and an initial fair value of $349. The convertible preferred stock pays quarterly cash dividends at a rate of 8% per year ($24 per year). Each share of convertible preferred stock is convertible at any time, at the option of the holder, into 89.8876 shares of common stock for a total of 26,966... -

Page 139

... Stock Units: Compensation expense is based upon the grant date market price. The compensation expense is recorded over the vesting period, which is normally three years from the date of grant, based on management's estimate of the number of shares expected to vest. Performance Shares: Prior to 2014... -

Page 140

...All PSs entitle the holder to one share of common stock, payable after a three-year service period and the attainment of the stated goals. In 2015, the maximum overachievement that can be earned was changed to 100% (from 50%) for officers and selected executives. All other terms of the awards remain... -

Page 141

...Benefit 33 12 5 $ December 31, 2014 Total Intrinsic Value 85 30 42 Cash Received $ - - 55 $ Tax Benefit 26 10 15 $ December 31, 2013 Total Intrinsic Value 91 62 51 Cash Received $ - - 124 $ Tax Benefit 30 22 19 Awards Restricted Stock Units Performance Shares Stock Options Xerox 2015 Annual Report... -

Page 142

... of sales - refer to Note 14 - Financial Instruments for additional information regarding our cash flow hedges. Reclassified to Total Net Periodic Benefit Cost - refer to Note 16 - Employee Benefit Plans for additional information. Represents our share of Fuji Xerox's benefit plan changes. Primarily... -

Page 143

... basic and diluted earnings per share of common stock (shares in thousands): Year Ended December 31, 2015 Basic Earnings per Share: Net income from continuing operations attributable to Xerox Accrued dividends on preferred stock Net Income From Continuing Operations Available to Common Shareholders... -

Page 144

... that its Board of Directors had approved management's plan to separate the Company's Business Process Outsourcing business from its Document Technology and Document Outsourcing business. Each of the businesses will operate as an independent, publicly-traded company. Leadership and names of the two... -

Page 145

... RESULTS OF OPERATIONS (Unaudited) (in millions, except per-share data) First Quarter Second Quarter Third Quarter Fourth Quarter Full Year 2015 Revenues Costs and Expenses Income (Loss) before Income Taxes and Equity Income Income tax expense (benefit) Equity in net income of unconsolidated... -

Page 146

... the time periods specified in the Securities and Exchange Commission's rules and forms relating to Xerox Corporation, including our consolidated subsidiaries, and was accumulated and communicated to the Company's management, including the principal executive officer and principal financial officer... -

Page 147

...our 2016 Proxy Statement. We have adopted a code of ethics applicable to our principal executive officer, principal financial officer and principal accounting officer. The Finance Code of Conduct can be found on our website at: http://www.xerox.com/ investor and then clicking on Corporate Governance... -

Page 148

... Services business for the Americas, head of its Global Delivery organization, and head of Strategy. He also ran the Travel and Transportation and Financial Services verticals, as well as the services operations in Latin America. In addition, he ran IBM's global financing unit. Mr. Ford joined Xerox... -

Page 149

... The management contracts or compensatory plans or arrangements listed in the "Index of Exhibits" that are applicable to the executive officers named in the Summary Compensation Table which appears in Registrant's 2016 Proxy Statement or to our directors are preceded by an asterisk (*). Xerox 2015... -

Page 150

... 19, 2016 Signature Principal Executive Officer: /S/ URSULA M. BURNS Ursula M. Burns Title Chairman of the Board, Chief Executive Officer and Director Principal Financial Officer: /S/ LESLIE F. VARON Leslie F. Varon Vice President and Interim Chief Financial Officer Principal Accounting Officer... -

Page 151

...payment such as customer accommodations and contract terminations. (2) Deductions and other, net of recoveries primarily relates to receivable write-offs, but also includes the impact of foreign currency translation adjustments and recoveries of previously written off receivables. Xerox 2015 Annual... -

Page 152

... trustee, and Wilmington Trust Company, as successor trustee, relating to the December 1991 Indenture. Incorporated by reference to Exhibit 4(a)(2) to Registrant's Annual Report on Form 10-K for the fiscal year ended December 31, 2000 filed on June 7, 2001. See SEC File Number 001-04471. Instrument... -

Page 153

... plans or arrangements listed below that are applicable to the executive officers named in the Summary Compensation Table which appears in Registrant's 2016 Proxy Statement or to our directors are preceded by an asterisk (*). Registrant's Form of Separation Agreement (with salary continuance... -

Page 154

... 31, 2014. See SEC File number 001-04471. Annual Performance Incentive Plan for 2016 ("2016 APIP") Performance Elements for 2016 Executive Long-Term Incentive Program Form of Award Agreement under 2016 ELTIP (Performance Shares) Form of Award Agreement under 2016 ELTIP (Restricted Stock Units) Form... -

Page 155

... Compensation Promised by Registrant. Incorporated by reference to Exhibit 10(r) to Registrant's Annual Report on Form 10-K for the fiscal year ended December 31, 2008. See SEC File Number 001-04471. 2006 Technology Agreement, effective as of April 1, 2006, by and between Registrant and Fuji Xerox... -

Page 156

... Extension Definition Linkbase. XBRL Instance Document. XBRL Taxonomy Extension Label Linkbase. XBRL Taxonomy Extension Presentation Linkbase. XBRL Taxonomy Extension Schema Linkbase. **Pursuant to the Freedom of Information Act and/or a request for confidential treatment filed with the Securities... -

Page 157

-

Page 158

...45 Glover Avenue P.O. Box 4505 Norwalk, CT 06856-4505 United States 203.968.3000 www.xerox.com © 2016 Xerox Corporation All rights reserved. Xerox®, Xerox and Design®, and Rialto® are trademarks of Xerox Corporation in the U.S. and/or other countries. Paper from responsible sources 002CSN5F24